Page 138 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 138

JSE – KAR Profile’s Stock Exchange Handbook: 2025 – Issue 2

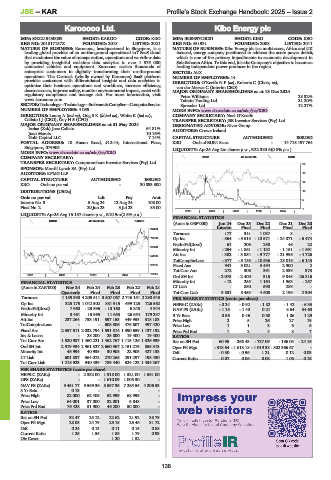

Karooooo Ltd. Kibo Energy plc

KAR KIB

ISIN: SGXZ19450089 SHORT: KAROO CODE: KRO ISIN: IE00B97C0C31 SHORT: KIBO CODE: KBO

REG NO: 201817157Z FOUNDED: 2018 LISTED: 2021 REG NO: 451931 FOUNDED: 2008 LISTED: 2011

NATURE OF BUSINESS: Karooooo, headquartered in Singapore, is a NATURE OF BUSINESS: Kibo Energy plc is a multi-asset, Africa and UK

leading global provider of an on-the-ground operational IoT SaaS cloud focused, energy company positioned to address the acute power deficit,

that maximizes the value of transportation, operations and workflow data which is one of the primary impediments to economic development in

by providing insightful real-time data analytics to over 1 575 000 Sub-Saharan Africa. To this end, it is the Company’s objective to become a

connected vehicles and equipment. Karooooo assists thousands of leading independent power producer in the region.

enterprise customers in digitally transforming their on-the-ground SECTOR: AltX

operations. The Cartrack (wholly owned by Karooooo) SaaS platform NUMBER OF EMPLOYEES: 14

provides customers with differentiated insights and data analytics to DIRECTORS: O’KeeffeNF(ne), Roberts C (Chair, ne),

optimize their business operations and workforce, increase efficiency, van der Merwe C (Interim CEO)

decrease costs, improve safety, monitor environmental impact, assist with MAJOR ORDINARY SHAREHOLDERS as at 18 Dec 2024

regulatory compliance and manage risk. For more information, visit Peter Williams 28.32%

www.karooooo.com. Tsitato Trading Ltd. 21.20%

SECTOR:Technology—Technology—Software&CompSer—ComputerService Spreadex Ltd. 12.27%

NUMBER OF EMPLOYEES: 4 039 MORE INFO: www.sharedata.co.za/sdo/jse/KBO

DIRECTORS: Leong A (ind ne), OngSK(ld ind ne), White K (ind ne), COMPANY SECRETARY: Noel O’Keeffe

Calisto I J (CEO), Goy H S (CFO) TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2024 DESIGNATED ADVISOR: River Group

Isaias (Zak) Jose Calisto 64.81% AUDITORS: Crowe Ireland

Juan Marais 10.16%

Gobi Capital LLC 7.14% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: 10 Anson Road, #12-14, International Plaza, KBO Ords of EUR1.5c ea - 14 715 197 764

Singapore, 079903 LIQUIDITY: Apr25 Avg 2m shares p.w., R22 380.6(0.8% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/KRO

COMPANY SECRETARY: INDM 40 Week MA KIBO

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 23

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: KPMG LLP 19

CAPITAL STRUCTURE AUTHORISED ISSUED

14

KRO Ords no par val - 30 893 300

DISTRIBUTIONS [USDc] 10

Ords no par val Ldt Pay Amt

5

Interim No 3 5 Aug 24 12 Aug 24 108.00

Final No 2 20 Jun 23 3 Jul 23 85.00 1

2020 | 2021 | 2022 | 2023 | 2024 |

LIQUIDITY: Apr25 Avg 15 157 shares p.w., R10.9m(2.6% p.a.)

FINANCIAL STATISTICS

SCOM 40 Week MA KAROO

(Amts in GBP’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

92450 Interim Final Final Final Final

Turnover 177 341 1 037 3 -

79289 Op Inc - 564 - 5 518 - 10 571 - 24 071 - 6 474

NetIntPd(Rcvd) 61 206 250 46 22

66128

Minority Int - 254 - 1 861 - 1 132 - 1 151 - 1 691

52966 Att Inc - 382 - 3 854 - 9 777 - 21 996 - 4 726

TotCompIncLoss - 377 - 5 133 - 10 536 - 23 016 - 6 143

39805 Fixed Ass 941 3 021 3 494 2 900 2

Tot Curr Ass 272 306 391 2 339 373

26644

2021 | 2022 | 2023 | 2024 | Ord SH Int - 2 075 - 2 400 316 9 845 26 816

FINANCIAL STATISTICS Minority Int - 12 255 1 164 1 963 - 257

(Amts in ZAR’000) Nov 24 Feb 24 Feb 23 Feb 22 Feb 21 LT Liab - 850 590 289 -

Quarterly Final Final Final Final Tot Curr Liab 3 831 5 453 4 608 2 199 2 304

Turnover 1 159 390 4 205 511 3 507 067 2 746 151 2 290 543 PER SHARE STATISTICS (cents per share)

Op Inc 325 175 1 042 502 881 915 699 125 726 562 HEPS-C (ZARc) - 0.24 - 0.92 - 1.82 - 1.42 - 6.33

NetIntPd(Rcvd) 7 960 - 23 596 - 13 160 6 248 4 944 NAV PS (ZARc) - 1.15 - 1.40 0.21 8.64 34.60

Minority Int 3 461 15 965 11 653 26 654 179 237 3 Yr Beta 0.56 0.46 0.30 1.06 1.29

Att Inc 237 264 738 191 597 153 449 953 318 183 Price High 2 5 26 27 19

TotCompIncLoss - - 608 806 476 607 497 420 Price Low 1 1 3 6 5

Fixed Ass 2 357 611 2 032 794 1 591 814 1 390 659 1 137 192 Price Prd End 1 2 4 8 7

Inv & Loans - 28 200 25 800 19 400 19 400 RATIOS

Tot Curr Ass 1 520 987 1 460 221 1 462 767 1 115 126 1 326 939 Ret on SH Fnd 60.95 266.43 - 737.09 - 196.03 - 24.16

Ord SH Int 2 919 934 2 961 527 2 660 967 2 151 276 855 313 Oper Pft Mgn - 318.64 - 1 618.18 - 1 019.38 - 802 366.67 -

Minority Int 45 994 40 935 30 908 22 905 427 133 D:E - 0.30 - 0.96 1.21 0.12 0.03

LT Liab 601 837 364 072 270 265 291 297 198 430 Current Ratio 0.07 0.06 0.08 1.06 0.16

Tot Curr Liab 1 218 923 940 439 789 440 624 123 1 434 267

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 2 382.00 1 918.00 1 521.00 1 561.00

DPS (ZARc) - - 1 610.09 1 005.30 -

NAV PS (ZARc) 9 451.77 9 569.36 8 597.35 7 285.55 4 206.53

3 Yr Beta 0.13 - - - -

Price High 82 000 62 405 52 999 68 999 -

Price Low 64 001 37 000 32 001 5 848 -

Price Prd End 76 428 51 900 46 200 50 800 -

RATIOS

Ret on SH Fnd 32.47 25.12 22.62 21.92 38.79

Oper Pft Mgn 28.05 24.79 25.15 25.46 31.72

D:E 0.24 0.13 0.11 0.15 0.88

Current Ratio 1.25 1.55 1.85 1.79 0.93

Div Cover - - 1.20 1.52 -

136