Page 141 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 141

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – LEW

EMAIL: graeme@tierlir.co.za

Lewis Group Ltd. WEBSITE: www.lewisgroup.co.za

LEW TELEPHONE: 021-460-4400

ISIN: ZAE000058236 COMPANY SECRETARY: Marisha Gibbons

SHORT: LEWIS TRANSFER SECRETARY: Computershare Investor

CODE: LEW Services (Pty) Ltd.

REG NO: 2004/009817/06

FOUNDED: 1934 SPONSOR: Standard Bank of SA Ltd.

LISTED: 2004 AUDITORS: EY Inc.

BANKERS: Absa Bank Ltd., First National Bank of

Scan the QR code to Africa Ltd., Investec Bank Ltd., Nedbank Ltd.,

NATURE OF BUSINESS: visit our website Standard Bank Ltd.

Lewis Group is a leading credit

retailer of household furniture, CALENDAR Expected Status

electrical appliances and home electronics and has been listed on Next Final Results May 2025 Unconfirmed

the JSE Ltd. since 2004 where it is classified under the General Annual General Meeting Oct 2025 Unconfirmed

Retailers sector. The group has a branch network of 897 stores Next Interim Results Nov 2025 Unconfirmed

which includes stores across all major metropolitan areas as well

as a strong presence in rural South Africa, with 138 stores in the CAPITAL STRUCTURE AUTHORISED ISSUED

neighbouring countries of Botswana, Eswatini, Lesotho and LEW Ords 1c ea 150 000 000 52 159 288

Namibia. DISTRIBUTIONS [ZARc]

The group operates the following primary brands: Ords 1c ea Ldt Pay Amt

- Lewis, the country’s largest furniture chain and one of the most Interim No 41 21 Jan 25 27 Jan 25 300.00

recognisable brands in furniture retailing, focused primarily on Final No 40 23 Jul 24 29 Jul 24 300.00

the growing middle to lower income market in the living Interim No 39 16 Jan 24 22 Jan 24 200.00

standards measurement (“LSM”) 4 to 7 categories. Final No 38 18 Jul 23 24 Jul 23 218.00

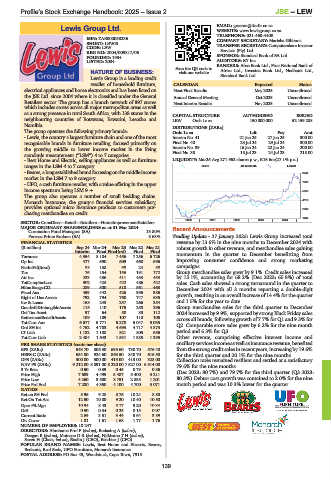

- Best Home and Electric, selling appliances as well as furniture LIQUIDITY: Mar25 Avg 271 962 shares p.w., R16.6m(27.1% p.a.)

ranges in the LSM 4 to 7 category. GERE 40 Week MA LEWIS

-Beares, alongestablishedbrandfocussingonthemiddleincome 8448

market in the LSM 7 to 9 category.

- UFO, a cash furniture retailer, with a value offering in the upper 7006

income spectrum being LSM 9 +. 5565

The group also operates a number of small bedding chains.

Monarch Insurance, the group’s financial services subsidiary, 4123

provides optional micro insurance products to customers pur- 2682

chasing merchandise on credit.

1240

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers 2020 | 2021 | 2022 | 2023 | 2024 |

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

Coronation Fund Managers (SA) 13.80% Recent Announcements

Peresec Prime Brokers (SA) 8.63% Trading Update - 27 January 2025: Lewis Group increased total

FINANCIAL STATISTICS revenue by 13.6% in the nine months to December 2024 with

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 robust growth in other revenue, and merchandise sales gaining

Interim Final Final(rst) Final Final momentum in the quarter to December benefitting from

Turnover 4 354 8 184 7 456 7 256 6 726

Op Inc 477 690 609 668 696 improving consumer confidence and strong marketing

NetIntPd(Rcvd) 88 138 98 24 88 campaigns.

Tax 76 154 156 191 172 Group merchandise sales grew by 9.1%. Credit sales increased

Att Inc 283 436 411 483 433 by 13.1%, accounting for 68.2% (Dec 2023: 65.8%) of total

TotCompIncLoss 302 425 422 486 422 sales. Cash sales showed a strong turnaround in the quarter to

Hline Erngs-CO 289 500 510 561 463

Fixed Ass 459 442 426 396 386 December 2024 with all 3 months reporting a double-digit

Right of Use Assets 792 794 760 747 635 growth, resulting in an overall increase of 14.4% for the quarter

Inv & Loans 168 243 257 266 254 and 1.5% for the year to date.

Goodwill&IntangibleAssets 115 110 175 258 296 Group merchandise sales for the third quarter to December

Def Tax Asset 97 64 50 83 112 2024 increased by 9.9%, supported by strong Black Friday sales

RetirementBenefitAssets 109 109 107 110 105 across all brands, following growth of 7.7% for Q1 and 9.3% for

Tot Curr Ass 6 677 5 771 5 270 5 047 5 035 Q2. Comparable store sales grew by 6.2% for the nine month

Ord SH Int 4 752 4 703 4 693 4 717 4 873

LT Liab 1 182 1 188 821 805 656 period and 6.3% for Q3.

Tot Curr Liab 2 484 1 643 1 531 1 385 1 295 Other revenue, comprising effective interest income and

PER SHARE STATISTICS (cents per share) ancillaryservicesincomeaswellasinsurancerevenue,benefited

EPS (ZARc) 543.70 806.30 695.60 730.70 576.40 from the strong credit sales in recent years, increasing by 19.6%

HEPS-C (ZARc) 554.80 924.60 863.50 848.70 616.50 for the third quarter and 20.1% for the nine months.

DPS (ZARc) 300.00 500.00 413.00 413.00 328.00 Collection rates remained resilient and settled at a satisfactory

NAV PS (ZARc) 9 212.00 8 891.00 8 220.00 7 527.00 6 814.00 79.6% for the nine months

3 Yr Beta 0.50 0.39 0.45 0.79 0.86

Price High 7 689 4 499 5 487 5 400 3 211 (Dec 2023: 80.7%) and 79.7% for the third quarter (Q3 2023:

Price Low 4 260 3 500 3 751 2 835 1 201 80.3%).Debtor cost growth was contained to 2.0% for the nine

Price Prd End 7 280 4 350 4 100 4 700 3 071 month period and was 10.3% lower for the quarter.

RATIOS

Ret on SH Fnd 5.96 9.28 8.76 10.24 8.88

Ret On Tot Ass 12.50 10.00 9.20 10.40 10.50

Oper Pft Mgn 10.94 8.43 8.17 9.20 10.34

D:E 0.50 0.34 0.25 0.15 0.07

Current Ratio 2.69 3.51 3.44 3.64 3.89

Div Cover 1.81 1.61 1.68 1.77 1.76

NUMBER OF EMPLOYEES: 10 247

DIRECTORS: Abrahams Prof F (ind ne), Bodasing A (ind ne),

Deegan B (ind ne), MotsepeDR(ind ne), NjikizanaTH(ind ne),

Saven H (Chair, ind ne), Enslin J (CEO), Bestbier J (CFO)

POPULAR BRAND NAMES: Lewis, Best Home and Electric, Beares,

Bedzone, Real Beds, UFO Furniture, Monarch Insurance

POSTAL ADDRESS: PO Box 43, Woodstock, Cape Town, 7915

139