Page 137 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 137

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – KAL

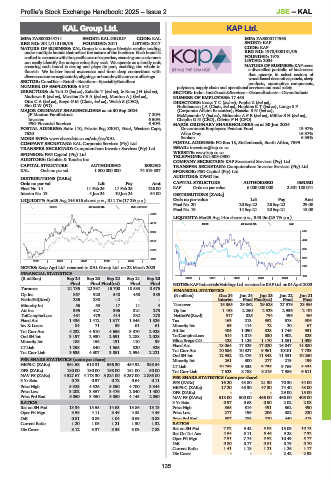

KAL Group Ltd. KAP Ltd.

KAL KAP

ISIN: ZAE000244711 SHORT: KAL GROUP CODE: KAL ISIN: ZAE000171963

REG NO: 2011/113185/06 FOUNDED: 2011 LISTED: 2017 SHORT: KAP

NATURE OF BUSINESS: KAL Group is a unique lifestyle retailer trading CODE: KAP

under multiple brands that reflect the nature of the business. Each brand is REG NO: 1978/000181/06

craftedtoresonatewithitsspecificareaofexpertise,ensuringourcustomers FOUNDED: 1978

can easily identify the unique value they seek. We operate as a family unit, LISTED: 2004

ensuring each brand is strong and plays its part, enabling the whole to NATURE OF BUSINESS: KAP owns

flourish. We bolster brand awareness and form deep connections with a diversified portfolio of businesses

diversecustomersegmentsbyaligningourbrandswithourcoreofferings. that operate in select sectors of

wood-based decorative panels, sleep

SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers products, automotive components,

NUMBER OF EMPLOYEES: 6 842 polymers, supply chain and operational services and road safety.

DIRECTORS: du Toit D (ind ne), Kabalin T (ind ne), le RouxJH(ind ne), SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr

Mathews B (ind ne), Messina DrEA(ind ne), MoutonAJ(ind ne), NUMBER OF EMPLOYEES: 17 453

OttoCA(ind ne), Steyn G M (Chair, ind ne), Walsh S (CEO), DIRECTORS: IsaacsTC(ind ne), Fuphe Z (ind ne),

Sim G W (FD) Holtzhausen J A (Chair, ind ne), HopkinsKT(ind ne), Lunga S P

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024 (Corporate Affairs Executive), MasekoSN(ind ne),

JF Mouton Familietrust 7.20% McMenamin V (ind ne), MthembuAFB(ind ne), MüllerSH(ind ne),

Investec 6.50% Chaplin G N (CEO), Olivier F H (CFO)

PSG Financial Services 6.40% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

POSTAL ADDRESS: Suite 110, Private Bag X3041, Paarl, Western Cape, Government Employees Pension Fund 19.97%

7620 Allan Gray 16.37%

MORE INFO: www.sharedata.co.za/sdo/jse/KAL Sanlam 6.35%

COMPANY SECRETARY: KAL Corporate Services (Pty) Ltd. POSTAL ADDRESS: PO Box 18, Stellenbosch, South Africa, 7599

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. EMAIL: investors@kap.co.za

SPONSOR: PSG Capital (Pty) Ltd. WEBSITE: www.kap.co.za

AUDITORS: Deloitte & Touche Inc. TELEPHONE: 021-808-0900

COMPANY SECRETARY: KAP Secretarial Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

KAL Ords no par val 1 000 000 000 74 319 837 SPONSOR: PSG Capital (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: KPMG Inc.

Ords no par val Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 14 11 Feb 25 17 Feb 25 126.00 KAP Ords no par value 6 000 000 000 2 501 188 041

Interim No 13 4 Jun 24 10 Jun 24 54.00 DISTRIBUTIONS [ZARc]

LIQUIDITY: Apr25 Avg 245 516 shares p.w., R11.7m(17.2% p.a.) Ords no par value Ldt Pay Amt

Final No 20 20 Sep 22 26 Sep 22 29.00

GERE 40 Week MA KAL GROUP

Final No 19 14 Sep 21 20 Sep 21 15.00

5500

LIQUIDITY: Mar25 Avg 14m shares p.w., R43.0m(29.7% p.a.)

4718 GENI 40 Week MA KAP

542

3937

3155 464

385

2373

307

1591

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Kaap Agri Ltd. renamed to KAL Group Ltd. on 22 March 2023 228

FINANCIAL STATISTICS 150

(R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20 2020 | 2021 | 2022 | 2023 | 2024 |

Final Final Final(rst) Final Final NOTES:KAPIndustrialsHoldingsLtd.renamedtoKAPLtd.on04April2023

Turnover 21 735 22 397 15 700 10 583 8 575 FINANCIAL STATISTICS

Op Inc 867 920 548 458 385 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

NetIntPd(Rcvd) 236 238 - 2 - - Interim Final Final(rst) Final Final

Minority Int 56 53 17 11 4 Turnover 15 355 29 062 29 628 27 979 23 956

Att Inc 395 427 396 321 275 Op Inc 1 153 2 250 2 523 2 936 2 102

TotCompIncLoss 451 479 414 332 278 NetIntPd(Rcvd) 517 825 794 499 466

Fixed Ass 1 436 1 412 1 317 1 546 1 526 Tax 163 213 352 578 506

Inv & Loans 84 71 59 61 61 Minority Int 59 114 72 20 67

Tot Curr Ass 4 232 4 510 4 656 3 370 2 928 Att Inc 405 1 090 528 1 746 991

Ord SH Int 3 197 2 930 2 691 2 288 2 028 TotCompIncLoss 514 1 013 830 1 902 825

Minority Int 185 156 131 110 99 Hline Erngs-CO 428 1 125 1 170 1 851 1 099

Fixed Ass 18 064 17 929 17 020 16 047 14 880

LT Liab 1 298 840 1 665 820 926 Tot Curr Ass 10 586 10 327 9 961 10101 7 733

Tot Curr Liab 3 535 4 307 3 851 2 594 2 221

Ord SH Int 12 952 12 475 11 542 11 531 10 250

PER SHARE STATISTICS (cents per share) Minority Int 261 300 277 219 199

HEPS-C (ZARc) 561.58 618.31 556.30 454.92 388.54 LT Liab 10 759 9 535 9 735 9 769 8 334

DPS (ZARc) 180.00 180.00 168.00 151.00 50.00 Tot Curr Liab 7 523 8 788 8 216 7 986 6 611

NAV PS (ZARc) 4 527.67 4 178.30 3 824.00 3 257.00 2 886.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.73 0.97 0.72 0.64 0.11 EPS (ZARc) 16.20 43.80 21.30 70.30 44.00

Price High 5 325 4 525 5 850 4 700 3 344 HEPS-C (ZARc) 17.20 45.30 47.30 74.40 43.00

Price Low 3 202 3 357 3 476 2 040 1 400 DPS (ZARc) - - - 29.00 15.00

Price Prd End 5 050 3 450 3 850 4 145 2 050 NAV PS (ZARc) 518.00 500.00 466.00 466.00 405.00

RATIOS 3 Yr Beta 0.97 0.63 0.90 2.02 2.08

Ret on SH Fnd 13.34 15.55 14.63 13.86 13.13 Price High 365 314 491 562 490

Oper Pft Mgn 3.99 4.11 3.49 4.33 4.49 Price Low 277 196 206 382 220

D:E 0.81 0.89 1.04 0.69 0.83 Price Prd End 307 285 270 440 413

Current Ratio 1.20 1.05 1.21 1.30 1.32 RATIOS

Div Cover 3.12 3.37 3.35 3.03 7.83 Ret on SH Fnd 7.02 9.42 5.08 15.03 10.13

Ret On Tot Ass 4.54 5.11 6.46 9.28 7.32

Oper Pft Mgn 7.51 7.74 8.52 10.49 8.77

D:E 0.80 0.77 0.81 0.79 0.70

Current Ratio 1.41 1.18 1.21 1.26 1.17

Div Cover - - - 2.42 2.93

135