Page 135 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 135

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – ISA

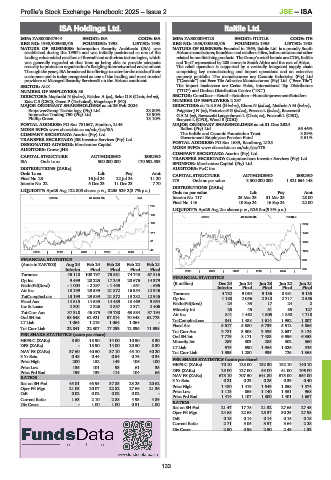

ISA Holdings Ltd. Italtile Ltd.

ISA ITA

ISIN: ZAE000067344 SHORT: ISA CODE: ISA ISIN: ZAE000099123 SHORT: ITLTILE CODE: ITE

REG NO: 1998/009608/06 FOUNDED: 1998 LISTED: 1998 REG NO: 1955/000558/06 FOUNDED: 1955 LISTED: 1988

NATURE OF BUSINESS: Information Security Architects (ISA) was NATURE OF BUSINESS: Founded in 1969, Italtile Ltd. is a proudly South

established during the 1990’s and was initially positioned as one of the Africanmanufacturer,franchisorandretaileroftiles,bathroomwareandother

leading value-added resellers of firewall and anti-virus technologies, which related home-finishing products. The Group’s retail brands are CTM, Italtile

was generally regarded at that time as being able to provide adequate and TopT represented by 208 stores in South Africa and the rest of Africa.

security to protect an organisation’s fledgling internetworked environment. The retail operation is supported by a vertically integrated supply chain

Through the years, ISA broadened its offerings to cater for the needs of their comprising key manufacturing and import operations and an extensive

customers and is today recognised as one of the leading and most trusted property portfolio. The manufacturers are Ceramic Industries (Pty) Ltd.

providers of Managed Security Services® on the African continent. (“Ceramic”) and Ezee Tile Adhesive Manufacturers (Pty) Ltd. (“Ezee Tile”).

SECTOR: AltX The import businesses are Cedar Point, International Tap Distributors

NUMBER OF EMPLOYEES: 36 (“ITD”) and Durban Distribution Centre (“DC”).

DIRECTORS: Maphothi N (ind ne), Naidoo A (ne), Seku O B (Chair, ind ne), SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers

Katz C S (CEO), Green P (Technical), Mogoboya P (FD) NUMBER OF EMPLOYEES: 2 297

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 DIRECTORS: du ToitSM(ld ind ne), Khoza N (ind ne), Mathole A M (ind ne),

EmpowerGroup Technology (Pty) Ltd. 23.80% Potgieter J N (ne), Pretorius S G (ind ne), Prezens L (ind ne), Ravazzotti

Interactive Trading 750 (Pty) Ltd. 13.90% GAM(ne), Ravazzotti Langenhoven L (Chair, ne), Foxcroft L (CEO),

Phillip Green 13.10% Booysen L (CFO), Wood B (COO)

POSTAL ADDRESS: PO Box 781667, Sandton, 2146 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

MORE INFO: www.sharedata.co.za/sdo/jse/ISA Rallen (Pty) Ltd. 56.46%

COMPANY SECRETARY: Acorim (Pty) Ltd. The Italtile and Ceramic Foundation Trust 3.89%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Government Employees Pension Fund 3.51%

DESIGNATED ADVISOR: Merchantec Capital POSTAL ADDRESS: PO Box 1689, Randburg, 2125

AUDITORS: Crowe JHB MORE INFO: www.sharedata.co.za/sdo/jse/ITE

COMPANY SECRETARY: Acorim (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISA Ords 1c ea 500 000 000 170 592 593

SPONSOR: Merchantec Capital (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: PwC Inc.

Ords 1c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 23 16 Jul 24 22 Jul 24 11.20 ITE Ords no par value 3 300 000 000 1 321 654 148

Interim No 22 5 Dec 23 11 Dec 23 7.70

DISTRIBUTIONS [ZARc]

LIQUIDITY: Apr25 Avg 122 800 shares p.w., R235 529.2(3.7% p.a.) Ords no par value Ldt Pay Amt

SCOM 40 Week MA ISA Interim No 117 25 Mar 25 31 Mar 25 28.00

Final No 116 10 Sep 24 16 Sep 24 22.00

225

LIQUIDITY: Apr25 Avg 2m shares p.w., R26.8m(9.3% p.a.)

189

GERE 40 Week MA ITLTILE

153 2012

117 1749

81 1485

45

2020 | 2021 | 2022 | 2023 | 2024 | 1222

FINANCIAL STATISTICS 959

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Interim Final Final Final Final 2020 | 2021 | 2022 | 2023 | 2024 | 695

Turnover 45 118 100 797 75 581 74 743 67 316

Op Inc 9 499 20 225 17 249 20 676 14 379 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 1 004 - 2 297 - 1 455 - 551 - 696 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Final

Final

Final

Att Inc 13 199 29 539 21 872 16 354 12 946 Turnover Interim 9 064 9 136 Final 9 135

8 981

4 782

TotCompIncLoss 13 199 29 539 21 872 19 232 12 946 Op Inc 1 180 2 056 2 318 2 717 2 556

Fixed Ass 14 615 14 535 14 489 13 469 9 654 NetIntPd(Rcvd) - 24 - 33 17 24 2

Inv & Loans 2 301 2 326 2 357 2 371 2 406 Minority Int 25 45 51 85 127

Tot Curr Ass 37 318 46 875 49 738 63 584 57 194 Att Inc 841 1 462 1 605 1 850 1 718

Ord SH Int 58 648 62 921 57 814 70 348 62 773 TotCompIncLoss 841 1 488 1 614 1 952 1 807

LT Liab 1 064 1 219 1 064 1 064 - Fixed Ass 5 617 5 680 5 739 5 512 4 866

Tot Curr Liab 22 841 22 307 17 293 12 895 11 698

Tot Curr Ass 3 781 3 908 3 335 2 637 3 124

PER SHARE STATISTICS (cents per share) Ord SH Int 7 779 8 171 7 483 6 696 6 353

HEPS-C (ZARc) 8.50 18.90 14.00 10.50 8.30 Minority Int 289 303 285 302 360

DPS (ZARc) - 18.90 14.00 20.50 8.30 LT Liab 679 690 1 066 1 026 526

NAV PS (ZARc) 37.60 40.50 37.10 45.10 40.20 Tot Curr Liab 1 395 1 280 935 725 1 368

3 Yr Beta 0.48 0.44 0.54 0.75 0.34 PER SHARE STATISTICS (cents per share)

Price High 200 152 149 106 100 HEPS-C (ZARc) 70.10 123.00 132.30 152.10 140.10

Price Low 135 101 93 61 35 DPS (ZARc) 28.00 127.00 53.00 61.00 106.00

Price Prd End 199 139 114 104 66 NAV PS (ZARc) 678.10 707.50 641.80 575.00 554.00

RATIOS 3 Yr Beta 0.21 0.23 0.25 0.39 0.40

Ret on SH Fnd 45.01 46.95 37.83 23.25 20.62 Price High 1 480 1 419 1 649 1 858 1 874

Oper Pft Mgn 21.05 20.07 22.82 27.66 21.36 Price Low 1 113 865 1 140 1 351 968

D:E 0.02 0.02 0.02 0.02 - Price Prd End 1 414 1 107 1 300 1 401 1 667

Current Ratio 1.63 2.10 2.88 4.93 4.89 RATIOS

Div Cover - 1.00 1.00 0.51 1.00

Ret on SH Fnd 21.47 17.78 21.32 27.65 27.48

Oper Pft Mgn 24.68 22.68 25.37 30.25 27.98

D:E 0.15 0.14 0.14 0.15 0.15

Current Ratio 2.71 3.05 3.57 3.64 2.28

Div Cover 2.50 0.96 2.50 2.49 1.33

133