Page 125 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 125

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – GRI

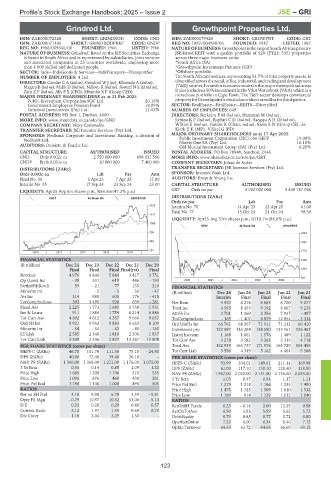

Grindrod Ltd. Growthpoint Properties Ltd.

GRI GRO

ISIN: ZAE000072328 SHORT: GRINDROD CODE: GND ISIN: ZAE000179420 SHORT: GROWPNT CODE: GRT

ISIN: ZAE000071106 SHORT: GRINDRODPREF CODE: GNDP REG NO: 1987/004988/06 FOUNDED: 1987 LISTED: 1987

REG NO: 1966/009846/06 FOUNDED: 1966 LISTED: 1986 NATUREOF BUSINESS:Growthpointisthe largestSouth Africanprimary

NATURE OF BUSINESS: Grindrod, listed on the JSE Securities Exchange, JSE-listed REIT with a quality portfolio of 528 (FY23: 535) properties

is based in South Africa and is represented by subsidiaries, joint venture across three major business units:

and associated companies in 23 countries worldwide, employing more *South Africa (SA)

than 4 000 skilled and dedicated people. *Growthpoint Investment Partners (GIP)

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer *Offshore portfolio.

NUMBER OF EMPLOYEES: 4 162 The South African business, representing 53.7% of total property assets, is

DIRECTORS: Carolus C A (ind ne), Grindrod W J (ne), Khumalo A (ind ne), diversifiedacrosstheretail,office, industrial,andtradinganddevelopment

Magara B (ind ne), Malik D (ind ne), Ndlovu R (ind ne), Sowazi N L (ld ind ne), (T&D) sectors, located in economic nodes in the major metropolitan areas.

Zatu Z P (ind ne), Ally F B (CFO), Mbambo X F (Group CEO) It also includes a 50% investment in the V&A Waterfront (V&A) which is a

MAJOR ORDINARY SHAREHOLDERS as at 21 Feb 2025 mixed-use portfolio in Cape Town. The T&D sector develops commercial

Public Investment Corporation SOC Ltd. 20.18% propertyforGrowthpoint’sownbalancesheetaswellasforthirdparties.

Government Employees Pension Fund 18.09% SECTOR: RealEstate—RealEstate—REITS—Diversified

Grindrod Investments (Pty) Ltd. 11.02% NUMBER OF EMPLOYEES: 649

POSTAL ADDRESS: PO Box 1, Durban, 4000 DIRECTORS: BerkeleyFM(ind ne), Hamman M (ind ne),

MORE INFO: www.sharedata.co.za/sdo/jse/GND LebinaKP(ind ne), RaphiriCD(ind ne), SangquAH(ld ind ne),

COMPANY SECRETARY: Vicky Commaille Wilton E (ind ne), Gasant R (Chair, ind ne), Sasse L N (Group CE), de

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Klerk E K (MD), Völkel G (FD)

SPONSORS: Nedbank Corporate and Investment Banking, a division of MAJOR ORDINARY SHAREHOLDERS as at 17 Apr 2025

Nedbank Ltd. Public Investment Corporation (PIC) obo GEPF 19.00%

AUDITORS: Deloitte & Touche Inc. Ninety One SA (Pty) Ltd. 10.10%

6.20%

Old Mutual Investment Group (SA) (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED POSTAL ADDRESS: PO Box 78949, Sandton, 2146

GND Ords 0.002c ea 2 750 000 000 698 031 586 MORE INFO: www.sharedata.co.za/sdo/jse/GRT

GNDP Prefs 0.031c ea 20 000 000 7 400 000 COMPANY SECRETARY: Johan de Koker

DISTRIBUTIONS [ZARc] TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Ords 0.002c ea Ldt Pay Amt SPONSOR: Investec Bank Ltd.

Final No 36 1 Apr 25 7 Apr 25 17.00 AUDITORS: Ernst & Young Inc.

Interim No 35 17 Sep 24 23 Sep 24 23.00 CAPITAL STRUCTURE AUTHORISED ISSUED

GRT Ords no par 5 000 000 000 3 430 787 066

LIQUIDITY: Apr25 Avg 6m shares p.w., R86.5m(47.2% p.a.)

DISTRIBUTIONS [ZARc]

INDT 40 Week MA GRINDROD

Ords no par Ldt Pay Amt

1576 Interim No 78 14 Apr 25 22 Apr 25 61.00

Final No 77 15 Oct 24 21 Oct 24 58.30

1317

LIQUIDITY: Apr25 Avg 57m shares p.w., R718.7m(85.8% p.a.)

1058

REIV 40 Week MA GROWPNT

799 2344

540 2062

281 1779

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 1496

(R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Final Final Final Final(rst) Final 1214

Revenue 4 976 4 846 5 884 3 417 3 751

931

Op (Loss) Inc - 39 531 619 446 - 193 2020 | 2021 | 2022 | 2023 | 2024 |

NetIntPd(Rcvd) 59 - 21 77 135 210 FINANCIAL STATISTICS

Minority Int - - 2 - 3 30 - 47 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Att Inc 314 988 601 176 - 415 Interim Final Final Final Final

TotCompIncLoss 503 1 490 920 639 - 281 Net Rent 4 470 8 218 8 883 8 700 9 077

Fixed Ass 2 225 1 773 1 681 1 738 1 951 Total Inc 4 593 8 453 9 192 8 867 9 215

Inv & Loans 911 1 886 1 754 8 214 6 886 Attrib Inc 2 701 1 269 2 356 7 937 - 497

Tot Curr Ass 4 892 4 612 4 357 9 666 9 657 TotCompIncLoss - 169 - 1 407 6 879 12 854 - 3 314

Ord SH Int 9 921 9 932 8 883 8 623 8 109 Ord UntHs Int 66 761 68 267 71 911 71 212 66 410

Minority Int - 54 - 54 - 62 - 45 - 150 Investment pro 122 597 135 294 138 590 133 161 126 452

LT Liab 2 585 2 348 1 818 2 306 1 837 Listed Investm 1 168 1 661 1 576 1 489 1 122

Tot Curr Liab 2 309 2 346 2 827 14 267 13 808 Tot Curr Ass 3 218 3 582 5 263 5 315 4 718

PER SHARE STATISTICS (cents per share) Total Ass 152 939 165 737 171 976 164 729 154 455

HEPS-C (ZARc) 46.70 151.70 111.50 75.10 - 24.80 Tot Curr Liab 3 556 4 349 5 162 4 464 5 388

DPS (ZARc) 40.00 72.40 39.40 20.10 - PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 1 366.00 1 368.00 1 211.00 1 176.00 1 075.00 HEPS-C (ZARc) 93.99 104.01 149.61 211.14 169.98

3 Yr Beta 0.36 0.14 0.85 1.09 1.20 DPS (ZARc) 61.00 117.10 130.10 128.40 118.50

Price High 1 609 1 200 1 198 570 535 NAV PS (ZARc) 1 967.00 2 020.00 2 151.00 2 158.00 2 023.00

Price Low 1 096 876 460 430 281 3 Yr Beta 1.03 0.97 0.94 1.17 1.11

Price Prd End 1 196 1 146 1 000 495 505 Price Prd End 1 273 1 218 1 166 1 235 1 490

RATIOS Price High 1 475 1 325 1 509 1 610 1 532

Ret on SH Fnd 3.18 9.98 6.78 2.39 - 5.81 Price Low 1 189 914 1 129 1 212 1 040

Oper Pft Mgn - 0.79 10.97 10.52 13.06 - 5.14 RATIOS

D:E 0.32 0.28 0.29 0.49 0.57 RetOnSH Funds 6.23 - 0.14 2.00 12.35 0.58

Current Ratio 2.12 1.97 1.54 0.68 0.70 RetOnTotAss 6.90 5.85 5.99 5.65 5.72

Div Cover 1.18 2.04 2.29 1.30 - Debt:Equity 0.79 0.85 0.77 0.72 0.80

OperRetOnInv 7.22 6.00 6.34 6.46 7.12

OpInc:Turnover 64.63 63.72 64.65 66.68 69.15

123