Page 129 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 129

Profile’s Stock Exchange Handbook: 2025 – Issue 2 JSE – HOS

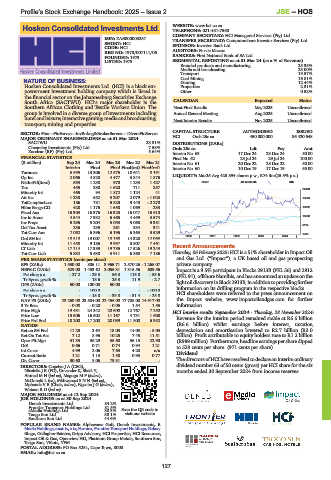

WEBSITE: www.hci.co.za

Hosken Consolidated Investments Ltd. TELEPHONE: 021-481-7560

HOS COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd.

ISIN: ZAE000003257 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SHORT: HCI SPONSOR: Investec Bank Ltd.

CODE: HCI

REG NO: 1973/007111/06 AUDITORS: Forvis Mazars

FOUNDED: 1973 BANKERS: First National Bank of SA Ltd.

LISTED: 1973 SEGMENTAL REPORTING as at 31 Mar 24 (asa%of Revenue)

Branded products and manufacturing 25.35%

Media and broadcasting 23.00%

Transport 19.57%

Coal Mining 16.81%

NATURE OF BUSINESS: Gaming 12.44%

Hosken Consolidated Investments Ltd. (HCI) is a black em- Properties 2.31%

powerment investment holding company which is listed in Other 0.52%

the financial sector on the Johannesburg Securities Exchange

South Africa (SACTWU). HCI’s major shareholder is the CALENDAR Expected Status

Southern African Clothing and Textile Workers Union. The Next Final Results May 2025 Unconfirmed

group is involved in a diverse group of investments including Annual General Meeting Aug 2025 Unconfirmed

hotelandleisure; interactivegaming;media andbroadcasting; Next Interim Results Nov 2025 Unconfirmed

transport; mining and properties.

CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 HCI Ords 25c ea 450 000 000 86 420 648

SACTWU 23.31% DISTRIBUTIONS [ZARc]

Chearsley Investments (Pty) Ltd. 7.58% Ords 25c ea Ldt Pay Amt

Zarclear (RF) (Pty) Ltd. 5.64%

Interim No 63 17 Dec 24 23 Dec 24 50.00

FINANCIAL STATISTICS Final No 62 23 Jul 24 29 Jul 24 100.00

(R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 Interim No 61 20 Dec 22 28 Dec 22 50.00

Interim Final Final Final(rst) Final(rst) Interim No 60 10 Dec 19 17 Dec 19 55.00

Turnover 6 595 13 306 12 576 10 641 8 191

Op Inc 2 066 4 828 4 477 3 844 1 876 LIQUIDITY: Mar25 Avg 423 894 shares p.w., R74.3m(25.5% p.a.)

NetIntPd(Rcvd) 593 1 230 970 1 233 1 427 GENF 40 Week MA HCI

Tax 455 388 1 620 711 257

24000

Minority Int 465 94 1 872 1 124 41

Att Inc 1 238 652 3 207 2 079 - 1 023 19546

TotCompIncLoss 186 781 5 823 3 440 - 2 270

Hline Erngs-CO 428 1 176 1 658 1 069 233 15092

Fixed Ass 16 303 16 376 16 325 16 047 16 610

Inv in Assoc 4 544 7 932 6 465 4 459 3 574 10638

Inv Props 5 296 5 204 5 053 5 068 5 381

6184

Def Tax Asset 236 235 261 334 341

Tot Curr Ass 7 062 6 396 6 196 6 363 5 529 1730

Ord SH Int 18 810 19 007 18 168 14 320 12 063 2020 | 2021 | 2022 | 2023 | 2024 |

Minority Int 11 458 9 186 9 997 8 507 7 461

LT Liab 17 114 17 389 19 786 17 526 19 243 Recent Announcements

Tot Curr Liab 5 832 5 638 3 911 6 868 7 186 Thursday, 06 February 2025: HCI is a 51% shareholder in Impact Oil

PER SHARE STATISTICS (cents per share) and Gas Ltd. (“Impact”), a UK based oil and gas prospecting

EPS (ZARc) 1 530.00 806.11 3 965.71 2 570.26 - 1 265.07 private company.

HEPS-C (ZARc) 529.00 1 453.62 2 056.31 1 315.56 609.56 Impact is a 9.5% participant in Blocks 2913B (PEL 56) and 2912

Pct chng p.a. - 27.2 - 29.3 56.3 115.8 - 53.6 (PEL 91), offshore Namibia, and has announced an update on the

Tr 5yr av grwth % - 18.6 25.3 11.9 - 2.7 lightoildiscoveryinBlock2913B,inadditiontoprovidingfurther

DPS (ZARc) 50.00 100.00 50.00 - -

Pct chng p.a. - 100.0 - - - 100.0 informationonits drilling programinthe respective blocks.

Tr 5yr av grwth % - - 15.8 - 33.8 - 31.4 - 28.8 HCI shareholders were referred to the press announcement on

NAV PS (ZARc) 23 260.00 23 504.00 22 466.00 17 708.00 14 917.00 the Impact website, www.impactoilandgas.com for further

3 Yr Beta - 0.08 - 0.20 - 0.06 1.54 1.56 information.

Price High 19 481 24 342 20 600 12 767 7 250 HCI interim results September 2024 - Thursday, 28 November 2024:

Price Low 15 606 16 502 11 167 4 731 1 600

Price Prd End 18 200 17 200 20 089 11 800 6 352 Revenue for the interim period remained stable at R6.6 billion

RATIOS (R6.6 billion) whilst earnings before interest, taxation,

Ret on SH Fnd 11.25 2.64 18.03 14.03 - 5.03 depreciation and amortisation lowered to R2.7 billion (R3.0

Ret On Tot Ass 7.12 8.96 10.25 7.45 11.51 billion). Profit attributable to equity holders rose to R1.2 billion

Oper Pft Mgn 31.33 36.29 35.60 36.13 22.90 (R989million).Furthermore,headlineearningspersharedipped

D:E 0.66 0.71 0.74 0.94 1.21 to 529 cents per share (971 cents per share).

Int Cover 4.99 2.06 7.63 4.20 n/a

Current Ratio 1.21 1.13 1.58 0.93 0.77 Dividend

Div Cover 30.60 8.06 79.31 - - The directors of HCI have resolved to declare an interim ordinary

DIRECTORS: Copelyn J A (CEO), dividend number 63 of 50 cents (gross) per HCI share for the six

Nicolella J R (FD), Govender K, Shaik Y, months ended 30 September 2024 from income reserves.

Ahmed M H (ind ne), Magugu M F (ind ne),

McDonald L (ne), Mkhwanazi S N N (ind ne),

Mphande V E (Chair, ind ne), Ngcobo J G (ind ne),

Watson R D (ind ne)

MAJOR HOLDINGS as at 12 Sep 2024

JOR HOLDINGS as at 30 Sep 2024

Deneb Investments Ltd. 84.2%

Frontier Transport Holdings Ltd. 81.5%

eMedia Holdings Ltd. 80.3% Scan the QR code to

Tsogo Sun Ltd. 50.1% visit our website

Southern Sun Ltd. 44.6%

POPULAR BRAND NAMES: Alphawave Golf, Deneb Investments, E

Media Holdings,e sat.tv, e.tv, Formex, FrontierTransportHoldings,Galaxy

Bingo, Gallagher Estates, Gripp Advisory, HCI Properties, HCI Resources,

Impact Oil & Gas, Openview HD, Platinum Group Metals, Southern Sun,

Tsogo Sun, VSlots, YFM

POSTAL ADDRESS: PO Box 5251, Cape Town, 8000

EMAIL: info@hci.co.za

127