Page 128 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 128

JSE – HER Profile’s Stock Exchange Handbook: 2025 – Issue 2

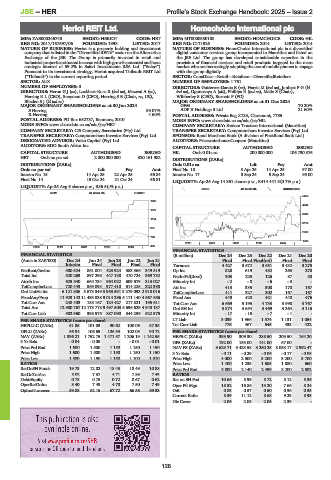

Heriot REIT Ltd. Homechoice International plc

HER HOM

ISIN: ZAE000246740 SHORT: HERIOT CODE: HET ISIN: MT0000850108 SHORT: HOMCHOICE CODE: HIL

REG NO: 2017/167697/06 FOUNDED: 1998 LISTED: 2017 REG NO: C171926 FOUNDED: 2014 LISTED: 2014

NATURE OF BUSINESS: Heriot is a property holding and investment NATURE OF BUSINESS: HomeChoice International plc is a diversified

company that is listed in the “Diversified REITs” sector on the Alternative digital consumer services group incorporated in Mauritius and listed on

Exchange of the JSE. The Group is primarily invested in retail and the JSE Ltd. The group has developed considerable expertise in the

industrial properties situated in areas with high growth potential and has a provision of financial services and retail products targeted to the mass

strategic interest of 59.2% in Safari Investments RSA Ltd. (“Safari”). market who are increasingly adopting the use of mobile phones to engage

Pursuant to its investment strategy, Heriot acquired Thibault REIT Ltd. with the group digitally.

(“Thibault”) in the current reporting period. SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

SECTOR: AltX NUMBER OF EMPLOYEES: 1 761

NUMBER OF EMPLOYEES: 0 DIRECTORS: Gutierrez-Garcia E (ne), Harris M (ind ne), JoubertPG(ld

DIRECTORS: HeronGJ(ne), Lockhart-Ross R (ind ne), Mazwai A (ne), ind ne), Ogunsanya A (alt), Phillips R (ind ne), Maltz S (Chair),

Herring R L (CEO), Snoyman D (CFO), Herring S B (Chair, ne, UK), Wibberley S (CEO), Burnett P (FD)

BliedenSJ(ld ind ne) MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 GFM 70.20%

S Herring 89.07% ADP II Holdings 3 Ltd. 21.60%

R Herring 4.60% POSTAL ADDRESS: Private Bag X123, Claremont, 7735

POSTAL ADDRESS: PO Box 652737, Benmore, 2010 MORE INFO: www.sharedata.co.za/sdo/jse/HIL

MORE INFO: www.sharedata.co.za/sdo/jse/HET COMPANY SECRETARY: Sanlam Trustees International (Mauritius)

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

DESIGNATED ADVISOR: Valeo Capital (Pty) Ltd. AUDITORS: PricewaterhouseCoopers (Mauritius)

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED HIL Ords 0.01c ea 200 000 000 106 730 376

HET Ords no par val 2 000 000 000 320 161 982

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.01c ea Ldt Pay Amt

Ords no par val Ldt Pay Amt Final No 18 8 Apr 25 14 Apr 25 97.00

Interim No 15 14 Apr 25 22 Apr 25 56.84 Interim No 17 3 Sep 24 9 Sep 24 95.00

Final No 14 15 Oct 24 21 Oct 24 56.81

LIQUIDITY: Apr25 Avg 14 861 shares p.w., R414 441.3(0.7% p.a.)

LIQUIDITY: Apr25 Avg 6 shares p.w., R86.5(-% p.a.)

GERE 40 Week MA HOMCHOICE

REIV 40 Week MA HERIOT

5255

1600

4544

1377

3834

1154

3124

931

2413

708

1703

2020 | 2021 | 2022 | 2023 | 2024 |

486

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

(Amts in ZAR’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Final Final Final(rst) Final Final

Interim Final Final Final Final Turnover 4 427 3 672 3 651 3 432 3 275

NetRent/InvInc 500 524 861 004 423 924 383 366 349 519 Op Inc 820 619 482 263 270

Total Inc 520 263 897 298 447 138 410 724 369 732 NetIntPd(Rcvd) 303 225 126 87 88

Attrib Inc 629 840 664 734 964 022 609 579 313 027 Minority Int - 2 - 8 - 6 - 3 -

TotCompIncLoss 720 443 869 093 977 410 614 225 322 398 Att Inc 413 335 308 170 167

Ord UntHs Int 6 121 806 5 673 349 3 953 591 3 279 093 2 918 016 TotCompIncLoss 411 327 302 167 167

FixedAss/Prop 11 923 142 11 493 038 9 014 296 5 111 140 4 667 686 Fixed Ass 449 428 421 448 476

Tot Curr Ass 248 403 185 167 124 427 217 821 195 611 Tot Curr Ass 6 669 5 195 4 733 3 998 3 767

Total Ass 12 980 767 12 173 778 9 497 503 5 696 629 4 948 137 Ord SH Int 3 874 3 654 3 469 3 264 3 116

Tot Curr Liab 502 960 398 575 887 090 344 236 522 575 Minority Int - 17 - 15 - 7 - 1 -

PER SHARE STATISTICS (cents per share) LT Liab 3 039 1 966 1 574 1 131 1 054

HEPLU-C (ZARc) 51.86 101.03 90.62 100.06 87.35 Tot Curr Liab 776 467 545 433 422

DPLU (ZARc) 56.84 106.69 106.33 102.05 90.72 PER SHARE STATISTICS (cents per share)

NAV (ZARc) 1 896.21 1 752.75 1 471.57 1 206.19 1 142.55 HEPS-C (ZARc) 393.90 309.30 288.50 203.50 164.20

3 Yr Beta - 0.04 - 0.05 - - 0.01 - 0.01 DPS (ZARc) 192.00 153.00 141.00 67.00 -

Price Prd End 1 600 1 500 1 150 1 150 1 150 NAV PS (ZARc) 3 629.71 3 423.58 3 250.25 3 058.17 2 992.47

Price High 1 600 1 500 1 150 1 150 1 150 3 Yr Beta - 0.11 - 0.29 - 0.06 - 0.17 - 0.08

Price Low 1 500 1 150 1 150 1 100 1 010 Price High 4 000 2 500 3 200 3 200 3 700

RATIOS Price Low 1 400 1 235 1 685 1 880 660

RetOnSH Funds 19.73 12.82 18.43 18.49 10.88 Price Prd End 3 000 2 140 2 499 3 200 2 502

RetOnTotAss 8.02 7.37 4.71 7.89 7.43 RATIOS

Debt:Equity 0.73 0.75 0.72 0.67 0.62 Ret on SH Fnd 10.66 8.99 8.72 5.12 5.36

OperRetOnInv 8.40 7.49 4.70 7.50 7.49 Oper Pft Mgn 18.52 16.86 13.20 7.66 8.24

OpInc:Turnover 59.83 62.15 67.72 66.56 69.33 D:E 0.83 0.57 0.50 0.36 0.35

Current Ratio 8.59 11.12 8.68 9.23 8.93

Div Cover 2.06 2.05 2.05 2.39 -

126