Page 120 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 120

JSE – FOR Profile’s Stock Exchange Handbook: 2025 – Issue 2

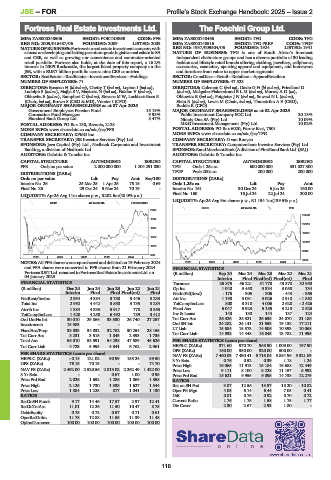

Fortress Real Estate Investments Ltd. The Foschini Group Ltd.

FOR FOS

ISIN: ZAE000248506 SHORT: FORTRESSB CODE: FFB ISIN: ZAE000148466 SHORT: TFG CODE: TFG

REG NO: 2009/016487/06 FOUNDED: 2009 LISTED: 2009 ISIN: ZAE000148516 SHORT: TFG PREF CODE: TFGP

NATUREOF BUSINESS:Fortressisarealestateinvestmentcompanywith REG NO: 1937/009504/06 FOUNDED: 1924 LISTED: 1941

a focus on developing and letting premium-grade logistics real estate in SA NATURE OF BUSINESS: TFG is one of South Africa’s foremost

and CEE, as well as growing our convenience and commuter-oriented independent chain-store groups and has a diverse portfolio of 30 leading

retail portfolio. Fortress also holds, at the date of this report, a 16.2% fashion and lifestyle retail brands offering clothing, jewellery, cellphones,

interest in NEPI Rockcastle, the largest listed property company on the accessories, cosmetics, sporting apparel and equipment, and homeware

JSE, with a EUR7 billion portfolio across nine CEE countries. and furniture from value to upper market segments.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers

NUMBER OF EMPLOYEES: 71 NUMBER OF EMPLOYEES: 47 523

DIRECTORS: BosmanH(ld ind ne), Chetty T (ind ne), Lopion I (ind ne), DIRECTORS: Coleman C (ind ne), DavinGH(ld ind ne), Friedland D

Ludolph S (ind ne), MajijaSV,MayiselaN(ind ne), Naidoo V (ind ne), (ind ne), Makgabo-FiskerstrandBLM(ind ne), MurrayAD(ne),

Oblowitz E (ind ne), Rampheri C (ind ne), Stevens M W, Lockhart-Ross R Oblowitz E (ind ne), PotgieterJN(ind ne), SowaziNL(ind ne),

(Chair, ind ne), Brown S (CEO & MD), Vorster I (CFO) Stein R (ind ne), Lewis M (Chair, ind ne), Thunström A E (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 07 Apr 2025 Buddle R (CFO)

Government Employees Pension Fund 15.19% MAJOR ORDINARY SHAREHOLDERS as at 02 Apr 2025

Coronation Fund Managers 9.93% Public Investment Company SOC Ltd. 20.13%

Standard Bank Group Ltd. 8.47% Ninety One SA (Pty) Ltd. 10.09%

POSTAL ADDRESS: PO Box 138, Rivonia, 2128 M&G Investment Management (Pty) Ltd. 10.02%

MORE INFO: www.sharedata.co.za/sdo/jse/FFB POSTAL ADDRESS: PO Box 6020, Parow East, 7501

COMPANY SECRETARY: KPMG Inc. MORE INFO: www.sharedata.co.za/sdo/jse/TFG

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: D van Rooyen

SPONSORS: Java Capital (Pty) Ltd., Nedbank Corporate and Investment TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Banking, a division of Nedbank Ltd. SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: Deloitte & Touche Inc. AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

FFB Ords no par value 2 000 000 000 1 204 291 830 TFG Ords 1.25c ea 600 000 000 331 027 300

TFGP Prefs 200c ea 200 000 200 000

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Scr/100 DISTRIBUTIONS [ZARc]

Interim No 26 25 Mar 25 1 Apr 25 76.15 0.69 Ords 1.25c ea Ldt Pay Amt

Final No 25 29 Oct 24 5 Nov 24 70.19 - Interim No 161 30 Dec 24 6 Jan 25 160.00

Final No 160 16 Jul 24 22 Jul 24 200.00

LIQUIDITY: Apr25 Avg 11m shares p.w., R202.6m(48.0% p.a.)

LIQUIDITY: Apr25 Avg 9m shares p.w., R1 194.1m(139.5% p.a.)

REIV 40 Week MA FORTRESSB

GERE 40 Week MA TFG

2060

23590

1814

20116

1568

16641

1322

13167

1076

9692

830

2020 | 2021 | 2022 | 2023 | 2024 |

6218

NOTES: All FFB shares were repurchased and delisted on 19 February 2024 2020 | 2021 | 2022 | 2023 | 2024 |

and FFA shares were converted to FFB shares from 21 February 2024. FINANCIAL STATISTICS

FortressREITLtd.renamedtoFortressRealEstateInvestmentsLtd.on (R million) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

04 January 2023.

Interim Final Final(rst) Final(rst) Final

FINANCIAL STATISTICS Turnover 25 875 56 221 51 778 43 370 32 950

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Op Inc 1 048 3 450 3 334 3 058 134

Interim Final Final Final(rst) Final NetIntPd(Rcvd) - 176 - 305 - 306 - 443 - 365

NetRent/InvInc 2 934 4 384 3 788 3 446 3 233 Att Inc 1 198 3 031 3 026 2 910 - 1 862

Total Inc 2 992 4 442 3 850 3 735 3 284 TotCompIncLoss 800 3 310 4 006 2 628 - 2 426

Attrib Inc 1 384 4 333 5 917 778 3 353 Fixed Ass 6 047 5 923 5 185 3 210 2 525

TotCompIncLoss 1 420 4 258 6 492 789 3 412 Inv & Loans 140 138 144 137 124

Ord UntHs Int 30 010 29 866 33 330 26 740 27 257 Tot Curr Ass 26 326 25 321 26 635 24 070 21 186

Investments 15 983 - - - - Ord SH Int 24 282 24 141 21 653 19 138 17 211

FixedAss/Prop 33 833 34 032 32 782 30 254 28 155 LT Liab 15 684 15 573 14 606 10 393 10 068

Tot Curr Ass 3 231 3 515 1 843 2 393 1 735 Tot Curr Liab 14 938 14 448 16 845 13 782 11 995

Total Ass 55 010 53 591 54 238 47 589 45 626 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 4 723 5 995 4 341 6 762 2 961 HEPS-C (ZARc) 371.60 970.70 968.90 1 009.00 197.90

DPS (ZARc) 160.00 350.00 320.00 500.00 -

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 7 460.03 7 430.41 6 716.04 5 884.96 5 321.89

HEPS-C (ZARc) - 0.14 121.02 90.99 153.24 89.50 3 Yr Beta 0.76 0.52 0.39 1.18 1.24

DPS (ZARc) 76.15 70.19 - - 74.70 Price High 16 065 11 913 15 184 16 688 12 449

NAV PS (ZARc) 2 492.00 2 520.56 2 813.02 2 262.49 1 422.00

Price Low 9 111 8 100 8 228 11 157 5 992

3 Yr Beta - - 0.67 1.00 0.95 Price Prd End 15 621 9 955 9 095 14 738 12 279

Price Prd End 2 026 1 652 1 286 1 069 1 358 RATIOS

Price High 2 125 1 730 1 338 1 627 1 544 Ret on SH Fnd 9.87 12.56 13.97 15.20 - 10.82

Price Low 1 584 1 225 877 1 041 1 130 Oper Pft Mgn 4.05 6.14 6.44 7.05 0.41

RATIOS D:E 0.81 0.76 0.92 0.70 0.72

RetOnSH Funds 9.17 14.46 17.57 2.97 12.41 Current Ratio 1.76 1.75 1.58 1.75 1.77

RetOnTotAss 11.01 12.26 11.50 10.47 8.75 Div Cover 2.30 2.67 2.93 1.80 -

Debt:Equity 0.75 0.72 0.57 0.71 0.61

OperRetOnInv 11.78 12.88 11.55 11.39 11.48

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

118