Page 116 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 116

JSE – EXX Profile’s Stock Exchange Handbook: 2025 – Issue 2

Exxaro Resources Ltd. CALENDAR Expected Status

Annual General Meeting 15 May 2025 Confirmed

EXX

Next Interim Results 21 Aug 2025 Confirmed

Next Final Results Mar 2026 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 349 305 092

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Final No 44 6 May 25 12 May 25 866.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Interim No 43 1 Oct 24 7 Oct 24 796.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001

Final No 42 7 May 24 13 May 24 1010.00

Special No 6 7 May 24 13 May 24 572.00

NATURE OF BUSINESS:

Exxaro, a public company incorporated in South Africa and LIQUIDITY: May25 Avg 6m shares p.w., R911.2m(82.3% p.a.)

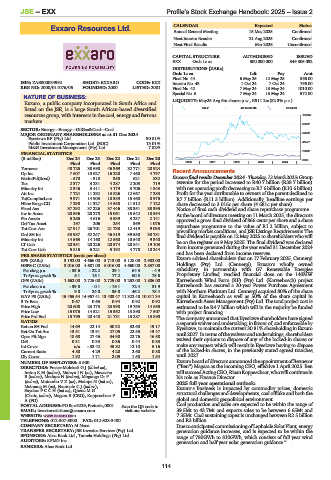

listed on the JSE, is a large South African-based diversified OILP 40 Week MA EXXARO

resources group, with interests in the coal, energy and ferrous 101842

markets.

83087

SECTOR: Energy—Energy—OilGas&Coal—Coal

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 64332

Eyesizwe RF (Pty) Ltd. 30.81%

Public Investment Corporation Ltd. (SOC) 13.01% 45577

M&G Investment Management (Pty) Ltd. 7.82%

26822

FINANCIAL STATISTICS

(R million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 8066

Final Final Final Final Final 2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 40 725 38 698 46 369 32 771 28 924

Op Inc 7 607 10 627 16 220 7 460 4 797 Recent Announcements

NetIntPd(Rcvd) - 570 - 318 358 621 832 Exxarofinal resultsDecember2024 -Thursday,13March2025:Group

Tax 2 377 3 231 4 287 2 203 719 revenuefor theperiodincreased to R40.7 billion (R38.7 billion)

Minority Int 2 346 3 411 4 179 3 706 1 943 with net operating profit decreasing to R7.6 billion (R10.6 billion).

Att Inc 7 724 11 292 13 826 12 667 7 283 Profit for the year attributable to owners of the parent declined to

TotCompIncLoss 9 971 14 903 18 389 15 460 8 975 R7.7 billion (R11.3 billion). Additionally, headline earnings per

Hline Erngs-CO 7 298 11 327 14 558 11 512 7 122 share decreased to 3 016c per share (4 681c per share).

Fixed Ass 37 292 37 226 37 446 38 351 38 395 Notice of final cash dividend and share repurchase programme

Inv in Assoc 20 596 20 278 15 061 15 542 18 594 At the board of directors meeting on 11 March 2025, the directors

Fin Assets 5 266 4 616 3 539 3 237 2 141 approved a gross final dividend of 866 cents per share and a share

Def Tax Asset 197 206 254 369 1 076 repurchase programme to the value of R1.2 billion, subject to

Tot Curr Ass 27 917 26 701 21 788 12 419 9 033 prevailing market conditions, and JSE Listings Requirements.The

Ord SH Int 53 987 52 247 46 819 39 550 38 781 final dividend is payable on 12 May 2025 to shareholders who will

Minority Int 14 563 14 160 12 560 10 548 9 340

LT Liab 20 351 20 226 20 574 20 841 19 103 be on the register on 9 May 2025. The final dividend was declared

Tot Curr Liab 5 815 6 221 5 192 4 778 10 244 from income generated during the year ended 31 December 2024

and has been declared from income reserves.

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 3 192.00 4 666.00 5 713.00 5 128.00 2 902.00 Exxaro advised shareholders that on 17 February 2025, Cennergi

HEPS-C (ZARc) 3 016.00 4 681.00 6 016.00 4 660.00 2 837.00 Holdings (Pty) Ltd. (Cennergi), Exxaro’s wholly owned

Pct chng p.a. - 35.6 - 22.2 29.1 64.3 - 4.9 subsidiary, in partnership with G7 Renewable Energies

Tr 5yr av grwth % 6.1 16.1 77.2 60.8 78.6 Proprietary Limited, reached financial close on the 140MW

DPS (ZARc) 1 662.00 2 725.00 2 729.00 3 252.00 1 886.00 Karreebosch Wind Farm (RF) (Pty) Ltd. (Karreebosch) project.

Pct chng p.a. - 39.0 - 0.1 - 16.1 72.4 31.9 Karreebosch has secured a 20-year Power Purchase Agreement

Tr 5yr av grwth % 9.8 24.0 35.0 46.2 78.4 with Northam Platinum Ltd. Cennergi acquired 80% of the share

NAV PS (ZARc) 15 455.54 14 957.41 13 403.47 11 322.48 10 811.34 capital in Karreebosch as well as 50% of the share capital in

3 Yr Beta 0.67 0.65 0.94 0.92 0.92 Karreebosch Asset Management (Pty) Ltd. The total project cost is

Price High 20 608 23 173 23 998 19 753 14 865 estimated to be R4.7 billion which will in the majority be funded

Price Low 15 076 14 521 15 362 13 890 7 507 with project financing.

Price Prd End 15 795 20 448 21 731 15 287 13 890 The company announced that Eyesizwe shareholders have signed

RATIOS aseparate waiver and undertaking, infavour of, and enforceable by

Ret on SH Fnd 14.69 22.14 30.32 32.68 19.17 Eyesizwe, to maintain the current 30.81% shareholding in Exxaro

Ret On Tot Ass 13.51 19.91 27.05 22.85 13.47 until2027.Intermsofthewaiversandundertakings,shareholders

Oper Pft Mgn 18.68 27.46 34.98 22.76 16.58

D:E 0.31 0.33 0.36 0.44 0.53 waived their options to dispose of any of the locked-in shares or

Int Cover n/a - 33.42 45.32 12.10 5.16 make any request which will result in Eyesizwe having to dispose

Current Ratio 4.80 4.29 4.20 2.60 0.88 of the locked-in shares, in the previously stated agreed tranches,

Div Cover 1.92 1.71 2.09 1.58 1.54 until 2027.

NUMBER OF EMPLOYEES: 8500 ExxaroboardofdirectorsannouncedtheappointmentofBennetor

DIRECTORS: Fraser-MoleketiGJ(ld ind ne), (“Ben”) Magara as the incoming CEO, effective 1 April 2025. Ben

IretonKM(ind ne), MalevuIN(ne), Mawasha willsucceedActingCEO,RiaanKoppeschaar,whowillcontinuein

B(ind ne), Medupe N (ind ne), Mnganga Dr P hisroleasFinance Director.

(ind ne), MntamboVZ(ne), Molope N (ind ne), 2025 full year operational outlook:

Msimang M (ne), NxumaloCJ(ind ne), Exxaro’s business is impacted by commodity prices, domestic

SnydersPCCH(ind ne), Qhena M G structural challenges and developments, coal offtake and both the

(Chair, ind ne), Magara B (CEO), Koppeschaar P

A (FD) global and domestic geopolitical environment.

POSTAL ADDRESS:POBox9229, Pretoria,0001 Scan the QR code to Coal production and sales are expected to be within the range of

EMAIL: investorrelations@exxaro.com visit our website 39.5Mt to 43.7Mt and exports sales to be between 6.65Mt and

WEBSITE: www.exxaro.com 7.35Mt. Coal sustaining capex is unchanged between R2.5 billion

TELEPHONE: 012-307-5000 FAX: 012-323-3400 and R3 billion.

COMPANY SECRETARY: M Nana Due toanticipated commissioningofLephalale Solar Plant, energy

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. generation guidance increases, and is expected to be within the

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd. range of 780GWh to 810GWh, which consists of full year wind

AUDITORS: KPMG Inc. generation and half year solar generation guidance.”

BANKERS: Absa Bank Ltd.

114