Page 27 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 27

Profile’s Stock Exchange Handbook: 2024 – Issue 4 NSX – FNB

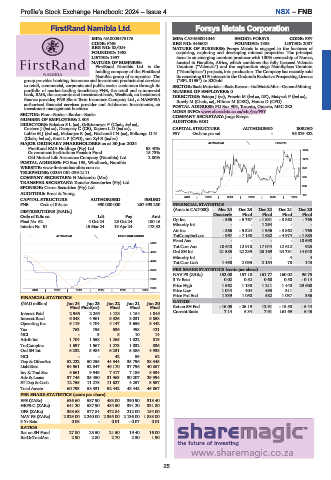

FirstRand Namibia Ltd. Forsys Metals Corporation

FNB FSY

ISIN: NA0003475176 ISIN: CA34660G1046 SHORT: FORSYS CODE: FSY

CODE: FNB REG NO: 34660G FOUNDED: 1985 LISTED: 2007

REG NO: 88/024 NATURE OF BUSINESS: Forsys Metals is engaged in the business of

FOUNDED: 1988 acquiring, exploring and developing mineral properties. The principal

LISTED: 1997 focus is an emerging uranium producer with 100% ownership of Norasa,

NATURE OF BUSINESS: located in Namibia, Africa, which combines the fully licensed Valencia

FirstRand Namibia Ltd. is the Uranium (“Valencia”) and the exploration stage Namibplaas Uranium

holding company of the FirstRand (“Namibplaas”) projects, into production. The Company has recently sold

Namibia group of companies. The its remaining 51% interest in the Ondundu Exclusive Prospecting Licence

group provides banking, insurance and investment products and services (“EPL 3195”) to B2Gold.

to retail, commercial, corporate and public sector customers through its SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

portfolio of market-leading franchises; FNB, the retail and commercial NUMBER OF EMPLOYEES: 0

bank, RMB, the corporate and investment bank, WesBank, an instalment DIRECTORS: Estepa J (ne), Frewin M (ind ne, UK), Matysek P (ind ne),

finance provider, FNB Short Term Insurance Company Ltd., a NAMFISA Rowly M (Chair, ne), Hilmer M (CEO), Hanna D (CFO)

authorised financial services provider and Ashburton Investments, an POSTAL ADDRESS: PO Box 909, Toronto, Ontario, M5C 2K3

investment management business. MORE INFO: www.sharedata.co.za/sdo/jse/FSY

SECTOR: Fins—Banks—Banks—Banks

NUMBER OF EMPLOYEES: 2 305 COMPANY SECRETARY: Jorge Estepa

AUDITORS: BDO

DIRECTORS: BalsdonSL(ne), Grüttemeyer P (Chair, ind ne),

Coetzee J (ind ne), Dempsey C (CE), KapereLD(ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

LubbeMJ(ind ne), Makanjee R (ne), NashandiIN(ne), Shikongo O N FSY Ords no par val - 96 875 422

(Chair, ind ne), Smit L P (CFO), van Zyl E (ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 40 Week MA FORSYS

FirstRand EMA Holdings (Pty) Ltd. 58.40%

Government Institutions Pension Fund 15.73% 1562

Old Mutual Life Assurance Company (Namibia) Ltd. 2.80%

1270

POSTAL ADDRESS: PO Box 195, Windhoek, Namibia

WEBSITE: www.firstrandnamibia.com.na 978

TELEPHONE: 00264 061-299-2111

COMPANY SECRETARY: N Makemba (Mrs) 685

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

393

SPONSOR: Cirrus Securities (Pty) Ltd.

AUDITORS: Ernst & Young 101

2019 | 2020 | 2021 | 2022 | 2023 | 2024

CAPITAL STRUCTURE AUTHORISED ISSUED

FNB Ords of 0.5c ea 990 000 000 267 593 250 FINANCIAL STATISTICS

(Amts in CAD’000) Mar 24 Dec 23 Dec 22 Dec 21 Dec 20

DISTRIBUTIONS [NADc] Quarterly Final Final Final Final

Ords of 0.5c ea Ldt Pay Amt

Final No 62 4 Oct 24 25 Oct 24 180.16 Op Inc - 866 - 5 767 - 1 631 - 3 862 - 765

Interim No 61 15 Mar 24 19 Apr 24 173.52 Minority Int - - 1 294 - -

Att Inc - 866 - 5 824 1 956 - 3 862 - 765

40 Week MA F FIRSTRAND NAMIBIA TotCompIncLoss - 997 - 7 150 1 682 - 4 974 - 1 683

Fixed Ass - - - - 10 698

5200

Tot Curr Ass 10 640 12 910 17 044 12 612 923

Ord SH Int 21 585 22 239 25 169 24 781 14 048

4620

Minority Int - - - 4 4

4040 Tot Curr Liab 1 490 2 035 2 154 78 143

PER SHARE STATISTICS (cents per share)

3460

NAV PS (ZARc) 152.08 157.18 161.77 160.02 96.75

2880 3 Yr Beta 0.02 0.52 0.60 0.50 - 0.14

Price High 1 562 1 138 1 211 1 440 29 600

2300

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Price Low 1 044 404 493 311 2

FINANCIAL STATISTICS Price Prd End 1 339 1 050 582 1 037 356

(NAD million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 RATIOS

Final Final(rst) Final Final Final Ret on SH Fnd - 16.05 - 26.19 12.91 - 15.58 - 5.44

Interest Paid 2 966 2 265 1 123 1 154 1 845 Current Ratio 7.14 6.34 7.91 161.69 6.45

Interest Rcvd 6 048 4 961 3 326 3 031 3 858

Operating Inc 5 119 4 704 4 147 3 656 3 442

Tax 763 755 636 498 421

NCI - 3 8 10 14

Attrib Inc 1 704 1 558 1 265 1 022 819

TotCompInc 1 697 1 567 1 273 1 032 836

Ord SH Int 6 232 5 984 6 231 5 586 4 938

NCI - - 42 59 62

Dep & OtherAcc 52 222 50 255 44 344 35 796 38 545

Liabilities 54 561 52 347 46 170 37 796 40 867

Inv & Trad Sec 8 661 9 949 7 417 7 186 8 534

Adv & Loans 37 745 35 450 31 963 30 207 29 994

ST Dep & Cash 12 755 11 278 11 627 4 257 5 557

Total Assets 60 793 58 331 52 442 43 442 45 867

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 636.60 587.90 483.00 390.90 313.40

HEPS-C (ZARc) 641.20 587.90 484.50 391.20 331.80

DPS (ZARc) 353.68 577.84 472.84 212.00 154.00

NAV PS (ZARc) 2 329.00 2 240.00 2 355.00 2 136.00 1 888.00

3 Yr Beta 0.08 - 0.01 - 0.07 0.01

RATIOS

Ret on SH Fund 27.80 25.50 21.50 19.40 16.00

RetOnTotalAss 2.90 2.80 2.70 2.30 1.90

25