Page 25 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 25

Profile’s Stock Exchange Handbook: 2024 – Issue 4 NSX – CGP

Capricorn Group Ltd. Celsius Resources Ltd.

CGP CER

ISIN: NA000A1T6SV9 SHORT: CAP GROUP CODE: CGP ISIN: AU000000CLA6 SHORT: CELSIUS CODE: CER

REG NO: 96/300 FOUNDED: 1996 LISTED: 2013 REG NO: F/ACN 009 162 949 FOUNDED: 1986 LISTED: 2018

NATURE OF BUSINESS: Capricorn Group is a leading Namibian-owned NATURE OF BUSINESS: Celsius Resources (ASX:CLA) is an ASX listed

financial services group listed on the NSX. We have three banking resources company with asecondary listing onthe NSX, aiming toleverage

subsidiaries operating in Namibia, Botswana and Zambia, with other off the coming boom in battery technology. Celsius is currently focused on

subsidiaries and associates providing adjacent and complementary cobalt projects and is looking to strategically add projects with the

products and services. Our customers range from personal to corporate, potential to contribute metals and materials into the construction and

small and medium enterprises. Our value proposition is built around usage of batteries.

customers rather than products or channels. We apply data and digital SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

technology intransactionalbanking services, productsandfunctionality to NUMBER OF EMPLOYEES: 0

address future customer needs. DIRECTORS: DudleyPJ(ind ne), Farrell S (ne), Hulmes M (ne),

SECTOR: Fins—Banks—Banks—Banks van Kerkwijk M, Sarmiento J ( (Chair, ne), Gregory R (MD),

NUMBER OF EMPLOYEES: 2 359 Bannister D (CFO)

DIRECTORS: BrandtJW(ne), Fahl E (ind ne), Gaomab IIHM(ne), MAJOR ORDINARY SHAREHOLDERS as at 10 Sep 2024

KaliDT(ind ne), Menetté G (ind ne), Reyneke D (ind ne), Computershare Clearing (Pty) Ltd. (CCNL DI A/C) 11.41%

Solomon E (ind ne), Nuyoma D (CEO), Maass J (CFO), HSBC Custody Nominees (Australia) Ltd. 11.04%

Swanepoel J J (Chair, ne), FourieDG(ld ind ne), PrinslooMJ(ne), BNP Paribas Nominees (Pty) Ltd. 5.14%

Nakazibwe-Sekandi G (ind ne) POSTAL ADDRESS:POBox7059, CloistersSquarePO,PerthWA,6850

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 MORE INFO: www.sharedata.co.za/sdo/jse/CER

Capricorn Investment Holdings Ltd. 44.00% COMPANY SECRETARY: Kellie Davis

Government Institutions Pension Fund 26.90% SPONSOR: IJG Securities (Pty) Ltd.

Nam-mic Financial Services Holdings (Pty) Ltd. 8.00%

POSTAL ADDRESS: PO Box 15, Windhoek, Namibia AUDITORS: PwC Inc., RSM Australia Partners

MORE INFO: www.sharedata.co.za/sdo/jse/CGP CAPITAL STRUCTURE AUTHORISED ISSUED

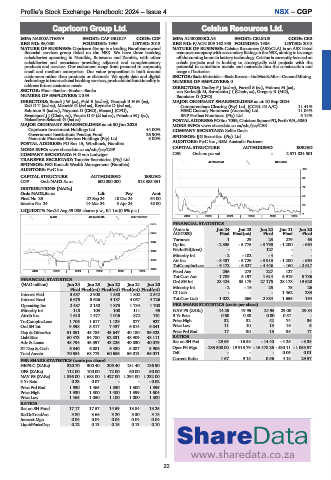

COMPANY SECRETARY: H G von Ludwiger CER Ords no par val - 2 571 024 501

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

40 Week MA CELSIUS

SPONSOR: PSG Konsult Wealth Management (Namibia)

AUDITORS: PwC Inc. 115

CAPITAL STRUCTURE AUTHORISED ISSUED

94

CGP Ords NAD2.5c ea 600 000 000 518 385 351

DISTRIBUTIONS [NADc] 72

Ords NAD2.5c ea Ldt Pay Amt

50

Final No 25 27 Sep 24 18 Oct 24 64.00

Interim No 24 14 Mar 24 5 Apr 24 48.00 29

LIQUIDITY: Nov24 Avg 59 005 shares p.w., R1.1m(0.6% p.a.)

7

2019 | 2020 | 2021 | 2022 | 2023 | 2024

ALSH 40 Week MA CAP GROUP

2579 FINANCIAL STATISTICS

(Amts in Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

2263 AUD’000) Final Final(rst) Final Final Final

Turnover 1 29 23 279 63

1947

Op Inc - 2 335 - 5 775 - 3 790 - 1 200 - 664

NetIntPd(Rcvd) - - 127 - -

1632

Minority Int - 2 - 102 - 4 - -

1316 Att Inc - 8 437 - 5 729 - 3 913 - 1 200 - 664

TotCompIncLoss - 9 172 - 6 527 - 4 446 - 160 - 2 617

1000

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Fixed Ass 256 273 227 127 -

Tot Curr Ass 1 709 5 197 1 614 6 919 5 736

FINANCIAL STATISTICS Ord SH Int 28 424 35 179 27 175 28 178 19 620

(NAD million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final(rst) Final(rst) Final(rst) Minority Int - 2 - 16 25 75 26

Interest Paid 3 587 2 908 1 850 1 802 2 542 LT Liab - - - 1 462 233

Interest Rcvd 6 675 5 626 4 187 4 057 4 726 Tot Curr Liab 1 022 566 2 884 1 655 194

Operating Inc 2 487 2 150 1 875 1 734 1 708 PER SHARE STATISTICS (cents per share)

Minority Int 118 103 100 111 95 NAV PS (ZARc) 14.25 19.95 24.95 29.00 29.84

Attrib Inc 1 618 1 477 1 046 872 761 3 Yr Beta 0.60 0.88 0.80 0.57 -

TotCompIncLoss 1 706 1 617 1 129 877 927 Price High 32 32 42 74 36

Ord SH Int 9 598 8 517 7 437 6 614 6 041 Price Low 11 10 13 16 6

Dep & OtherAcc 51 851 45 785 43 647 40 180 39 323 Price Prd End 17 30 13 35 17

Liabilities 60 473 54 780 52 831 48 909 48 111 RATIOS

Adv & Loans 48 794 45 397 43 226 40 830 40 079 Ret on SH Fnd - 29.69 - 16.58 - 14.40 - 4.25 - 3.38

ST Dep & Cash 6 340 6 081 6 480 5 087 3 906 Oper Pft Mgn - 233 500.00 - 19 913.79 - 16 478.26 - 430.11 - 1 053.97

Total Assets 70 584 63 773 60 686 56 013 56 071 D:E - - - 0.05 0.01

Current Ratio 1.67 9.18 0.56 4.18 29.57

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 320.70 300.40 205.40 181.40 186.90

DPS (ZARc) 112.00 100.00 72.00 60.00 50.00

NAV PS (ZARc) 1 896.00 1 683.00 1 427.00 1 294.00 1 232.00

3 Yr Beta 0.23 0.07 - - - 0.02

Price Prd End 1 930 1 465 1 330 1 300 1 399

Price High 1 930 1 500 1 400 1 399 1 604

Price Low 1 465 1 050 1 100 1 000 1 300

RATIOS

Ret on SH Fund 17.17 17.57 14.59 13.84 13.25

RetOnTotalAss 3.80 3.66 3.20 3.30 3.18

Interest Mgn 0.04 0.04 0.04 0.04 0.04

LiquidFnds:Dep 0.12 0.13 0.15 0.13 0.10

23