Page 24 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 24

NSX – B2G Profile’s Stock Exchange Handbook: 2024 – Issue 4

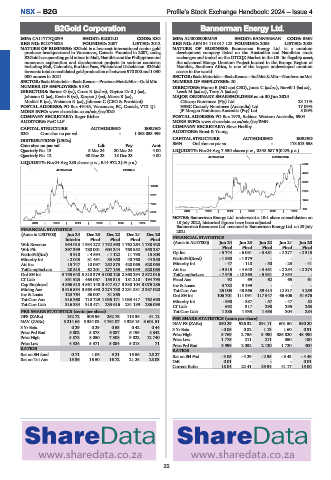

B2Gold Corporation Bannerman Energy Ltd.

B2G BMN

ISIN: CA11777Q2099 SHORT: B2GOLD CODE: B2G ISIN: AU000000BMN9 SHORT: BANNERMAN CODE: BMN

REG NO: BC0776025 FOUNDED: 2007 LISTED: 2012 REG NO: ABN 34 113 017 128 FOUNDED: 2005 LISTED: 2008

NATURE OF BUSINESS: B2Gold is a low-cost international senior gold NATURE OF BUSINESS: Bannerman Energy Ltd. is a uranium

producer headquartered in Vancouver, Canada. Founded in 2007, today, development company listed on the Australian and Namibian stock

B2Gold has operating gold mines in Mali, Namibia and the Philippines and exchanges and traded on the OTCQX Market in the US. Its flagship asset,

numerous exploration and development projects in various countries the advanced Etango Uranium Project located in the Erongo Region of

including Mali, Colombia, Burkina Faso, Finland and Uzbekistan. B2Gold Namibia, Southern Africa, is one of the largest undeveloped uranium

forecasts total consolidated gold production of between 970 000 and 1 030 assets in the world.

000 ounces in 2021. SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin NUMBER OF EMPLOYEES: 20

NUMBER OF EMPLOYEES: 5 392 DIRECTORS: MunroB(MDand CEO),Jones C(ind ne), Burvill I (ind ne),

DIRECTORS: Barnes G (ne), Cross R (ind ne), Gayton DrRJ(ne), Leech M (ind ne), Terry A (ind ne)

Johnson G (ne), Kevin B (ne), Korpan J (ne), Maree B (ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Mtshisi B (ne), Weisman R (ne), Johnson C (CEO & President) Citicorp Nominees (Pty) Ltd. 23.11%

POSTAL ADDRESS: PO Box 49143, Vancouver, BC, Canada, V7X 1J1 HSBC Custody Nominees (Australia) Ltd. 17.09%

MORE INFO: www.sharedata.co.za/sdo/jse/B2G JP Morgan Nominees Australia (Pty) Ltd. 8.00%

COMPANY SECRETARY: Roger Richer POSTAL ADDRESS: PO Box 1973, Subiaco Western Australia, 6904

AUDITORS: PwC LLP MORE INFO: www.sharedata.co.za/sdo/jse/BMN

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Steve Herlihy

B2G Cmn shrs no par val - 1 063 053 499 AUDITORS: Ernst & Young

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [USDc] BMN Ord shrs no par va - 178 613 558

Cmn shrs no par val Ldt Pay Amt

Quarterly No 13 5 Mar 24 20 Mar 24 4.00 LIQUIDITY: Nov24 Avg 7 550 shares p.w., R348 687.9(0.2% p.a.)

Quarterly No 12 30 Nov 23 18 Dec 23 4.00 40 Week MA BANNERMAN

LIQUIDITY: Nov24 Avg 283 shares p.w., R14 972.2(-% p.a.) 5540

40 Week MA B2GOLD

4468

3396

10909

2324

9079

1252

7248

180

5418 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Bannerman Energy Ltd. underwent a 10:1 share consolidation on

3587 18 July 2022, historical figures have been adjusted

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Bannerman Resources Ltd. renamed to Bannerman Energy Ltd. on 29 July

FINANCIAL STATISTICS 2021.

(Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final FINANCIAL STATISTICS

Wrk Revenue 954 013 1 934 272 1 732 590 1 762 264 1 788 928 (Amts in AUD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Wrk Pft 397 399 780 001 604 244 768 552 958 287 Final Final Final Final Final

NetIntPd(Rcd) 3 910 - 4 594 - 1 122 11 798 15 803 Op Inc - 5 744 - 6 081 - 3 481 - 2 277 - 2 315

Minority Int - 2 043 31 491 33 850 40 760 44 350 NetIntPd(Rcvd) - 1 590 - 1 379 - - -

Att Inc 15 747 10 097 252 873 420 065 628 063 Minority Int - 47 - 110 - 30 - 23 - 41

TotCompIncLoss 20 513 62 201 277 153 463 059 628 063 Att Inc - 9 515 - 4 640 - 3 451 - 2 254 - 2 274

Ord SH Int 3 755 640 3 810 379 3 008 126 2 860 294 2 572 016 TotCompIncLoss - 7 945 - 10 363 - 5 931 2 654 -

LT Liab 851 923 463 067 153 313 181 210 194 793 Fixed Ass 92 69 62 65 61

Cap Employed 4 866 518 4 561 148 3 447 617 3 330 104 3 076 286 Inv & Loans 3 782 9 199 - - -

Mining Ass 3 616 534 3 563 490 2 274 730 2 231 831 2 387 020 Tot Curr Ass 25 003 43 366 59 414 12 517 4 259

Inv & Loans 123 764 86 007 31 865 - - Ord SH Int 106 701 111 091 117 947 66 406 51 676

Tot Curr Ass 916 360 710 729 1 035 171 1 033 417 762 698 Minority Int - 990 - 387 - 57 - 47 52

Tot Curr Liab 316 334 313 471 233 616 231 189 286 093 LT Liab 692 317 298 295 263

PER SHARE STATISTICS (cents per share) Tot Curr Liab 1 386 1 935 1 653 304 284

DPS (ZARc) 152.72 305.96 262.75 113.36 61.12 PER SHARE STATISTICS (cents per share)

NAV (ZARc) 5 214.66 5 354.03 4 764.07 4 329.15 3 601.51 NAV PS (ZARc) 850.29 926.32 891.11 601.50 580.20

3 Yr Beta 0.29 0.29 0.53 0.42 0.44 3 Yr Beta - 0.05 0.82 1.13 1.60 0.91

Price Prd End 5 002 5 878 6 087 6 199 8 342 Price High 5 769 2 756 3 490 386 820 48 490

Price High 5 878 8 050 7 308 9 022 12 740

Price Low 1 775 211 211 350 180

Price Low 4 524 5 371 5 084 5 018 71 Price Prd End 3 999 2 052 2 120 1 720 400

RATIOS RATIOS

Ret on SH fund 0.71 1.06 9.21 15.56 25.27 Ret on SH Fnd - 9.05 - 4.29 - 2.95 - 3.43 - 4.48

Ret on Tot Ass 15.36 16.50 16.72 21.25 28.03 D:E 0.01 - - - 0.01

Current Ratio 18.04 22.41 35.94 41.17 15.00

22