Page 31 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 31

Profile’s Stock Exchange Handbook: 2024 – Issue 4 NSX – ORY

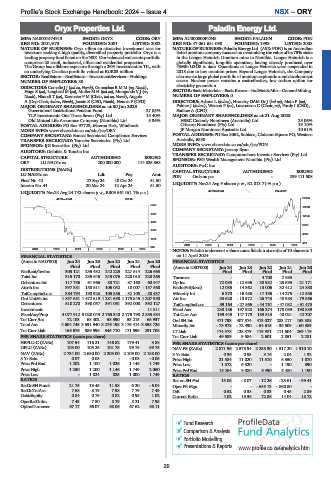

Oryx Properties Ltd. Paladin Energy Ltd.

ORY PDN

ISIN: NA0001574913 SHORT: ORYX CODE: ORY ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002 REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008

NATURE OF BUSINESS: Oryx offers an attractive investment case for NATURE OF BUSINESS: Paladin Energy Ltd. (ASX: PDN) is an Australian

investors seeking a high quality, diversified property portfolio. Oryx is a listed uranium company focused on maximising the value of its 75% stake

leading property fund listed on the NSX. Our balanced real estate portfolio in the Langer Heinrich Uranium mine in Namibia. Langer Heinrich is a

comprises 28 retail, industrial, office and residential properties. globally significant, long-life operation, having already produced over

The Group has offshore exposure through a 26% investment in TIL, with 43Mlb U3O8 to date. Operations at Langer Heinrich were suspended in

an underlying Croatian portfolio valued at EUR83 million. 2018 due to low uranium prices. Beyond Langer Heinrich, the Company

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings also owns a large global portfolio of uranium exploration and development

NUMBER OF EMPLOYEES: 30 assets. Nuclear power remains a cost-effective, low carbon option for

DIRECTORS: ComalieJJ(ind ne, Namb), GomachasRMM(ne, Namb), electricity generation.

HugoS(ne), Langheld M (ne), Muller M H (ind ne), Mungunda V J (ne, SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

Namb), Nkandi T (ne), Kazmaier P M (Chair, ind ne, Namb), Angula NUMBER OF EMPLOYEES: 0

A(DepChair, ind ne, Namb), Jooste B (CEO, Namb), Heunis F (CFO) DIRECTORS: Adams L (ind ne), Hronsky OAM Dr J (ind ne), Main P (ne),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 Palmer J (ind ne), Watson P (ne), Lawrenson C (Chair, ne), Purdy I (CEO),

Government Institutions Pension Fund 27.85% Sudlow A (CFO)

TLP Investments One Three Seven (Pty) Ltd. 15.40% MAJOR ORDINARY SHAREHOLDERS as at 21 Aug 2023

Old Mutual Life Assurance Company (Namibia) Ltd. 5.36% HSBC Custody Nominees (Australia) Ltd. 25.06%

POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek Citicorp Nominees (Pty) Ltd. 19.10%

MORE INFO: www.sharedata.co.za/sdo/jse/ORY JP Morgan Nominees Australia Ltd. 10.51%

COMPANY SECRETARY: Bonsai Secretarial Compliance Services POSTAL ADDRESS: PO Box 8062, Subiaco, Cloisters Square PO, Western

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. Australia, 6850

SPONSOR: IJG Securities (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/PDN

AUDITORS: Deloitte & Touche Inc. COMPANY SECRETARY: Jeremy Ryan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

ORY LU NAD1c ea 200 000 000 114 325 868

AUDITORS: PwC Inc.

DISTRIBUTIONS [NADc] CAPITAL STRUCTURE AUTHORISED ISSUED

LU NAD1c ea Ldt Pay Amt PDN Ords no par - 299 111 508

Final No 42 27 Sep 24 18 Oct 24 51.50

Interim No 41 20 Mar 24 12 Apr 24 51.50 LIQUIDITY: Nov24 Avg 9 shares p.w., R2 013.7(-% p.a.)

LIQUIDITY: Nov24 Avg 24 742 shares p.w., R303 561.0(1.1% p.a.) 40 Week MA PALADIN

40 Week MA ORYX 20185

2060

16230

1813

12275

1566

8320

1319

4365

1072

410

2019 | 2020 | 2021 | 2022 | 2023 | 2024

825

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Paladin underwent a share consolidation at a ratio of 10 shares to 1

FINANCIAL STATISTICS on 11 April 2024.

(Amts in NAD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 FINANCIAL STATISTICS

Final Final Final Final Final (Amts in USD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

NetRent/InvInc 303 121 235 432 242 225 227 514 226 663 Final Final Final Final Final

Total Inc 315 170 235 646 243 076 228 013 228 265 Turnover - - 4 700 2 985 -

Debenture Int 117 756 91 966 88 721 87 160 60 947 Op Inc 72 083 - 12 696 - 30 932 - 25 695 - 21 171

Attrib Inc 397 381 158 511 105 052 10 007 - 157 568 NetIntPd(Rcvd) 12 085 14 362 13 006 32 412 24 880

TotCompIncLoss 384 794 190 923 105 856 - 32 105 - 88 437 Minority Int 6 370 - 16 486 - 17 196 - 14 275 - 12 586

Ord UntHs Int 1 857 681 1 472 619 1 281 698 1 175 845 1 207 950 Att Inc 53 628 - 10 572 - 26 743 - 43 983 - 79 866

Debentures 510 270 390 057 391 061 392 008 392 127 TotCompIncLoss 59 164 - 27 565 - 44 761 - 47 082 - 91 473

Investments - - - - 11 811 Fixed Ass 230 186 197 928 166 274 178 089 190 889

FixedAss/Prop 4 077 912 3 020 049 2 763 340 2 775 798 2 855 684 Tot Curr Ass 199 449 147 179 189 513 40 021 42 707

Tot Curr Ass 72 103 68 402 58 390 53 215 65 937 Ord SH Int 471 793 407 574 413 027 283 217 153 388

Total Ass 4 604 745 3 531 940 3 276 198 3 176 414 3 358 726 Minority Int - 73 978 - 72 490 - 54 615 - 36 509 - 60 389

Tot Curr Liab 166 676 589 596 345 710 171 599 291 708 LT Liab 174 378 128 379 119 981 111 604 269 119

PER SHARE STATISTICS (cents per share) Tot Curr Liab 49 589 9 584 2 601 2 851 2 281

HEPLU-C (ZARc) 107.54 116.21 146.82 179.41 3.88 PER SHARE STATISTICS (cents per share)

DPLU (ZARc) 103.00 105.25 101.75 99.75 69.75 NAV PS (ZARc) 2 871.96 2 575.94 2 255.30 1 517.20 1 310.10

NAV (ZARc) 2 734.00 2 680.00 2 203.00 2 109.00 2 188.00 3 Yr Beta 0.36 0.93 3.16 2.04 1.32

3 Yr Beta 0.07 0.05 - - 0.08 - 0.05 Price High 21 584 11 020 11 510 6 350 1 870

Price Prd End 1 202 1 100 1 026 1 146 1 749 Price Low 1 872 6 320 - 1 190 390

Price High 1 250 1 200 1 146 1 749 2 060 Price Prd End 15 264 9 080 6 490 5 480 1 190

Price Low - 1 024 825 1 000 1 749 RATIOS

RATIOS Ret on SH Fnd 15.08 - 8.07 - 12.26 - 23.61 - 99.41

RetOnSH Funds 21.75 13.45 11.58 6.20 - 6.04 Oper Pft Mgn - - - 658.13 - 860.80 -

RetOnTotAss 7.68 8.19 7.98 7.79 7.49 D:E 0.52 0.38 0.33 0.45 2.89

Debt:Equity 0.84 0.79 0.82 0.95 1.02 Current Ratio 4.02 15.36 72.86 14.04 18.72

OperRetOnInv 7.43 7.80 8.79 8.21 7.95

OpInc:Turnover 67.17 66.07 68.06 67.62 68.11

Fund Research

Comparison & Analysis

Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm

29