Page 33 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 33

Profile’s Stock Exchange Handbook: 2024 – Issue 4 NSX – SILP

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 97.00 150.00 119.00 71.00 81.00 Tadvest Ltd.

TAD

DPS (ZARc) 68.00 100.00 66.00 31.00 35.00 ISIN: MU0510N00001 SHORT: TADVEST CODE: TAD

NAV PS (ZARc) 1 009.00 970.00 912.00 841.00 797.00 REG NO: 126446 FOUNDED: 2016 LISTED: 2016

3 Yr Beta - 0.43 - 0.48 - 0.14 - - NATURE OF BUSINESS: Tadvest is an investment holding company with

Price Prd End 858 845 441 613 690 the primary objective of investing in attractive, high yielding, cash

Price High 890 890 613 800 921 generative assets. Tadvest provides investors with a combination of

Price Low 761 441 399 550 690 sustainable capital and income growth with a portfolio that consists of

RATIOS private equity investments, listed equity investments, and direct and

Ret on SH Fund 19.11 15.13 13.05 8.44 10.07 indirect property holdings.

RetOnTotalAss 4.24 3.35 2.98 2.41 2.63 SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

Interest Mgn 0.05 0.05 0.04 0.03 0.04 NUMBER OF EMPLOYEES: 0

DIRECTORS: Chambers I, Gray M (ne), Marianen D, Neser C (ne),

LiquidFnds:Dep 0.08 0.06 0.06 0.05 0.04

Savage D (ne)

POSTAL ADDRESS: 7th Floor, Tower 1, NeXteracom Cybercity, Ebene,

Stimulus Investments Ltd. Mauritius, 72201

MORE INFO: www.sharedata.co.za/sdo/jse/TAD

SILP

ISIN: NA000A1JN0Z7 SHORT: STIMULUS CODE: SILP COMPANY SECRETARY: Safyr Utilis Fund Services Ltd.

REG NO: 2004/482 FOUNDED: 2004 LISTED: 2004 TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

NATURE OF BUSINESS: Stimulus Investment Ltd. is a private equity firm SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

specializing in investments in logistics, renewable energy, tourism, and AUDITORS: Lancasters Chartered Accountants

high value retailing. The firm seeks to invest in Namibia. Stimulus

Investment Ltd. is based in Namibia. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: Add—Debt—Preference Shares—Pref Shares TAD Ords no par - 51 544 995

NUMBER OF EMPLOYEES: 0

DIRECTORS: Geingos M (ne), McleodEI(ind ne), Okafor C (ind ne), 40 Week MA TADVEST

Mwatotele J S (CEO) 1795

POSTAL ADDRESS: PO Box 97438, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/SILP 1680

COMPANY SECRETARY: MMM Consultancy CC

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. 1565

CAPITAL STRUCTURE AUTHORISED ISSUED 1451

SILP Pref shares - 4 650 786

1336

LIQUIDITY: Nov24 Avg 980 shares p.w., R125 321.8(1.1% p.a.)

1221

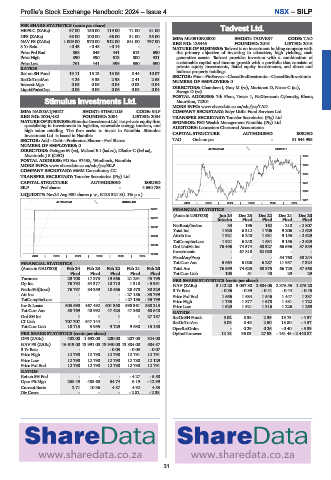

40 Week MA STIMULUS 2019 | 2020 | 2021 | 2022 | 2023 | 2024

12801 FINANCIAL STATISTICS

(Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

12667

Interim Final Final Final Final

NetRent/InvInc 33 196 162 - 218 - 2 807

12532

Total Inc 1 925 6 312 1 706 9 206 - 2 629

12398 Attrib Inc 1 921 6 248 1 631 9 156 - 2 629

TotCompIncLoss 1 921 6 248 1 631 9 156 - 2 629

12263

Ord UntHs Int 76 496 74 574 68 327 66 696 57 539

Investments - 67 818 62 088 - -

12129

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FixedAss/Prop - - - 54 768 50 244

FINANCIAL STATISTICS Tot Curr Ass 5 664 6 026 6 287 11 957 7 324

(Amts in NAD’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 Total Ass 76 599 74 625 68 375 66 725 57 568

Final Final Final Final Final Tot Curr Liab 103 51 48 29 29

Turnover 29 708 17 373 19 566 21 291 45 795 PER SHARE STATISTICS (cents per share)

Op Inc 76 792 84 377 10 710 1 318 - 5 951 NAV (ZARc) 3 112.20 3 037.80 2 604.06 2 376.55 1 875.20

NetIntPd(Rcvd) 76 797 84 359 10 686 28 478 30 329 3 Yr Beta - 0.36 - 0.39 - 0.41 - 0.44 - 0.45

AttInc - - - -27186 -35799 Price Prd End 1 656 1 684 1 546 1 447 1 337

TotCompIncLoss - - - - 27 186 - 35 799 Price High 1 755 1 877 1 678 1 481 1 722

Inv & Loans 503 690 467 492 601 358 598 361 588 213 Price Low 1 629 1 521 1 316 1 226 1 269

Tot Curr Ass 50 769 40 992 47 423 47 360 68 648 RATIOS

Ord SH Int 1 1 1 1 27 187 RetOnSH Funds 5.02 8.38 2.39 13.73 - 4.57

LT Liab 707 707 647 144 - - - RetOnTotAss 5.03 8.46 2.50 13.80 - 4.57

Tot Curr Liab 18 713 3 955 9 729 9 630 15 150 OperRetOnInv - 0.29 0.26 - 0.40 - 5.39

PER SHARE STATISTICS (cents per share) OpInc:Turnover 12.18 36.03 27.93 - 161.48 - 2 440.87

DPS (ZARc) 402.00 1 692.00 200.00 207.00 324.00

NAV PS (ZARc) 15 619.00 13 991.00 13 940.00 13 884.00 584.57

3 Yr Beta - - - 0.03 - 0.03 - 0.07

Price High 12 790 12 790 12 790 12 791 12 791

Price Low 12 790 12 790 12 790 12 780 12 129

Price Prd End 12 790 12 790 12 790 12 790 12 791

RATIOS

RetonSHFnd - - - -4.27 - 5.58

Oper Pft Mgn 258.49 485.68 54.74 6.19 - 12.99

Current Ratio 2.71 10.36 4.87 4.92 4.53

Div Cover - - - - 2.82 - 2.38

31