Page 32 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 32

NSX – PNH Profile’s Stock Exchange Handbook: 2024 – Issue 4

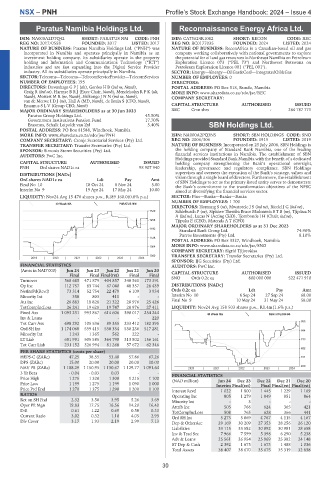

Paratus Namibia Holdings Ltd. Reconnaissance Energy Africa Ltd.

PNH REC

ISIN: NA000A2DTQ42 SHORT: PARATUS NM CODE: PNH ISIN: CA75624R1082 SHORT: RECON CODE: REC

REG NO: 2017/0558 FOUNDED: 2017 LISTED: 2017 REG NO: BC0177035 FOUNDED: 2024 LISTED: 2024

NATURE OF BUSINESS: Paratus Namibia Holdings Ltd. (“PNH”) was NATURE OF BUSINESS: ReconAfrica is a Canadian-based oil and gas

incorporated in Namibia and operates principally in Namibia as an company working collaboratively with national governments to explore

investment holding company. Its subsidiaries operate in the property the potential for oil and gas resources in Northeast Namibia on Petroleum

holding and Information and Communications Technology (”ICT”) Exploration Licence 073 (“PEL 73") and Northwest Botswana on

industries and are fast expanding into the Digital Service Provider Petroleum Exploration Licence 001 (”PEL 001").

industry. All its subsidiaries operate principally in Namibia. SECTOR: Energy—Energy—OilGas&Coal—IntegratedOil&Gas

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 195 DIRECTORS:

DIRECTORS: Duvenhage G P J (alt), Gerdes H B (ind ne, Namb), POSTAL ADDRESS: PO Box 518, Rundu, Namibia

Graig R (ind ne), Harmse B R J (Exec Chair, Namb), Mendelsohn R P K (alt, MORE INFO: www.sharedata.co.za/sdo/jse/REC

Namb), MostertMR(ne, Namb), Shikongo J N N (ind ne, Namb), COMPANY SECRETARY:

van de Merwe I D J (ne), HallA(MD, Namb), de Bruin S (CFO, Namb),

Erasmus S L V (Group CEO, Namb) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 REC Cmn shrs - 264 787 771

Paratus Group Holdings Ltd. 45.50%

Government Institutions Pension Fund 17.70%

Erasmus, Schalk Leipoldt van Zyl 5.40% SBN Holdings Ltd.

POSTAL ADDRESS: PO Box 81588, Windhoek, Namibia

SNO

MORE INFO: www.sharedata.co.za/sdo/jse/PNH ISIN: NA000A2PQ3N5 SHORT: SBN HOLDINGS CODE: SNO

COMPANY SECRETARY: Cronje Secretarial Services (Pty) Ltd. REG NO: 2006/306 FOUNDED: 1915 LISTED: 2019

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. NATURE OF BUSINESS: Incorporated on 25 July 2006, SBN Holdings is

SPONSOR: Simonis Storm Securities (Pty) Ltd. the holding company of Standard Bank Namibia, one of the leading

AUDITORS: PwC Inc. financial services institutions in Namibia. The establishment of SBN

Holdings provided Standard Bank Namibia with the benefit of a dedicated

CAPITAL STRUCTURE AUTHORISED ISSUED holding company strengthening the Bank’s operational oversight,

PNH Ord shares NAD1c ea - 98 907 940 leadership, governance and regulatory compliance. SBN Holdings

supervises and oversees the execution of the Bank’s strategy, values and

DISTRIBUTIONS [NADc]

Ord shares NAD1c ea Ldt Pay Amt vision through a single board of directors. Furthermore, the establishment

of SBN Holdings to act as the primary listed entity serves to demonstrate

Final No 10 18 Oct 24 8 Nov 24 5.00 the Bank’s commitment to the transformation objectives of the NFSC

Interim No 9 19 Apr 24 17 May 24 10.00 aimed at diversifying the financial services sector.

LIQUIDITY: Nov24 Avg 15 470 shares p.w., R189 160.0(0.8% p.a.) SECTOR: Fins—Banks—Banks—Banks

NUMBER OF EMPLOYEES: 1 700

40 Week MA PARATUS NM

DIRECTORS: Hornung S (ne), Mwatotele J S (ind ne), Riedel J G (ind ne),

1320 Schlebusch P (ne), SiphiweThembaBruce MadonselaSTB(ne), Tjipitua N

A(ind ne), Lucas N (Acting CEO), Tjombonde I H (Chair, ind ne),

1256 TjipukaE(CEO), MatendaAT(CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

1192

Standard Bank Group Ltd. 74.90%

Purros Investments (Pty) Ltd. 8.10%

1128

POSTAL ADDRESS: PO Box 3327, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/SNO

1064

COMPANY SECRETARY: Sigrid Tjijorokisa

1000 TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

2019 | 2020 | 2021 | 2022 | 2023 | 2024

SPONSOR: IJG Securities (Pty) Ltd.

FINANCIAL STATISTICS AUDITORS: PwC Inc.

(Amts in NAD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 CAPITAL STRUCTURE AUTHORISED ISSUED

Final Final Final(rst) Final Final

Turnover 568 685 471 879 404 857 340 561 173 391 SNO Ords 0.2c ea 800 000 000 522 471 910

Op Inc 112 757 83 744 67 040 48 357 28 439 DISTRIBUTIONS [NADc]

NetIntPd(Rcvd) 73 314 52 754 22 479 6 109 3 934 Ords 0.2c ea Ldt Pay Amt

Minority Int 358 803 411 - - Interim No 10 6 Sep 24 27 Sep 24 68.00

Att Inc 26 883 18 826 21 322 28 976 25 426 Final No 9 10 May 24 31 May 24 58.00

TotCompIncLoss 26 241 19 628 19 747 28 976 27 411 LIQUIDITY: Nov24 Avg 158 503 shares p.w., R1.4m(1.6% p.a.)

Fixed Ass 1 093 231 993 867 614 606 390 017 254 244

40 Week MA SBN HOLDINGS

Inv & Loans - - - - 220

955

Tot Curr Ass 698 292 105 536 89 355 233 412 182 395

Ord SH Int 1 174 068 559 415 550 334 550 236 517 281

844

Minority Int 1 243 1 365 562 222 -

LT Liab 681 991 505 585 364 790 313 802 156 161 733

Tot Curr Liab 231 152 326 994 81 268 57 672 62 346

622

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 47.25 38.55 53.48 57.86 67.26 511

DPS (ZARc) 15.00 20.00 20.00 20.00 10.00

NAV PS (ZARc) 1 188.29 1 150.95 1 130.67 1 129.77 1 091.64 2020 | 2021 | 2022 | 2023 | 2024 400

3 Yr Beta - 0.04 - 0.03 0.03 - - FINANCIAL STATISTICS

Price High 1 275 1 320 1 300 1 215 1 100 (NAD million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Price Low 1 199 1 275 1 199 1 090 1 000 Interim Final(rst) Final Final(rst) Final(rst)

Price Prd End 1 270 1 275 1 290 1 200 1 100 Interest Rcvd 1 022 1 800 1 445 1 229 1 169

RATIOS Operating Inc 805 1 279 1 049 851 864

Ret on SH Fnd 2.32 3.50 3.95 5.26 3.69 Minority Int - 3 - - -

Oper Pft Mgn 19.83 17.75 16.56 14.20 16.40 Attrib Inc 505 766 624 365 421

D:E 0.61 1.22 0.69 0.58 0.33 TotCompIncLoss 508 765 628 366 441

Current Ratio 3.02 0.32 1.10 4.05 2.93 Ord SH Int 5 273 5 069 4 767 4 115 4 167

Div Cover 3.17 1.93 2.19 2.99 7.13

Dep & OtherAcc 29 169 30 209 27 353 28 256 26 120

Liabilities 33 115 33 582 30 892 30 981 28 658

Inv & Trad Sec 7 966 7 599 5 398 6 290 5 238

Adv & Loans 25 561 26 954 25 969 25 382 24 148

ST Dep & Cash 2 392 1 675 1 673 1 488 1 036

Total Assets 38 407 38 670 35 675 35 319 32 838

30