Page 211 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 211

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – VUK

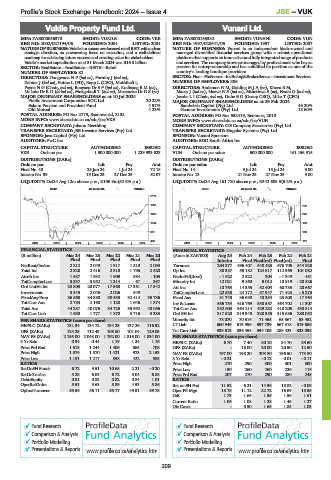

Vukile Property Fund Ltd. Vunani Ltd.

VUK VUN

ISIN: ZAE000056370 SHORT: VUKILE CODE: VKE ISIN: ZAE000163382 SHORT: VUNANI CODE: VUN

REG NO: 2002/027194/06 FOUNDED: 2004 LISTED: 2004 REG NO: 1997/020641/06 FOUNDED: 1997 LISTED: 2007

NATURE OF BUSINESS: Vukile is a consumer-focused retail REIT with a clear NATURE OF BUSINESS: Vunani is an independent black-owned and

strategic direction, an unwavering focus on execution, and a well-defined managed diversified financial services group with a robust operational

roadmap for achieving future success and creating value for stakeholders. platform that supports an innovative and fully integrated range of products

Vukile’s market capitalisation as at 31 March 2024 was R16.8 billion. and services. The company is owner-managed by professionals who have a

SECTOR: RealEstate—RealEstate—REITS—Retail passion for entrepreneurship and has solidified its position as one of the

NUMBER OF EMPLOYEES: 82 country’s leading boutique providers.

DIRECTORS: DongwanaNP(ind ne), Formby J (ind ne), SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services

Zehner J (ind ne), Pottas L (FD), Rapp L (CEO), Mothibeli I, NUMBER OF EMPLOYEES: 386

Payne N G (Chair, ind ne), Booysen DrSF(ind ne), KodisangBM(ne), DIRECTORS: Anderson N M, GoldingMJA(ne), Khoza B M,

Mokate DrRD(ld ind ne), Mokgabudi T (ind ne), Moseneke DrGS(ne) Macey J (ind ne), MazwiNS(ind ne), Mthethwa S (ne), Nzalo G (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 10 Jul 2024 Jacobs L I (Chair, ind ne), Dube E G (Group CEO), Mika T (CFO)

Public Investment Corporation SOC Ltd. 20.22% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Eskom Pension and Provident Fund 4.97% Bambelela Capital (Pty) Ltd. 49.20%

Old Mutual 4.23% Geomer Investments (Pty) Ltd. 18.60%

POSTAL ADDRESS: PO Box 2779, Saxonworld, 2132 POSTAL ADDRESS: PO Box 652419, Benmore, 2010

MORE INFO: www.sharedata.co.za/sdo/jse/VKE MORE INFO: www.sharedata.co.za/sdo/jse/VUN

COMPANY SECRETARY: Johann Neethling COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Singular Systems (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd. SPONSOR: Vunani Sponsors

AUDITORS: PwC Inc. AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

VKE Ords no par 1 500 000 000 1 229 933 623 VUN Ords no par value 500 000 000 161 155 915

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt Ords no par value Ldt Pay Amt

Final No 40 25 Jun 24 1 Jul 24 72.18 Final No 14 9 Jul 24 15 Jul 24 9.00

Interim No 39 19 Dec 23 27 Dec 23 52.07 Interim No 13 21 Nov 23 27 Nov 23 9.00

LIQUIDITY: Oct24 Avg 12m shares p.w., R196.9m(52.6% p.a.) LIQUIDITY: Oct24 Avg 161 780 shares p.w., R342 608.3(5.2% p.a.)

REIV 40 Week MA VUKILE GENF 40 Week MA VUNANI

2174

1831 263

1488 226

1144 190

801 153

458 116

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 (Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

Final Final Final Final Final Interim Final Final(rst) Final(rst) Final

NetRent/InvInc 2 212 2 049 1 917 1 510 2 093 Turnover 204 377 496 407 548 423 676 705 544 928

Total Inc 2 328 2 416 2 310 1 796 2 628 Op Inc 38 387 55 182 124 617 112 965 101 082

Attrib Inc 1 587 1 932 1 909 584 - 103 NetIntPd(Rcvd) - 1 622 2 322 304 - 1 349 451

TotCompIncLoss 3 337 3 952 1 314 - 67 397 Minority Int 12 021 9 860 5 012 10 919 - 20 826

Ord UntHs Int 23 803 20 077 17 568 17 361 17 542 Att Inc 10 764 14 355 52 404 60 785 20 667

Investments 3 545 2 046 2 026 949 - TotCompIncLoss 22 538 24 172 57 947 71 423 - 5 273

FixedAss/Prop 36 568 34 380 30 535 32 414 35 736 Fixed Ass 31 740 36 690 40 294 23 508 17 964

Tot Curr Ass 2 783 2 168 1 128 1 646 1 874 Inv & Loans 685 754 616 769 530 557 464 702 11 307

Total Ass 44 237 40 076 34 725 35 992 40 056 Tot Curr Ass 352 603 364 214 429 282 418 205 430 814

Tot Curr Liab 1 630 1 777 1 878 3 716 3 233 Ord SH Int 317 520 319 348 328 385 315 686 280 052

PER SHARE STATISTICS (cents per share) Minority Int 78 070 70 516 71 465 65 367 53 452

HEPS-C (ZARc) 131.34 134.72 134.25 137.26 116.92 LT Liab 660 949 619 996 597 739 567 318 519 686

DPS (ZARc) 124.25 112.43 105.80 101.04 129.03 Tot Curr Liab 333 613 336 454 334 105 288 423 338 098

NAV PS (ZARc) 2 155.00 2 048.00 1 792.00 1 816.00 1 834.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.34 0.44 1.19 1.24 1.16 HEPS-C (ZARc) 6.70 7.40 30.10 34.70 33.60

Price Prd End 1 518 1 244 1 406 865 708 DPS (ZARc) - 18.00 20.00 20.50 12.50

Price High 1 574 1 570 1 421 973 2 153 NAV PS (ZARc) 197.00 198.20 203.80 196.50 173.80

Price Low 1 151 1 217 858 422 585 3 Yr Beta - 0.21 - - 0.12 0.01 - 0.11

RATIOS Price High 270 290 300 301 300

RetOnSH Funds 6.72 9.51 10.68 2.21 - 0.20 Price Low 150 260 260 226 116

RetOnTotAss 5.28 6.05 6.72 5.04 6.88 Price Prd End 207 270 290 280 245

Debt:Equity 0.81 0.83 0.82 0.84 1.01 RATIOS

OperRetOnInv 5.51 5.63 5.89 4.53 5.86 Ret on SH Fnd 11.52 6.21 14.36 18.82 - 0.05

OpInc:Turnover 55.54 56.11 55.17 49.51 59.78 Oper Pft Mgn 18.78 11.12 22.72 16.69 18.55

D:E 1.73 1.65 1.55 1.56 1.61

Current Ratio 1.06 1.08 1.28 1.45 1.27

Div Cover - 0.50 1.65 1.85 1.03

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

209