Page 215 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 215

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – YOR

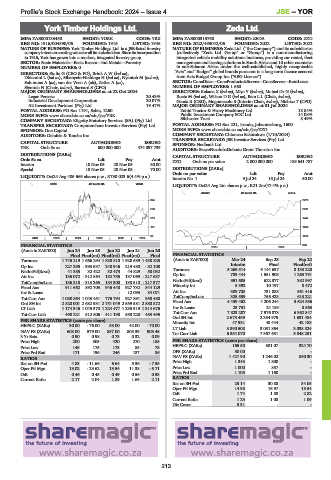

York Timber Holdings Ltd. Zeda Ltd.

YOR ZED

ISIN: ZAE000133450 SHORT: YORK CODE: YRK ISIN: ZAE000315768 SHORT: ZEDA CODE: ZZD

REG NO: 1916/004890/06 FOUNDED: 1916 LISTED: 1946 REG NO: 2022/493042/06 FOUNDED: 2022 LISTED: 2022

NATURE OF BUSINESS: York Timber Holdings Ltd. is a JSE-listed forestry NATURE OF BUSINESS: Zeda Ltd. (“the Company”) and its subsidiaries

companyintentoncreatingvalueforallitsstakeholders.Sinceitsincorporation (collectively “Zeda Ltd. Group” or “Group”) is a non-manufacturing

in 1916, York has grown into a modern, integrated forestry group. integrated vehicle mobility solutions business, providing car rental, fleet

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Forestry management and leasing solutions in South Africa and 10 other countries

NUMBER OF EMPLOYEES: 0 in sub-Saharan Africa under the well-established, highly recognisable

DIRECTORS: Stoltz G (CEO & FD), BrinkAW(ind ne), “Avis” and “Budget” global brands pursuant to a long-term licence secured

Dhlamini L (ind ne), Mbanyele-Ntshinga H (ind ne), Nyanteh M (ind ne), from Avis Budget Group Inc (“ABG Licence”).

Solomons A (ne), van der Veen A (alt), Zetler A (ne), SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—RentLease

Siyotula N (Chair, ind ne), Barnard S (CFO) NUMBER OF EMPLOYEES: 1 660

MAJOR ORDINARY SHAREHOLDERS as at 22 Oct 2024 DIRECTORS: KakanaX(ind ne), Miya Y (ind ne), Motsei Dr N (ind ne),

Legae Peresec 20.43% Roets M (ind ne), Wilson D G (ind ne), BamLL(Chair, ind ne),

Industrial Development Corporation 20.07% Ganda R (CEO), Mngomezulu S (Interim Chair, ind ne), Ntshiza T (CFO)

A2 Investment Partners (Pty) Ltd. 19.47% MAJOR ORDINARY SHAREHOLDERS as at 01 Jul 2024

POSTAL ADDRESS: PO Box 1191, Sabie, 1260 Zahid Tractor & Heavy Machinery Ltd. 18.84%

MORE INFO: www.sharedata.co.za/sdo/jse/YRK Public Investment Company SOC Ltd. 14.08%

COMPANY SECRETARY: Kilgetty Statutory Services (SA) (Pty) Ltd. Silchester Trust 8.49%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 221, Isando, Johannesburg, 1600

SPONSOR: One Capital MORE INFO: www.sharedata.co.za/sdo/jse/ZZD

AUDITORS: Deloitte & Touche Inc. COMPANY SECRETARY: Chioneso Sakutukwa (1/10/2024)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Nedbank Ltd.

YRK Ords 5c ea 600 000 000 474 097 739

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords 5c ea Ldt Pay Amt ZZD Ords no par value 2 000 000 000 189 641 787

Interim 18 Nov 05 28 Nov 05 30.00

Special 18 Nov 05 28 Nov 05 70.00 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

LIQUIDITY: Oct24 Avg 405 669 shares p.w., R730 023.6(4.4% p.a.) Interim No 1 9 Jul 24 15 Jul 24 50.00

IDMS 40 Week MA YORK

LIQUIDITY: Oct24 Avg 2m shares p.w., R21.2m(47.4% p.a.)

JS4021 40 Week MA ZEDA

345 2276

280 2011

216 1747

151 1482

86 1218

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 2023 | 2024 953

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final(rst) Final(rst) Final FINANCIAL STATISTICS

Turnover 1 745 219 1 666 294 1 838 810 1 928 589 1 438 825 (Amts in ZAR’000) Mar 24 Sep 23 Sep 22

Interim Final Final(rst)

Op Inc 227 295 - 393 537 248 946 219 480 - 82 108

NetIntPd(Rcvd) 41 385 32 422 32 473 44 829 58 032 Turnover 5 269 514 9 144 637 8 133 228

Att Inc 136 072 - 312 864 182 755 137 069 - 217 637 Op Inc 789 444 1 551 903 1 263 791

TotCompIncLoss 136 315 - 313 265 184 300 138 510 - 217 377 NetIntPd(Rcvd) 351 605 622 377 382 997

Fixed Ass 911 662 892 703 946 448 927 732 844 129 Minority Int 5 392 10 197 8 472

Inv & Loans - - - 12 093 84 071 Att Inc 309 708 731 883 561 416

Tot Curr Ass 1 080 864 1 043 451 776 794 927 891 958 480 TotCompIncLoss 325 559 756 423 613 221

Ord SH Int 2 820 001 2 682 931 2 751 049 2 559 581 2 880 872 Fixed Ass 4 439 462 4 206 244 3 624 656

LT Liab 1 174 346 1 045 370 1 224 477 1 235 919 1 314 676 Inv & Loans 23 731 24 189 8 563

Tot Curr Liab 498 221 512 506 411 198 550 228 453 495 Tot Curr Ass 7 823 287 7 976 873 6 362 847

Ord SH Int 2 675 469 2 354 975 1 631 484

PER SHARE STATISTICS (cents per share) Minority Int 47 931 48 444 42 188

HEPS-C (ZARc) 30.00 - 76.00 53.00 42.00 - 70.00 LT Liab 3 890 508 3 051 864 3 038 824

NAV PS (ZARc) 608.00 579.00 857.00 805.39 903.45 Tot Curr Liab 6 354 070 7 357 651 5 848 251

3 Yr Beta 0.90 0.98 0.73 0.32 0.09

Price High 200 305 420 270 185 PER SHARE STATISTICS (cents per share)

Price Low 145 175 173 85 78 HEPS-C (ZARc) 165.50 381.07 324.70

Price Prd End 171 196 246 187 86 DPS (ZARc) 50.00 - -

RATIOS NAV PS (ZARc) 1 427.90 1 246.02 860.30

Ret on SH Fnd 4.83 - 11.66 6.64 5.36 - 7.55 Price High 1 343 1 800 -

Oper Pft Mgn 13.02 - 23.62 13.54 11.38 - 5.71 Price Low 1 000 857 -

D:E 0.46 0.45 0.49 0.56 0.53 Price Prd End 1 105 1 160 -

Current Ratio 2.17 2.04 1.89 1.69 2.11 RATIOS

Ret on SH Fnd 23.14 30.88 34.05

Oper Pft Mgn 14.98 16.97 15.54

D:E 1.74 1.88 2.82

Current Ratio 1.23 1.08 1.09

Div Cover 3.31 - -

213