Page 214 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 214

JSE – WOR Profile’s Stock Exchange Handbook: 2024 – Issue 4

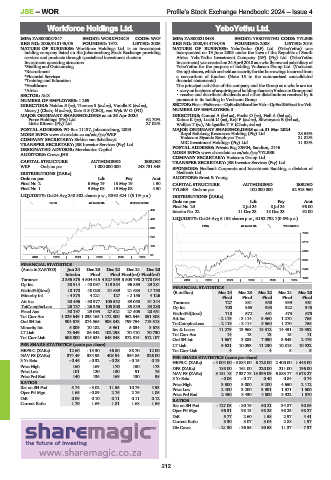

Workforce Holdings Ltd. YeboYethu Ltd.

WOR YEB

ISIN: ZAE000087847 SHORT: WORKFORCE CODE: WKF ISIN: ZAE000218483 SHORT: YEBOYETHU CODE: YYLBEE

REG NO: 2006/018145/06 FOUNDED: 1972 LISTED: 2006 REG NO: 2008/014734/06 FOUNDED: 2008 LISTED: 2016

NATURE OF BUSINESS: Workforce Holdings Ltd. is an investment NATURE OF BUSINESS: YeboYethu (RF) Ltd. (YeboYethu) was

holding company listed on the Johannesburg Stock Exchange providing incorporated on 19 June 2008 under the laws of the Republic of South

services and products through specialised investment clusters. Africa. YeboYethu Investment Company (RF) (Pty) Ltd. (YeboYethu

Investment operating structure: Investment) was created on 24 April 2018 as a wholly-owned subsidiary of

*Staffing and Outsourcing YeboYethu for the purpose of holding Vodacom Group Ltd. (Vodacom

*Recruitment Group) shares, which are held as security for the borrowings incurred from

*Financial Services a consortium of funders (Note 15 to the summarised consolidated

*Training and Education financial statements).

*Healthcare The principal activities of the company and the Group as a whole are to:

*Africa •carryonbusinessofacquiring andholdingsharesinVodacomGroup;and

SECTOR: AltX • receive and distribute dividends and other distributions received by it

NUMBER OF EMPLOYEES: 1 269 pursuant to its holding in Vodacom Group.

DIRECTORS: Naidoo S (ne), Thomas S (ind ne), Vundla K (ind ne), SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

Macey J (Chair, ld ind ne), Katz R S (CEO), van Wyk W O (FD) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 26 Apr 2024 DIRECTORS: Conrad A (ind ne), Fuchs O (ne), Hall A (ind ne),

Force Holdings (Pty) Ltd. 62.70% Kobue K (ne), Lucht U (ne), Roji F (ind ne), Silwanyana B (ind ne),

Little Kittens (Pty) Ltd. 27.02% Walljee T (ne), Mokgatlha T V (Chair, ind ne)

POSTAL ADDRESS: PO Box 11137, Johannesburg, 2000 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

MORE INFO: www.sharedata.co.za/sdo/jse/WKF Royal Bafokeng Resources Holding (Pty) Ltd. 28.56%

COMPANY SECRETARY: Sirkien van Schalkwyk Vodacom Siyanda Employee Trust 21.82%

MIC Investment Holdings (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. POSTAL ADDRESS: Private Bag X9904, Sandton, 2146 11.33%

DESIGNATED ADVISOR: Merchantec Capital

AUDITORS: Crowe JHB MORE INFO: www.sharedata.co.za/sdo/jse/YYLBEE

COMPANY SECRETARY: Vodacom Group Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

WKF Ords no par 1 000 000 000 243 731 343 SPONSORS: Nedbank Corporate and Investment Banking, a division of

DISTRIBUTIONS [ZARc] Nedbank Ltd.

Ords no par Ldt Pay Amt AUDITORS: Ernst & Young

Final No 2 6 May 19 13 May 19 1.50 CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 1 9 May 08 19 May 08 4.50 YYLBEE Ords no par 100 000 000 52 915 960

LIQUIDITY: Oct24 Avg 240 582 shares p.w., R392 624.1(5.1% p.a.) DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

SUPS 40 Week MA WORKFORCE

FinalNo 23 2 Jul24 8 Jul24 96.00

489

Interim No 22 11 Dec 23 18 Dec 23 92.00

409 LIQUIDITY: Oct24 Avg 6 138 shares p.w., R152 792.7(0.6% p.a.)

FINA 40 Week MA YEBOYETHU

328

7316

247

6173

166

5030

85

2019 | 2020 | 2021 | 2022 | 2023 | 2024

3887

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 2743

Interim Final Final Final(rst) Final(rst)

1600

Turnover 2 355 875 4 504 615 4 327 959 3 503 798 2 778 034 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Op Inc 38 914 - 40 097 119 354 96 869 29 281 FINANCIAL STATISTICS

NetIntPd(Rcvd) 18 170 40 023 31 689 21 683 17 758

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Minority Int - 4 373 4 221 127 - 2 156 4 126 Final Final Final Final Final

Att Inc 30 496 - 30 977 105 532 89 058 31 244 Turnover 727 881 950 939 961

TotCompIncLoss 25 737 - 26 356 105 300 85 839 33 230 Op Inc 700 865 933 922 945

Fixed Ass 30 197 29 093 27 521 27 505 20 651 NetIntPd(Rcvd) 710 572 451 473 675

Tot Curr Ass 1 029 649 1 038 165 1 172 300 962 546 851 308 Att Inc - 2 119 - 3 114 3 560 1 270 765

Ord SH Int 904 675 874 565 908 842 799 754 713 318 TotCompIncLoss - 2 119 - 3 114 3 560 1 270 765

Minority Int 5 809 10 182 5 961 5 834 3 678 Inv & Loans 11 279 13 968 18 312 14 451 13 392

LT Liab 78 649 86 542 102 298 70 410 70 730 Tot Curr Ass 14 13 13 15 11

Tot Curr Liab 606 000 615 624 648 848 572 315 512 107 Ord SH Int 1 667 3 883 7 090 3 643 2 476

PER SHARE STATISTICS (cents per share) LT Liab 9 621 10 093 11 230 10 818 10 922

HEPS-C (ZARc) 12.60 - 13.30 46.80 38.70 12.00 Tot Curr Liab 4 4 4 5 5

NAV PS (ZARc) 374.49 384.93 403.94 354.85 326.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta - 0.46 - 0.32 - 0.28 - 0.15 0.19 HEPS-C (ZARc) - 4 004.00 - 5 884.00 6 728.00 2 400.00 1 445.00

Price High 160 169 170 150 173 DPS (ZARc) 188.00 161.00 220.00 211.00 196.00

Price Low 101 120 130 91 76 NAV PS (ZARc) 3 151.18 7 337.78 13 399.09 6 883.77 4 678.27

Price Prd End 140 135 169 130 98 3 Yr Beta - 0.06 - 0.17 0.40 0.84 0.74

RATIOS Price High 3 600 5 000 5 200 4 650 2 112

Ret on SH Fnd 5.74 - 3.02 11.55 10.79 4.93 Price Low 2 400 3 200 3 901 1 571 1 500

Oper Pft Mgn 1.65 - 0.89 2.76 2.76 1.05 Price Prd End 2 450 3 430 4 500 3 922 1 570

D:E 0.09 0.10 0.11 0.11 0.12 RATIOS

Current Ratio 1.70 1.69 1.81 1.68 1.66 Ret on SH Fnd - 127.05 - 80.19 50.21 34.87 30.89

Oper Pft Mgn 96.31 98.13 98.25 98.25 98.27

D:E 5.77 2.60 1.58 2.97 4.41

Current Ratio 3.30 3.07 3.04 2.88 1.97

Div Cover - 21.30 - 36.55 30.58 11.37 7.37

212