Page 68 - shbh24_complete

P. 68

JSE – ACC Profile’s Stock Exchange Handbook: 2024 – Issue 3

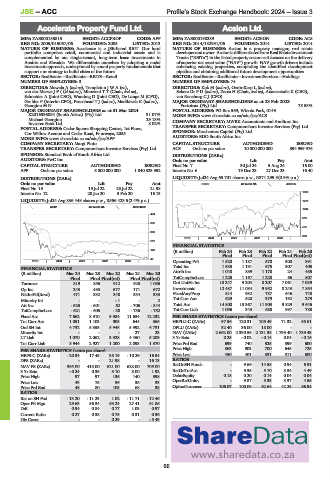

Accelerate Property Fund Ltd. Acsion Ltd.

ACC ACS

ISIN: ZAE000185815 SHORT: ACCPROP CODE: APF ISIN: ZAE000198289 SHORT: ACSION CODE: ACS

REG NO: 2005/015057/06 FOUNDED: 2005 LISTED: 2013 REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014

NATURE OF BUSINESS: Accelerate is a JSE-listed REIT. Our local NATURE OF BUSINESS: Acsion is a property manager, real estate

portfolio comprises retail, commercial and industrial assets and is developer and owner. Acsion is differentiated from Real Estate Investment

complemented by our single-tenant, long-term lease investments in Trusts (“REITs”) in the listed property sector as it focuses on the delivery

Austria and Slovakia. We differentiate ourselves by adopting a nodal of superior net asset value (“NAV”) growth. NAV growth drivers include

investment approach, underpinned by sound property fundamentals that enhancing existing properties, completing the identified development

support our strategy to build cities of the future. pipeline and obtaining additional future development opportunities.

SECTOR: RealEstate—RealEstate—REITS—Retail SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 0 NUMBER OF EMPLOYEES: 74

DIRECTORS: Mawela A (ind ne), TempletonJWA(ne), DIRECTORS: KokM(ind ne), Osrin-Karp L (ind ne),

van der MerweJF((ld ind ne), Mboweni T T (Chair, ind ne), Sekete DrPD(ind ne), Zarca H (Chair, ind ne), Anastasiadis K (CEO),

Schneider A (Joint CEO), Wandrag D (Joint CEO), De Lange M (CFO), van Rensburg C J (CFO)

Grobler P (Interim CFO), FearnheadTJ(ind ne), Madikizela K (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2023

Georgiou M N Fortutrax (Pty) Ltd. 75.53%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 POSTAL ADDRESS: PO Box 569, Wierda Park, 0149

K2016336084 (South Africa) (Pty) Ltd. 31.07% MORE INFO: www.sharedata.co.za/sdo/jse/ACS

Michael Georgiou 29.13% COMPANY SECRETARY: MWRK Accountants and Auditors Inc.

Investec Bank Ltd. 8.02% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: Cedar Square Shopping Centre, 1st Floor,

Cnr Willow Avenue and Cedar Road, Fourways, 2055 SPONSOR: Merchantec Capital (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/APF AUDITORS: BDO South Africa Inc.

COMPANY SECRETARY: Margi Pinto CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. ACS Ords no par value 10 000 000 000 394 959 976

SPONSOR: Standard Bank of South Africa Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: PwC Inc. Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 7 30 Jul 24 5 Aug 24 16.00

APF Ords no par value 5 000 000 000 1 840 323 952 Interim No 6 19 Dec 23 27 Dec 23 16.40

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul24 Avg 65 701 shares p.w., R371 299.5(0.9% p.a.)

Ords no par value Ldt Pay Amt REDS 40 Week MA ACSION

Final No 13 19 Jul 22 25 Jul 22 21.98

Interim No 12 28 Jan 20 3 Feb 20 16.13 1506

LIQUIDITY: Jul24 Avg 836 448 shares p.w., R556 423.5(2.4% p.a.) 1275

REIV 40 Week MA ACCPROP

1044

484

813

395

581

306

350

2019 | 2020 | 2021 | 2022 | 2023 |

218

FINANCIAL STATISTICS

129 (R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final(rst)

40

2019 | 2020 | 2021 | 2022 | 2023 | Operating Prft 1 520 1 187 570 300 391

Total Inc 1 535 1 191 575 307 405

FINANCIAL STATISTICS

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 Attrib Inc 1 040 889 1 170 24 485

Final Final Final(rst) Final Final(rst) TotCompIncLoss 1 225 1 167 1 228 66 507

Turnover 819 856 912 625 1 086 Ord UntHs Int 10 247 9 204 8 207 7 061 7 039

Op Inc 243 483 577 171 672 Investments 12 487 11 084 9 952 8 243 7 854

NetIntPd(Rcvd) 471 332 348 334 333 FixedAss/Prop 814 932 737 646 748

Minority Int - - - 1 - 2 Tot Curr Ass 629 520 379 192 279

Att Inc - 625 - 601 62 - 706 - 844 Total Ass 14 800 13 367 11 903 9 829 9 646

TotCompIncLoss - 621 - 605 - 38 - 736 - 752 Tot Curr Liab 1 096 343 688 997 788

Fixed Ass 7 662 8 910 9 984 11 634 12 232 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 051 1 103 905 644 565 HEPLU-C (ZARc) 97.56 120.31 105.49 71.32 65.61

Ord SH Int 4 732 5 353 5 948 5 992 6 731 DPLU (ZARc) 32.40 36.00 18.00 - -

Minority Int - - - 27 23 NAV (ZARc) 2 662.00 2 390.56 2 131.38 1 795.40 1 789.43

LT Liab 1 070 2 062 3 928 4 450 5 209 3 Yr Beta 0.25 - 0.02 - 0.14 0.04 - 0.16

Tot Curr Liab 3 944 2 927 1 200 2 093 1 570 Price Prd End 699 740 525 399 600

PER SHARE STATISTICS (cents per share) Price High 863 903 700 645 725

HEPS-C (ZARc) - 20.34 17.45 38.19 - 10.26 16.54 Price Low 450 401 331 311 600

DPS (ZARc) - - 21.98 - 16.13 RATIOS

NAV PS (ZARc) 365.00 413.00 621.00 628.00 705.00 RetOnSH Funds - 9.66 14.58 0.94 6.91

3 Yr Beta - 0.24 0.35 3.10 3.00 1.92 RetOnTotAss - 9.35 5.10 3.34 4.49

Price High 97 97 136 140 398 Debt:Equity 0.18 0.20 0.14 0.04 0.04

Price Low 43 75 56 36 33 OperRetOnInv - 9.87 5.33 3.37 4.55

Price Prd End 48 80 105 68 38 OpInc:Turnover 106.07 100.09 62.64 42.25 56.94

RATIOS

Ret on SH Fnd - 13.20 - 11.23 1.02 - 11.71 - 12.46

Oper Pft Mgn 29.63 56.34 63.24 27.41 61.86

D:E 0.94 0.84 0.77 1.03 0.97

Current Ratio 0.27 0.38 0.75 0.31 0.36

Div Cover - - 0.29 - - 5.49

66