Page 71 - shbh24_complete

P. 71

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE –EC

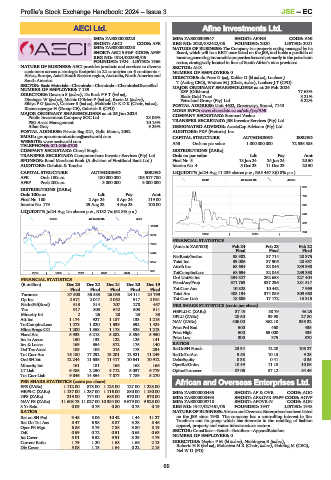

AECI Ltd. Afine Investments Ltd.

EC AFI

ISIN: ZAE000000220 ISIN: ZAE000303947 SHORT: AFINE CODE: ANI

SHORT: AECI CODE: AFE REG NO: 2020/852422/06 FOUNDED: 2020 LISTED: 2021

ISIN: ZAE000000238 NATURE OF BUSINESS: The Company is a property entity, managed by its

SHORT: AECI 5.5%P CODE: AFEP Board, which will be a REIT once listed on the JSE, and holds a portfolio of

REG NO: 1924/002590/06 income generating immovable properties focused primarily in the petroleum

FOUNDED: 1924 LISTED: 1966 sector, strategically located in four of South Africa’s nine provinces.

NATURE OF BUSINESS: AECI provides products and services to diverse SECTOR: AltX

customers across a strategic footprint in 22 countries on 6 continents – NUMBER OF EMPLOYEES: 0

Africa, Europe, Asia’s South Eastern region, Australia, North America and DIRECTORS: du Preez G (ne), Kohler D (ld ind ne), Loubser J

South America. T (Acting CEO), Watters M J (Chair, ind ne), Loubser J T (CFO)

SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

NUMBER OF EMPLOYEES: 7 189 KSP (Offshore) 77.63%

DIRECTORS: Dawson S (ind ne), De Buck FFT(ind ne), Black Gold Trust 8.21%

Dissinger W (ind ne), Mishic O’Brien P (ind ne), Roets M (ind ne), Petroland Group (Pty) Ltd. 6.22%

Sibiya P G (ind ne), Coetzer S (ind ne), Mokhele Dr K D K (Chair, ind ne), POSTAL ADDRESS: Unit 4602, Greenways, Strand, 7140

Riemensperger H (Group CE), Gabriels R (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/ANI

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2024

Public Investment Company SOC Ltd. 23.06% COMPANY SECRETARY: Sonmari Vosloo

PSG Asset Management 10.15% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Allan Gray 9.29% DESIGNATED ADVISOR: AcaciaCap Advisors (Pty) Ltd.

POSTAL ADDRESS: Private Bag X21, Gallo Manor, 2052 AUDITORS: PKF (Pretoria) Inc.

EMAIL: groupcommunications@aeciworld.com CAPITAL STRUCTURE AUTHORISED ISSUED

WEBSITE: www.aeciworld.com ANI Ords no par value 1 000 000 000 72 536 585

TELEPHONE: 011-806-8700

COMPANY SECRETARY: Cheryl Singh DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Final No 5 18 Jun 24 24 Jun 24 20.50

AUDITORS: Deloitte & Touche Interim No 4 5 Dec 23 11 Dec 23 20.50

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul24 Avg 11 239 shares p.w., R55 467.8(0.8% p.a.)

AFE Ords 100c ea 180 000 000 105 517 780

REIV 40 Week MA AFINE

AFEP Prefs 200c ea 3 000 000 3 000 000

881

DISTRIBUTIONS [ZARc]

Ords 100c ea Ldt Pay Amt 762

Final No 180 2 Apr 24 8 Apr 24 119.00

Interim No 179 29 Aug 23 4 Sep 23 100.00 642

LIQUIDITY: Jul24 Avg 1m shares p.w., R132.7m(62.8% p.a.)

523

CHES 40 Week MA AECI

403

11900

284

2022 | 2023 |

9714

FINANCIAL STATISTICS

7529

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22

Final Final Final

5343

NetRent/InvInc 38 982 37 714 28 375

3157 Total Inc 39 086 37 905 28 657

Attrib Inc 68 694 32 045 239 398

972 TotCompIncLoss 68 694 32 045 239 398

2019 | 2020 | 2021 | 2022 | 2023 |

Ord UntHs Int 294 327 262 658 227 404

FINANCIAL STATISTICS

(R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 FixedAss/Prop 371 763 337 296 281 517

Final Final Final Final Final Tot Curr Ass 10 328 10 442 7 969

Turnover 37 500 35 583 26 053 24 111 24 799 Total Ass 408 194 374 089 309 660

Op Inc 2 571 2 047 2 052 917 2 031 Tot Curr Liab 18 686 17 172 13 315

NetIntPd(Rcvd) 513 314 207 278 457 PER SHARE STATISTICS (cents per share)

Tax 917 803 642 503 511 HEPLU-C (ZARc) 37.19 38.79 46.23

Minority Int 2 26 20 23 33 DPLU (ZARc) 20.50 39.90 27.80

Att Inc 1 174 927 1 187 133 1 216 NAV (ZARc) 406.00 362.10 355.32

TotCompIncLoss 1 273 1 020 1 539 392 1 424 Price Prd End 500 460 435

Hline Erngs-CO 1 200 1 358 1 178 928 1 213

Fixed Ass 6 933 6 218 5 882 5 896 5 950 Price High 500 65 000 435

300

370

375

Price Low

Inv in Assoc 150 133 122 125 141

Inv & Loans 169 354 372 176 140 RATIOS

Def Tax Asset 189 106 215 173 234 RetOnSH Funds 23.34 12.20 105.27

Tot Curr Ass 16 180 17 292 13 201 12 921 11 249 RetOnTotAss 9.58 10.13 9.25

Ord SH Int 12 244 11 635 11 417 10 641 10 912 Debt:Equity 0.38 0.41 0.35

Minority Int 161 181 166 168 166 OperRetOnInv 10.49 11.18 10.08

LT Liab 6 485 2 250 4 712 5 037 6 779 OpInc:Turnover 87.06 87.12 84.46

Tot Curr Liab 9 046 14 354 7 877 7 789 5 270

PER SHARE STATISTICS (cents per share) African and Overseas Enterprises Ltd.

EPS (ZARc) 1 112.00 878.00 1 125.00 127.00 1 223.00 AFR

HEPS-C (ZARc) 1 137.00 1 287.00 1 116.00 880.00 1 150.00 ISIN: ZAE000000485 SHORT: AF & OVR CODE: AOO

DPS (ZARc) 219.00 774.00 685.00 570.00 570.00 ISIN: ZAE000000493 SHORT: AF&OVR 6%PP CODE: AOVP

NAV PS (ZARc) 11 603.73 11 027.00 10 384.00 9 679.00 9 925.00 ISIN: ZAE000009718 SHORT: AFOVR-N CODE: AON

3 Yr Beta 0.09 0.76 0.80 0.75 0.19 REG NO: 1947/027461/06 FOUNDED: 1947 LISTED: 1948

RATIOS NATURE OF BUSINESS: African and Overseas Enterprises has been listed

Ret on SH Fnd 9.48 8.06 10.42 1.44 11.27 on the JSE since 1948. The company has a controlling interest in Rex

Ret On Tot Ass 8.47 6.98 8.87 3.28 8.46 Trueform and its group which has interests in the retailing of fashion

apparel, property and water infrastructure sectors.

Oper Pft Mgn 6.86 5.75 7.88 3.80 8.19 SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers

D:E 0.59 0.72 0.51 0.65 0.63

Int Cover 5.01 6.52 9.91 3.29 4.79 NUMBER OF EMPLOYEES: 0

Current Ratio 1.79 1.20 1.68 1.66 2.13 DIRECTORS: NaylorPM(ld ind ne), Ntshingwa B (ind ne),

RobertsHB(ind ne), Molosiwa M R (Chair, ind ne), Golding M (CEO),

Div Cover 5.08 1.13 1.64 0.22 2.15

Nel W D (FD)

69