Page 69 - shbh24_complete

P. 69

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – ADC

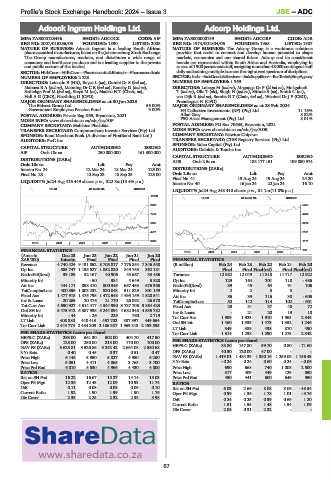

Adcock Ingram Holdings Ltd. Adcorp Holdings Ltd.

ADC ADC

ISIN: ZAE000123436 SHORT: ADCOCK CODE: AIP ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR

REG NO: 2007/016236/06 FOUNDED: 1890 LISTED: 2008 REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987

NATURE OF BUSINESS: Adcock Ingram is a leading South African NATURE OF BUSINESS: The Adcorp Group is a workforce solutions

pharmaceutical manufacturer, listed on the Johannesburg Stock Exchange. provider that seeks to connect and develop human potential to shape

The Group manufactures, markets, and distributes a wide range of markets, economies and our shared future. Adcorp and its constituent

consumer and healthcare products and is a leading supplier to the private brands are represented within South Africa and Australia, employing in

and public sectors of the market. excessof1 900 permanentstaff,assigning morethan48 000 contingentstaff

SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals dailyandtrainingmultiplelearnersthroughavastspectrumofdisciplines.

NUMBER OF EMPLOYEES: 2 223 SECTOR: Inds—IndsGoods&Services—IndsSupptServ—BusTrain&EmpAgency

DIRECTORS: Letsoalo B (HR), Boyce L (ne), Gumbi Dr S (ind ne), NUMBER OF EMPLOYEES: 1 959

MabuzaBA(ind ne), Manning DrCE(ind ne), Ransby D (ind ne), DIRECTORS: Lubega M (ind ne), Mnganga Dr P (ld ind ne), Mokgabudi

Sathekge Prof M (ind ne), Steyn M (ne), Madisa N T (Chair, ne), T(ind ne), Olls T (alt), Singh H (ind ne), Sithole S (ne), Smith C (ne),

Hall A G (CEO), Neethling D (CFO) van Dijk R (ind ne), Serobe G T (Chair, ind ne), Wentzel Dr J P (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 Prendergast N (CFO)

The Bidvest Group Ltd. 56.00% MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2024

Government Employees Pension Fund 9.00% H4 Collective Investments (RF) (Pty) Ltd. 11.16%

POSTAL ADDRESS: Private Bag X69, Bryanston, 2021 Allan Gray 8.82%

MORE INFO: www.sharedata.co.za/sdo/jse/AIP PSG Asset Management (Pty) Ltd. 8.01%

COMPANY SECRETARY: Mahlatse Phalafala POSTAL ADDRESS: PO Box 70635, Bryanston, 2021

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ADR

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) COMPANY SECRETARY: Newton Chipswa

AUDITORS: PwC Inc. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SPONSOR: Valeo Capital (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Deloitte & Touche Inc.

AIP Ords 10c ea 250 000 000 161 300 000

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] ADR Ords 2.5c ea 183 177 151 109 880 974

Ords 10c ea Ldt Pay Amt

Interim No 24 12 Mar 24 18 Mar 24 125.00 DISTRIBUTIONS [ZARc]

Final No 23 12 Sep 23 18 Sep 23 125.00 Ords 2.5c ea Ldt Pay Amt

Final No 41 13 Aug 24 19 Aug 24 24.20

LIQUIDITY: Jul24 Avg 416 449 shares p.w., R22.8m(13.4% p.a.)

Interim No 40 16 Jan 24 22 Jan 24 16.10

PHAR 40 Week MA ADCOCK

LIQUIDITY: Jul24 Avg 248 410 shares p.w., R1.1m(11.8% p.a.)

10783

SUPS 40 Week MA ADCORP

9268 5253

7752 4232

6237 3212

4721 2191

3206 1171

2019 | 2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS 150

2019 | 2020 | 2021 | 2022 | 2023 |

(Amts in Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

ZAR’000) Interim Final Final Final Final FINANCIAL STATISTICS

Revenue 4 740 424 9 131 852 8 705 817 7 776 854 7 346 558 (R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Op Inc 585 747 1 135 527 1 052 820 849 755 862 181 Final Final Final(rst) Final Final(rst)

NetIntPd(Rcvd) 39 189 52 167 40 906 43 667 33 486 Turnover 12 982 12 049 11 318 11 717 12 922

Minority Int - - 50 384 4 649 5 828 Op Inc 129 164 201 118 - 486

Att Inc 444 171 898 410 800 345 657 463 676 366 NetIntPd(Rcvd) 39 45 64 91 106

TotCompIncLoss 400 356 1 003 232 830 043 511 829 801 159 Minority Int 2 2 3 3 -

Fixed Ass 1 477 918 1 475 795 1 472 548 1 495 159 1 528 541 Att Inc 86 39 116 38 - 605

Inv & Loans 20 269 20 476 21 770 26 092 26 570 TotCompIncLoss 52 142 114 102 - 601

Tot Curr Ass 4 690 927 4 614 417 4 344 990 3 737 706 3 864 423 Fixed Ass 25 31 37 48 72

Ord SH Int 5 475 912 5 387 938 5 244 894 4 682 348 4 535 782 Inv & Loans - 21 20 19 18

Minority Int - 44 - 26 229 760 2 719 Tot Curr Ass 1 989 1 923 1 910 1 963 2 545

LT Liab 408 380 440 413 457 702 387 997 449 654 Ord SH Int 1 460 1 535 1 473 1 352 1 246

Tot Curr Liab 2 444 775 2 434 209 2 186 337 1 969 313 2 193 595

LT Liab 349 389 438 870 490

PER SHARE STATISTICS (cents per share) Tot Curr Liab 1 314 1 238 1 290 1 273 2 342

HEPS-C (ZARc) 293.00 561.30 502.00 404.70 417.50

DPS (ZARc) 125.00 250.00 213.00 170.00 100.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 3 625.81 3 526.86 3 242.42 2 664.08 2 580.68 HEPS-C (ZARc) 83.80 147.80 99.70 0.80 - 71.60

3 Yr Beta 0.40 0.45 0.37 0.51 0.47 DPS (ZARc) 40.30 120.00 47.00 - -

Price High 6 148 5 950 5 827 4 950 6 250 NAV PS (ZARc) 1 419.01 1 484.39 1 380.16 1 259.08 1 156.43

Price Low 5 051 4 411 4 065 3 765 3 700 3 Yr Beta - 0.24 0.24 0.60 0.24 - 0.06

Price Prd End 6 010 5 630 4 966 4 430 4 800 Price High 690 668 740 1 008 2 500

RATIOS Price Low 317 409 449 129 850

Ret on SH Fnd 16.22 16.67 15.27 14.14 15.03 Price Prd End 450 441 600 649 950

Oper Pft Mgn 12.36 12.43 12.09 10.93 11.74 RATIOS

D:E 0.11 0.08 0.09 0.09 0.10 Ret on SH Fnd 6.03 2.66 8.08 3.06 - 48.54

Current Ratio 1.92 1.90 1.99 1.90 1.76 Oper Pft Mgn 0.99 1.36 1.78 1.01 - 3.76

Div Cover 2.33 2.25 2.32 2.33 3.98 D:E 0.24 0.25 0.39 0.69 1.20

Current Ratio 1.51 1.55 1.48 1.54 1.09

Div Cover 2.08 0.31 2.32 - -

67