Page 133 - shbh24_complete

P. 133

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – ITA

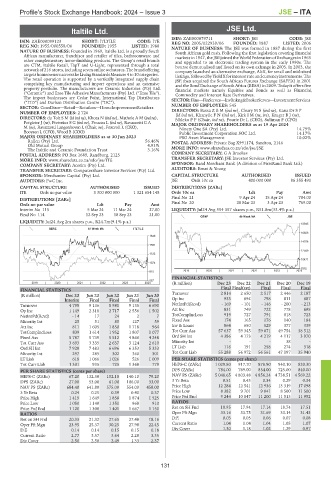

Italtile Ltd. JSE Ltd.

JSE

ITA ISIN: ZAE000079711 SHORT: JSE CODE: JSE

ISIN: ZAE000099123 SHORT: ITLTILE CODE: ITE REG NO: 2005/022939/06 FOUNDED: 1887 LISTED: 2006

REG NO: 1955/000558/06 FOUNDED: 1955 LISTED: 1988 NATURE OF BUSINESS: The JSE was formed in 1887 during the first

NATURE OF BUSINESS: Founded in 1969, Italtile Ltd. is a proudly South South African gold rush. Following the first legislation covering financial

African manufacturer, franchisor and retailer of tiles, bathroomware and markets in 1947, the JSEjoinedthe World Federation of Exchanges in 1963

other complementary home-finishing products. The Group’s retail brands and upgraded to an electronic trading system in the early 1990s. The

are CTM, Italtile Retail, TopT and U-Light, represented through a total bourse demutualised and listed on its own exhange in 2005. In 2003, the

networkof216 stores,includingsevenonlinewebstores.Thebrandoffering company launched an alternative exchange, AltX, for small and mid-sized

targetshomeownersacrosstheLivingStandardsMeasure4to10categories. listings,followedbyYieldXforinterestrateandcurrency instruments.The

The retail operation is supported by a vertically integrated supply chain JSE then acquired the South African Futures Exchange (SAFEX) in 2001

comprising key manufacturing and import operations and an extensive and the Bond Exchange of South Africa (BESA) in 2009. Today it offers five

property portfolio. The manufacturers are Ceramic Industries (Pty) Ltd. financial markets namely Equities and Bonds as well as Financial,

(“Ceramic”) and Ezee Tile Adhesive Manufacturers (Pty) Ltd. (“Ezee Tile”). Commodity and Interest Rate Derivatives.

The import businesses are Cedar Point, International Tap Distributors SECTOR:Fins—FinServcs—InvBnkng&BrokerServcs—InvestmentServices

(“ITD”) and Durban Distribution Centre (“DC”).

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers NUMBER OF EMPLOYEES: 545

NUMBER OF EMPLOYEES: 2 726 DIRECTORS: BassaZBM(ind ne), ClearyMS(ind ne), Kana Dr S P

(ld ind ne), KhanyileFN(ind ne), KirkIM(ne, Ire), KrugerBJ(ne),

DIRECTORS: du ToitSM(ld ind ne), Khoza N (ind ne), Mathole A M (ind ne), Nhleko P F (Chair, ind ne), Fourie Dr L (CEO), Suliman F (CFO)

Potgieter J (ne), Pretorius S G (ind ne), Prezens L (ind ne), Ravazzotti G A MAJOR ORDINARY SHAREHOLDERS as at 19 Apr 2024

M(ne), Ravazzotti Langenhoven L (Chair, ne), Foxcroft L (CEO), Ninety One SA (Pty) Ltd. 14.79%

Booysen L (CFO), Wood B (COO) Public Investment Corporation SOC Ltd. 14.17%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 PSG Asset Management 10.02%

Rallen (Pty) Ltd. 56.46% POSTAL ADDRESS: Private Bag X991174, Sandton, 2146

Old Mutual Group 4.91% MORE INFO: www.sharedata.co.za/sdo/jse/JSE

The Italtile and Ceramic Foundation Trust 3.16%

POSTAL ADDRESS: PO Box 1689, Randburg, 2125 COMPANY SECRETARY: G A Brookes

MORE INFO: www.sharedata.co.za/sdo/jse/ITE TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

COMPANY SECRETARY: Acorim (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Ernst & Young

SPONSOR: Merchantec Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc. JSE Ords 10c ea 400 000 000 86 355 491

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ITE Ords no par value 3 300 000 000 1 321 654 148 Ords 10c ea Ldt Pay Amt

Final No 21 9 Apr 24 15 Apr 24 784.00

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Final No 20 28 Mar 23 3 Apr 23 769.00

Interim No 115 5 Mar 24 11 Mar 24 27.00 LIQUIDITY: Jul24 Avg 554 357 shares p.w., R51.8m(33.4% p.a.)

Final No 114 12 Sep 23 18 Sep 23 21.00

GENF 40 Week MA JSE

LIQUIDITY: Jul24 Avg 2m shares p.w., R24.7m(9.1% p.a.)

18945

GERE 40 Week MA ITLTILE

16826

1849

14708

1591

12589

1332

10471

1074

8352

815 2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

557

2019 | 2020 | 2021 | 2022 | 2023 | 2024 (R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

Final Final(rst) Final Final Final

FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Turnover 2 814 2 650 2 517 2 446 2 187

Interim Final Final Final Final Op Inc 933 894 798 811 687

Turnover 4 798 9 136 8 981 9 135 6 690 NetIntPd(Rcvd) - 169 - 101 - 146 - 200 - 213

Op Inc 1 149 2 318 2 717 2 556 1 502 Att Inc 831 749 722 778 695

TotCompIncLoss 919 727 791 818 723

NetIntPd(Rcvd) - 14 17 24 2 7

Minority Int 25 51 85 127 59 Fixed Ass 174 165 176 140 184

Att Inc 811 1 605 1 850 1 718 964 Inv & Loans 864 650 529 377 339

TotCompIncLoss 839 1 614 1 952 1 807 1 077 Tot Curr Ass 57 637 59 345 59 071 49 754 38 512

Fixed Ass 5 787 5 739 5 512 4 866 4 248 Ord SH Int 4 386 4 173 4 219 4 117 3 970

Tot Curr Ass 3 693 3 335 2 637 3 124 2 610 Minority Int - - - 38 -

Ord SH Int 7 928 7 483 6 696 6 353 5 333 LT Liab 116 191 258 274 318

Minority Int 297 285 302 360 301 Tot Curr Liab 55 288 56 972 56 561 47 197 35 940

LT Liab 618 1 066 1 026 526 1 009 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 1 331 935 725 1 368 779 HEPS-C (ZARc) 1 029.80 917.70 878.90 940.10 820.30

PER SHARE STATISTICS (cents per share) DPS (ZARc) 784.00 769.00 854.00 725.00 840.00

HEPS-C (ZARc) 67.20 132.30 152.10 140.10 79.20 NAV PS (ZARc) 5 048.65 4 803.48 4 856.24 4 738.51 4 569.22

DPS (ZARc) 27.00 53.00 61.00 106.00 33.00 3 Yr Beta 0.51 0.43 0.34 0.29 0.34

NAV PS (ZARc) 684.40 641.80 575.00 554.00 458.00 Price High 12 284 12 541 12 936 13 319 17 098

3 Yr Beta 0.24 0.25 0.39 0.40 0.37 Price Low 8 382 9 701 9 841 8 500 11 500

Price High 1 419 1 649 1 858 1 874 1 525 Price Prd End 9 244 10 847 11 200 11 513 11 952

Price Low 1 050 1 140 1 351 968 910 RATIOS

Price Prd End 1 120 1 300 1 401 1 667 1 150 Ret on SH Fnd 18.95 17.94 17.14 18.74 17.51

RATIOS Oper Pft Mgn 33.16 33.75 31.69 33.14 31.43

Ret on SH Fnd 20.33 21.32 27.65 27.48 18.16 D:E 0.03 0.05 0.06 0.07 0.08

Oper Pft Mgn 23.95 25.37 30.25 27.98 22.45 Current Ratio 1.04 1.04 1.04 1.05 1.07

D:E 0.14 0.14 0.15 0.15 0.18 Div Cover 1.30 1.18 1.02 1.29 0.97

Current Ratio 2.77 3.57 3.64 2.28 3.35

Div Cover 2.50 2.50 2.49 1.33 2.37

131