Page 129 - shbh24_complete

P. 129

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – HUL

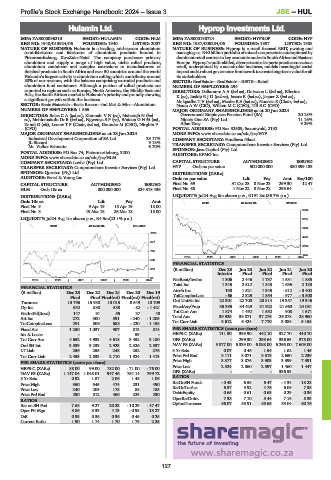

Hulamin Ltd. Hyprop Investments Ltd.

HUL HYP

ISIN: ZAE000096210 SHORT: HULAMIN CODE: HLM ISIN: ZAE000190724 SHORT: HYPROP CODE: HYP

REG NO: 1940/013924/06 FOUNDED: 1940 LISTED: 2007 REG NO: 1987/005284/06 FOUNDED: 1987 LISTED: 1988

NATURE OF BUSINESS: Hulamin is a leading, mid-stream aluminium NATURE OF BUSINESS: Hyprop is a retail focused REIT, owning and

semi-fabricator and fabricator of aluminium products located in managing a c. R40 billion portfolio of mixed-use precincts underpinned by

Pietermaritzburg, KwaZulu-Natal. The company purchases primary dominant retail centres in key economic nodes in South Africa and Eastern

aluminium and supply a range of high value, niche rolled products, Europe. Hyprop’smulti-skilled, diverseteamofexpertspractice conscious

aluminium containers and complex extrusions to manufacturers of retail, underpinned by a sustainable business, models meaningful social

finished products in South Africa and over 50 countries around the world. impact andarobust governanceframeworktocreate long-termvalueforall

Hulamin’s largest activity is aluminium rolling which contributes around its stakeholders.

80% of our revenue, with the balance comprising extruded products and SECTOR: RealEstate—RealEstate—REITS—Retail

aluminium food containers. Although a portion of rolled products are NUMBER OF EMPLOYEES: 294

exported to regions such as Europe, North America, the Middle East and DIRECTORS: DallamoreAA(ind ne), Dotwana L (ind ne), Ellerine

Asia, the South African market is Hulamin’s priority and proudly showing K(ne), InskipRJD(ind ne), Isaacs R (ind ne), Jasper Z (ind ne),

a significant growth within the business. MokgatlhaTV(ind ne), MzobeBS(ind ne), Noussis S (Chair, ind ne),

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Aluminium Nauta A W (CIO), Wilken M C (CEO), Till B C (CFO)

NUMBER OF EMPLOYEES: 1 866 MAJOR ORDINARY SHAREHOLDERS as at 20 Jun 2024

DIRECTORS: BolesCA(ind ne), KhumaloVN(ne), Maharajh N (ind Government Employees Pension Fund (SA) 20.18%

ne), Mehlomakulu Dr B (ind ne), NgwenyaSP(ne), WatsonGHM(ne), Ninety One SA (Pty) Ltd. 11.16%

Zondi G (alt), Leeuw T P (Chair, ind ne), Gounder M (CEO), Nirghin P Allan Gray 9.29%

(CFO) POSTAL ADDRESS: PO Box 52509, Saxonwold, 2132

MAJOR ORDINARY SHAREHOLDERS as at 28 Jun 2024 MORE INFO: www.sharedata.co.za/sdo/jse/HYP

Industrial Development Corporation of SA Ltd. 29.17% COMPANY SECRETARY: Fundiswa Nkosi

JL Biccard 9.18% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mr. Volker Schuette 6.70% SPONSOR: Java Capital (Pty) Ltd.

POSTAL ADDRESS: PO Box 74, Pietermaritzburg, 3200

MORE INFO: www.sharedata.co.za/sdo/jse/HLM AUDITORS: KPMG Inc.

COMPANY SECRETARY: Luvivi (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. HYP Ords no par value 500 000 000 380 399 133

SPONSOR: Questco (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: Ernst & Young Inc. Ords no par value Ldt Pay Amt Scr/100

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 69 31 Oct 23 8 Nov 23 299.30 12.47

HLM Ords 10c ea 800 000 000 324 318 436 Final No 68 1 Nov 22 8 Nov 22 293.64 -

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul24 Avg 6m shares p.w., R191.3m(86.7% p.a.)

Ords 10c ea Ldt Pay Amt REIV 40 Week MA HYPROP

Final No 9 9 Apr 19 15 Apr 19 18.00

9792

Final No 8 19 Mar 18 26 Mar 18 15.00

LIQUIDITY: Jul24 Avg 1m shares p.w., R4.5m(22.1% p.a.) 8127

INDM 40 Week MA HULAMIN

6462

1199

4797

977

3132

755

1467

2019 | 2020 | 2021 | 2022 | 2023 | 2024

533

FINANCIAL STATISTICS

310 (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final Final Final

88 NetRent/InvInc 1 306 2 446 1 737 1 531 1 885

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Total Inc 1 345 2 512 1 843 1 636 2 138

FINANCIAL STATISTICS

(R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 Attrib Inc 190 1 521 1 345 - 812 - 3 402

Final Final Final(rst) Final(rst) Final(rst) TotCompIncLoss - 66 2 329 1 554 - 977 - 3 500

Turnover 13 796 15 930 13 015 8 549 10 709 Ord UntHs Int 22 301 22 700 20 814 19 357 19 346

Op Inc 532 530 538 - 82 - 1 421 FixedAss/Prop 35 395 34 429 31 922 21 660 24 081

Tot Curr Ass 1 874 1 492 1 552 908 1 671

NetIntPd(Rcvd) 147 91 55 37 48

Att Inc 272 300 591 - 240 - 1 205 Total Ass 39 925 39 871 37 276 26 878 28 960

TotCompIncLoss 291 309 588 - 220 - 1 158 Tot Curr Liab 3 612 6 424 7 770 3 088 5 158

Fixed Ass 1 250 1 037 907 813 814 PER SHARE STATISTICS (cents per share)

Inv & Loans - - - 59 - HEPS-C (ZARc) 111.30 393.90 442.10 327.70 410.70

Tot Curr Ass 4 652 4 933 4 618 3 452 3 180 DPS (ZARc) - 299.30 293.64 336.53 375.00

Ord SH Int 3 539 3 233 2 923 2 326 2 537 NAV PS (ZARc) 5 877.00 6 339.00 6 088.00 6 296.00 7 609.00

LT Liab 256 255 248 252 276 3 Yr Beta 0.07 0.46 1.54 1.62 1.45

Tot Curr Liab 2 453 2 833 2 710 1 924 1 413 Price Prd End 3 111 3 071 3 319 2 650 2 239

Price High 3 377 3 876 3 903 3 399 7 391

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 88.00 99.00 182.00 - 71.00 - 76.00 Price Low 2 524 2 860 2 397 1 460 1 447

NAV PS (ZARc) 1 147.04 1 048.01 947.46 754.14 799.72 DPS (ZARc) - - - 336.53 -

3 Yr Beta 0.92 1.87 2.06 1.48 1.06 RATIOS

Price High 350 545 474 231 490 RetOnSH Funds - 0.43 6.58 6.47 - 4.34 - 18.28

Price Low 240 205 178 85 185 RetOnTotAss 6.57 5.92 4.76 6.08 7.38

Price Prd End 290 312 460 225 230 Debt:Equity 0.65 0.61 0.63 0.29 0.36

RATIOS OperRetOnInv 7.38 7.10 5.44 7.16 8.33

Ret on SH Fnd 7.68 9.27 20.23 - 10.29 - 47.47 OpInc:Turnover 56.07 55.91 55.65 55.04 60.76

Oper Pft Mgn 3.86 3.33 4.13 - 0.95 - 13.27

D:E 0.35 0.36 0.36 0.45 0.25

Current Ratio 1.90 1.74 1.70 1.79 2.25

127