Page 128 - shbh24_complete

P. 128

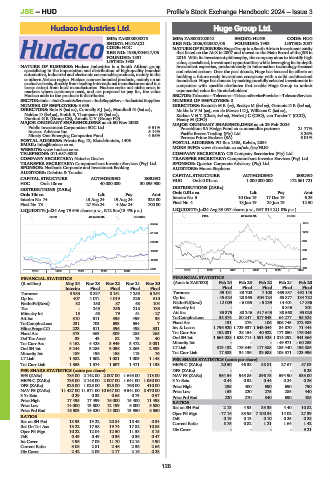

JSE – HUD Profile’s Stock Exchange Handbook: 2024 – Issue 3

Hudaco Industries Ltd. Huge Group Ltd.

HUD HUG

ISIN: ZAE000003273 ISIN: ZAE000102042 SHORT: HUGE CODE: HUG

SHORT: HUDACO REG NO: 2006/023587/06 FOUNDED: 1993 LISTED: 2007

CODE: HDC NATURE OF BUSINESS: Huge Group is a South African investment entity

REG NO: 1985/004617/06 that listed on the AltX in 2007 and moved to the Main Board of the JSE in

FOUNDED: 1891 2016. With its investment philosophy, the company aims to identify high

LISTED: 1985 value, specialised, investment opportunities while leveraging its in-depth

NATURE OF BUSINESS: Hudaco Industries is a South African group investment expertise, predominantly in information technology-focused

specialising in the importation and distribution of high-quality branded and related sectors. Over the past decade, Huge has focused its efforts on

automotive, industrial and electronic consumable products, mainly in the building a future-ready investment ecosystem with a solid architectural

southern African region. Hudaco sources branded products, mainly on an foundation. Huge has done so by making carefully selected investments in

exclusive basis, directly from leading international manufacturers and to a

lesser extent from local manufacturers. Hudaco seeks out niche areas in companies with specific attributes that enable Huge Group to unlock

markets where customers need, and are prepared to pay for, the value exponential value for its stakeholders.

Hudaco adds to the products it distributes. SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 3 635 DIRECTORS: Beamish M R (ne), Boakye M (ind ne), Gammie D R (ind ne),

DIRECTORS: Bulo B (ind ne), ConnellySJ(ne), Mandindi N (ind ne), Mokholo V M (ne), van de Merwe I D J, Williams C (ind ne),

Naidoo D (ind ne), Smith E, Thompson M (ind ne), Kathan V H T (Chair, ind ne), Herbst J C (CEO), van Tonder T (CCO),

Dunford G R (Group CE), Amoils C V (Group FD) Heraty M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Nov 2023 MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Public Investment Corporation SOC Ltd. 9.51% Praesidium SA Hedge Fund en commandite partners 21.77%

Invesco Advisers Inc. 5.14% Pacific Breeze Trading (Pty) Ltd. 8.26%

Ninety One Emerging Companies Fund 4.55%

POSTAL ADDRESS: Private Bag 13, Elandsfontein, 1406 Peresec Prime Brokers (SA) 6.01%

EMAIL: info@hudaco.co.za POSTAL ADDRESS: PO Box 1585, Kelvin, 2054

WEBSITE: www.hudaco.co.za MORE INFO: www.sharedata.co.za/sdo/jse/HUG

TELEPHONE: 011-657-5000 COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

COMPANY SECRETARY: Natasha Davies TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking AUDITORS: Moore Stephens

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED HUG Ords 0.01c ea 1 000 000 000 172 561 721

HDC Ords 10c ea 40 000 000 30 895 980

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt Ords 0.01c ea Ldt Pay Amt

Interim No 74 13 Aug 24 19 Aug 24 325.00 Interim No 5 10 Dec 19 17 Dec 19 6.25

Final No 73 27 Feb 24 4 Mar 24 700.00 Final No 4 18 Jun 19 24 Jun 19 12.50

LIQUIDITY: Jul24 Avg 79 646 shares p.w., R12.8m(13.4% p.a.) LIQUIDITY: Jul24 Avg 33 057 shares p.w., R67 314.2(1.0% p.a.)

FTEL 40 Week MA HUGE

SUPS 40 Week MA HUDACO

38334 1478

1213

31783

25233 948

18682 683

418

12132

5581 153

2019 | 2020 | 2021 | 2022 | 2023 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) May 24 Nov 23 Nov 22 Nov 21 Nov 20 (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Interim Final Final Final Final Final Final Final Final Final

Turnover 3 983 8 897 8 151 7 258 6 254 Turnover 59 131 33 700 7 100 469 857 492 145

Op Inc 407 1 071 1 019 826 510 Op Inc - 45 624 28 965 504 124 65 877 134 782

NetIntPd(Rcvd) 82 150 87 68 104 NetIntPd(Rcvd) - 12 009 - 6 085 - 5 239 14 401 17 856

Tax - 245 256 218 133 Minority Int - - - 3 846 301

Minority Int 15 58 79 51 - 27 Att Inc 35 375 80 246 517 643 38 568 95 023

Att Inc 310 611 596 499 36 TotCompIncLoss 35 374 80 247 517 643 64 277 95 324

TotCompIncLoss 231 703 693 554 7 Fixed Ass 191 276 106 306 745 272 983

Hline Erngs-CO 223 611 596 498 331 Inv & Loans 1 796 920 1 729 337 1 643 044 84 870 71 444

Fixed Ass 373 363 309 285 265 Tot Curr Ass 152 031 28 154 40 922 177 850 176 045

Def Tax Asset 33 43 82 75 40 Ord SH Int 1 664 088 1 628 714 1 551 925 1 014 292 941 366

Tot Curr Ass 4 162 4 428 3 949 3 472 3 031 Minority Int - - - - 49 971 - 60 253

Ord SH Int 3 244 3 285 3 096 2 863 2 593 LT Liab 319 132 175 349 117 388 185 440 196 885

Minority Int 189 196 158 113 76 Tot Curr Liab 17 383 34 136 33 688 108 371 123 996

LT Liab 1 582 1 602 1 081 1 003 1 148 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 1 353 1 574 1 607 1 471 1 138 HEPS-C (ZARc) 20.50 46.38 58.81 27.67 57.03

PER SHARE STATISTICS (cents per share) DPS (ZARc) - - - - 6.25

EPS (ZARc) 785.00 2 142.00 2 007.00 1 643.00 113.00 NAV PS (ZARc) 964.54 943.85 896.75 594.90 533.00

HEPS-C (ZARc) 785.00 2 148.00 2 007.00 1 641.00 1 050.00 3 Yr Beta 0.44 0.52 0.44 0.24 0.26

DPS (ZARc) 325.00 1 025.00 925.00 760.00 410.00 Price High 295 400 690 690 790

NAV PS (ZARc) 11 427.00 11 571.00 10 647.00 9 541.00 8 470.00 Price Low 153 220 275 285 440

3 Yr Beta 0.29 0.33 0.65 0.73 0.57 Price Prd End 220 270 340 690 485

Price High 17 495 17 499 16 000 15 400 11 498 RATIOS

Price Low 14 000 13 800 12 199 6 800 5 580 Ret on SH Fnd 2.13 4.93 33.35 4.40 10.82

Price Prd End 16 503 16 320 14 000 13 950 8 550 Oper Pft Mgn - 77.16 85.95 7 100.34 14.02 27.39

RATIOS D:E 0.19 0.13 0.10 0.25 0.28

Ret on SH Fnd 18.93 19.22 20.84 18.48 0.34

Ret On Tot Ass 13.22 17.58 19.74 17.82 10.85 Current Ratio 8.75 0.82 1.21 1.64 1.42

Oper Pft Mgn 10.22 12.04 12.50 11.38 8.15 Div Cover - - - - 9.21

D:E 0.49 0.49 0.36 0.36 0.47

Int Cover 4.96 7.09 11.70 12.15 4.90

Current Ratio 3.08 2.81 2.46 2.36 2.66

Div Cover 2.42 2.09 2.17 2.16 0.28

126