Page 134 - shbh24_complete

P. 134

JSE – JUB Profile’s Stock Exchange Handbook: 2024 – Issue 3

POSTALADDRESS:Suite110,PrivateBagX3041,Paarl,WesternCape,7620

Jubilee Metals Group plc MORE INFO: www.sharedata.co.za/sdo/jse/KAL

JUB COMPANY SECRETARY: KAL Corporate Services (Pty) Ltd.

ISIN: GB0031852162 SHORT: JUBILEE CODE: JBL TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 4459850 FOUNDED: 2002 LISTED: 2006 SPONSOR: PSG Capital (Pty) Ltd.

NATURE OF BUSINESS: Jubilee Metals Group plc is an industry leading

metal recovery business focussed on the retreatment and metals recovery AUDITORS: PwC Inc.

from mine tailings, waste, slag, slurry and other secondary materials CAPITAL STRUCTURE AUTHORISED ISSUED

generated from mining operations. KAL Ords no par val 1 000 000 000 74 319 837

SECTOR: AltX DISTRIBUTIONS [ZARc]

NUMBER OF EMPLOYEES: 923 Ords no par val Ldt Pay Amt

DIRECTORS: Kerr T (ind ne), Kirby Dr E, Molefe C (ne), Taylor N (ne), Interim No 13 4 Jun 24 10 Jun 24 54.00

de Sousa-OliveiraMLS (Chair, ne, Ptgl), Phosa Dr M (Vice Chair, ne),

Coetzer L (CEO) Final No 12 13 Feb 24 19 Feb 24 130.00

MAJOR ORDINARY SHAREHOLDERS as at 10 Jun 2024 LIQUIDITY: Jul24 Avg 238 440 shares p.w., R9.6m(16.7% p.a.)

Slater Investments 12.24%

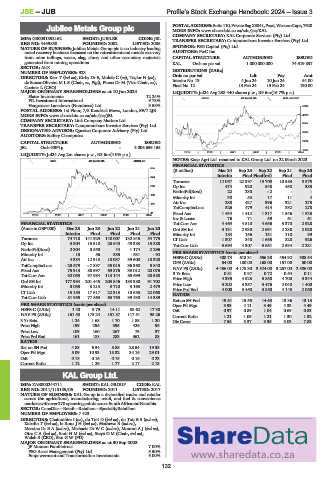

FIL Investment International 9.73% GERE 40 Week MA KAL GROUP

Hargreaves Lansdown (Nominees) Ltd. 9.58% 5500

POSTAL ADDRESS: 1st Floor, 7/8 Kendrick Mews, London, SW7 2JE

MORE INFO: www.sharedata.co.za/sdo/jse/JBL 4679

COMPANY SECRETARY: Link Company Matters Ltd.

3857

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd.

3036

AUDITORS: Saffery Champness

CAPITAL STRUCTURE AUTHORISED ISSUED 2214

JBL Ords GBP1p - 3 005 659 155

1393

2019 | 2020 | 2021 | 2022 | 2023 | 2024

LIQUIDITY: Jul24 Avg 2m shares p.w., R3.6m(4.0% p.a.)

NOTES: Kaap Agri Ltd. renamed to KAL Group Ltd. on 22 March 2023

MINI 40 Week MA JUBILEE

FINANCIAL STATISTICS

395

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

Interim Final Final(rst) Final Final

324

Turnover 12 057 22 397 15 700 10 583 8 575

253 Op Inc 474 920 548 458 385

NetIntPd(Rcvd) 22 238 - 2 - -

183 Minority Int 38 53 17 11 4

Att Inc 288 427 396 321 275

112

TotCompIncLoss 326 479 414 332 278

41 Fixed Ass 1 434 1 412 1 317 1 546 1 526

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Inv & Loans 76 71 59 61 61

FINANCIAL STATISTICS Tot Curr Ass 4 464 4 510 4 656 3 370 2 928

(Amts in GBP’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Ord SH Int 3 131 2 930 2 691 2 288 2 028

Interim Final Final Final Final Minority Int 184 156 131 110 99

Turnover 74 718 141 929 140 007 132 845 54 775 LT Liab 1 307 840 1 665 820 926

Op Inc 3 804 15 518 25 643 45 383 15 888 Tot Curr Liab 3 694 4 307 3 851 2 594 2 221

NetIntPd(Rcvd) 2 304 3 550 44 1 174 2 296 PER SHARE STATISTICS (cents per share)

Minority Int - 15 56 335 - 631 - 92 HEPS-C (ZARc) 408.74 618.31 556.30 454.92 388.54

Att Inc 4 384 12 913 18 037 39 600 18 320 DPS (ZARc) 54.00 180.00 168.00 151.00 50.00

TotCompIncLoss - 23 579 - 7 897 35 015 36 368 5 840 NAV PS (ZARc) 4 466.00 4 178.30 3 824.00 3 257.00 2 886.00

Fixed Ass 75 913 88 697 69 876 33 012 20 076 3 Yr Beta 0.81 0.97 0.72 0.64 0.11

Tot Curr Ass 92 053 97 984 113 144 85 699 30 580 Price High 4 395 4 525 5 850 4 700 3 344

Ord SH Int 177 994 201 445 203 846 133 380 91 702 Price Low 3 202 3 357 3 476 2 040 1 400

Minority Int 3 085 3 213 3 710 3 163 2 479 Price Prd End 4 000 3 450 3 850 4 145 2 050

LT Liab 15 153 17 617 22 313 18 685 22 068 RATIOS

Tot Curr Liab 81 955 77 863 63 753 39 438 14 389

Ret on SH Fnd 19.61 15.55 14.63 13.86 13.13

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 3.93 4.11 3.49 4.33 4.49

HEPS-C (ZARc) 1.40 9.79 14.11 38.62 17.30 D:E 0.97 0.89 1.04 0.69 0.83

NAV PS (ZARc) 161.53 175.24 151.87 117.51 95.26 Current Ratio 1.21 1.05 1.21 1.30 1.32

3 Yr Beta 1.24 1.68 1.70 1.85 1.20 Div Cover 7.58 3.37 3.35 3.03 7.83

Price High 199 296 395 426 95

Price Low 109 160 267 73 37

Price Prd End 161 188 283 362 83

RATIOS

Ret on SH Fnd 4.83 6.34 8.85 28.54 19.35

Oper Pft Mgn 5.09 10.93 18.32 34.16 29.01

D:E 0.18 0.16 0.15 0.16 0.23

Current Ratio 1.12 1.26 1.77 2.17 2.13

KAL Group Ltd.

KAL

ISIN: ZAE000244711 SHORT: KAL GROUP CODE: KAL

REG NO: 2011/113185/06 FOUNDED: 2011 LISTED: 2017

NATURE OF BUSINESS: KAL Group is a diversified trader and retailer

across the agricultural, manufacturing, retail, and fuel & convenience

marketswithover270 operatingpointsacrossSouthAfricaandNamibia.

SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

NUMBER OF EMPLOYEES: 7 423

DIRECTORS: Chalumbira I (ne), du Toit D (ind ne), du ToitBS(ind ne),

Kabalin T (ind ne), le RouxJH(ind ne), Mathews B (ind ne),

Messina DrEA(ind ne), Michaels DrWC(ind ne), MoutonAJ(ind ne),

OttoCA(ind ne), SmitHM(ind ne), Steyn G M (Chair, ind ne),

Walsh S (CEO), Sim G W (FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023

JF Mouton Familietrust 7.00%

PSG Asset Management (Pty) Ltd. 5.50%

Empowerment and Transformation Investments 5.00%

132