Page 215 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 215

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - YEB

YeboYethu Ltd. York Timber Holdings Ltd.

ISIN: ZAE000218483 SHORT: YEBOYETHU CODE: YYLBEE ISIN: ZAE000133450 SHORT: YORK CODE: YRK

REG NO: 2008/014734/06 FOUNDED: 2008 LISTED: 2016 REG NO: 1916/004890/06 FOUNDED: 1916 LISTED: 1946

NATURE OF BUSINESS: YeboYethu (RF) Ltd. (‘YeboYethu’) was NATURE OF BUSINESS: York Timber Holdings Ltd. is a JSE-listed

incorporated on 19 June 2008 under the laws of the Republic forestry company intent on creating value for all its stakeholders.

of South Africa. YeboYethu Investment Company (RF) (Pty) Ltd. Since its incorporation in 1916, York has grown into a modern,

(‘YeboYethu Investment’) was created on 24 April 2018 as a integrated forestry group.

wholly-owned subsidiary of YeboYethu for the purpose of holding SECTOR: Basic Materials--Basic Resrcs--Ind Metals--Forestry

Vodacom Group Ltd. (‘Vodacom Group’) shares, which shares are NUMBER OF EMPLOYEES: 0

held as security for the borrowings incurred from a consortium of DIRECTORS: Stoltz G (CEO & FD), Brink A W (ind ne), Dhlamini L (ind ne),

funders. The principal activities of the company and the Group as Mbanyele-Ntshinga H (ind ne), Nyanteh M (ind ne), Solomons A (ne),

a whole are to:• carry on business of acquiring and holding shares van der Veen A (alt), Zetler A (ne), Siyotula N (Chair, ind ne),

in Vodacom Group; and• receive and distribute dividends and other Barnard S (CFO)

distributions received by it pursuant to its holding in Vodacom MAJOR ORDINARY SHAREHOLDERS as at 22 Oct 2024

Group. Legae Peresec 20.43%

SECTOR: Fins--FinServcs--OpEnd&Miscel Inv Veh--OpEnd&Miscel Inv Veh Industrial Development Corporation 20.07%

NUMBER OF EMPLOYEES: 0 A2 Investment Partners (Pty) Ltd. 19.47%

DIRECTORS: Conrad A (ind ne), Fuchs O (ne), Hall A (ind ne), Kobue K POSTAL ADDRESS: PO Box 1191, Sabie, 1260

(ne), Lucht U (ne), Roji F (ind ne), Silwanyana B (ind ne), Walljee T (ne), MORE INFO: www.sharedata.co.za/sdo/jse/YRK

Mokgatlha T V (Chair, ind ne) COMPANY SECRETARY: Kilgetty Statutory Services (SA) (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Royal Bafokeng Resources Holding (Pty) Ltd. 28.56% SPONSOR: One Capital

Vodacom Siyanda Employee Trust 21.54% AUDITORS: Deloitte & Touche Inc.

MIC Investment Holdings (Pty) Ltd. 11.33% CAPITAL STRUCTURE Authorised Issued

POSTAL ADDRESS: Private Bag X9904, Sandton, 2146 YRK Ords 5c ea 600 000 000 474 097 739

MORE INFO: www.sharedata.co.za/sdo/jse/YYLBEE

COMPANY SECRETARY: Vodacom Group Ltd. DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Ords 5c ea Ldt Pay Amt

SPONSOR: Tamela Holdings (Pty) Ltd. Interim 18 Nov 05 28 Nov 05 30.00

AUDITORS: Ernst & Young Special 18 Nov 05 28 Nov 05 70.00

CAPITAL STRUCTURE Authorised Issued LIQUIDITY: Jul25 Avg 234 314 shares p.w., R507 278.9(2.6% p.a.)

YYLBEE Ords no par 100 000 000 52 915 960

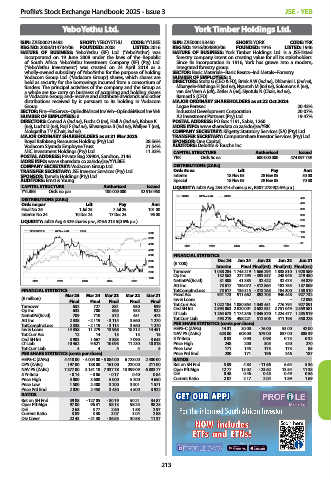

YORK 40 Week MA IDMS

DISTRIBUTIONS [ZARc] 450

Ords no par Ldt Pay Amt 400

Final No 25 1 Jul 25 7 Jul 25 101.00 350

Interim No 24 10 Dec 24 17 Dec 24 96.00 300

LIQUIDITY: Jul25 Avg 6 529 shares p.w., R156 213.5(0.6% p.a.) 250

200

YEBOYETHU 40 Week MA FINA

5500 150

5000 100

4500 50

2021 2022 2023 2024 2025

4000

3500 FINANCIAL STATISTICS

3000 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

(R ’000)

2500 Interim Final Final(rst) Final(rst) Final(rst)

2000 Turnover 1 038 284 1 745 219 1 666 294 1 838 810 1 928 589

Op Inc 132 562 227 295 - 393 537 248 946 219 480

1500

2021 2022 2023 2024 2025 NetIntPd(Rcvd) 31 308 41 385 32 422 32 473 44 829

Att Inc 73 617 136 072 - 312 864 182 755 137 069

FINANCIAL STATISTICS TotCompIncLoss 73 617 136 315 - 313 265 184 300 138 510

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Fixed Ass 941 173 911 662 892 703 946 448 927 732

(R million) Inv & Loans - - - - 12 093

Final Final Final Final Final

Turnover 652 727 881 950 939 Tot Curr Ass 1 022 184 1 080 864 1 043 451 776 794 927 891

Op Inc 633 700 865 933 922 Ord SH Int 2 893 063 2 820 001 2 682 931 2 751 049 2 559 581

NetIntPd(Rcvd) 709 710 572 451 473 LT Liab 1 264 673 1 174 346 1 045 370 1 224 477 1 235 919

Att Inc 2 338 - 2 119 - 3 114 3 560 1 270 Tot Curr Liab 493 219 498 221 512 506 411 198 550 228

TotCompIncLoss 2 338 - 2 119 - 3 114 3 560 1 270 PER SHARE STATISTICS (cents per share)

Inv & Loans 14 358 11 279 13 968 18 312 14 451 HEPS-C (ZARc) 14.31 30.00 - 76.00 53.00 42.00

Tot Curr Ass 12 14 13 13 15 NAV PS (ZARc) 623.00 608.00 579.00 857.00 805.39

Ord SH Int 3 903 1 667 3 883 7 090 3 643 3 Yr Beta 0.83 0.90 0.98 0.73 0.32

LT Liab 10 462 9 621 10 093 11 230 10 818 Price High 248 200 305 420 270

Tot Curr Liab 4 4 4 4 5 Price Low 171 145 175 173 85

PER SHARE STATISTICS (cents per share) Price Prd End 230 171 196 246 187

HEPS-C (ZARc) 4 418.00 - 4 004.00 - 5 884.00 6 728.00 2 400.00 RATIOS

DPS (ZARc) 197.00 188.00 161.00 220.00 211.00 Ret on SH Fnd 5.09 4.83 - 11.66 6.64 5.36

NAV PS (ZARc) 7 377.00 3 151.18 7 337.78 13 399.09 6 883.77 Oper Pft Mgn 12.77 13.02 - 23.62 13.54 11.38

3 Yr Beta - 0.14 - 0.06 - 0.17 0.40 0.84 D:E 0.48 0.46 0.45 0.49 0.56

Price High 3 000 3 600 5 000 5 200 4 650 Current Ratio 2.07 2.17 2.04 1.89 1.69

Price Low 1 500 2 400 3 200 3 901 1 571

Price Prd End 2 020 2 450 3 430 4 500 3 922

RATIOS

Ret on SH Fnd 59.88 - 127.05 - 80.19 50.21 34.87

Oper Pft Mgn 97.00 96.31 98.13 98.25 98.25

D:E 2.68 5.77 2.60 1.58 2.97

Current Ratio 3.09 3.30 3.07 3.04 2.88

Div Cover 22.43 - 21.30 - 36.55 30.58 11.37

213