Page 214 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 214

JSE - WIL Profile’s Stock Exchange Handbook: 2025 - Issue 3

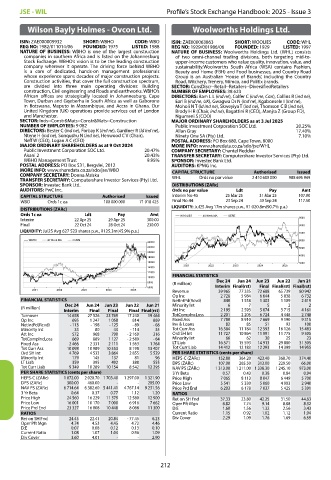

Wilson Bayly Holmes - Ovcon Ltd. Woolworths Holdings Ltd.

ISIN: ZAE000009932 SHORT: WBHO CODE: WBO ISIN: ZAE000063863 SHORT: WOOLIES CODE: WHL

REG NO: 1982/011014/06 FOUNDED: 1975 LISTED: 1988 REG NO: 1929/001986/06 FOUNDED: 1929 LISTED: 1997

NATURE OF BUSINESS: WBHO is one of the largest construction NATURE OF BUSINESS: Woolworths Holdings Ltd. (WHL) consists

companies in southern Africa and is listed on the Johannesburg of two omni-channel trading divisions, both targeting mid-to-

Stock Exchange. WBHO’s vision is to be the leading construction upper-income customers who value quality, innovation, value, and

company wherever it operate. The driving force behind WBHO sustainability.Woolworths South Africa (WSA) contains Fashion,

is a core of dedicated, hands-on management professionals Beauty and Home (FBH) and Food businesses, and Country Road

whose experience spans decades of major construction projects. Group is an Australian ‘House of Brands’, including the Country

Construction activities, that cover the full construction spectrum, Road, Witchery, Trenery, Mimco, and Politix brands.

are divided into three main operating divisions: Building SECTOR: ConsDiscr--Retail--Retailers--DiversifiedRetailers

construction, Civil engineering and Roads and earthworks. WBHO’s NUMBER OF EMPLOYEES: 38 623

African offices are strategically located in Johannesburg, Cape DIRECTORS: Bam L L (ind ne), Colfer C (ind ne, Can), Collins R (ind ne),

Town, Durban and Gqeberha in South Africa as well as Gaborone Earl B (ind ne, UK), Gwagwa Dr N (ind ne), Kgaboesele I (ind ne),

in Botswana, Maputo in Mozambique, and Accra in Ghana. Our Moholi N T (ld ind ne), Skweyiya T (ind ne), Thomson C B (ind ne),

United Kingdom (UK) operations provide services out of London Brody H R (Chair, ind ne), Bagattini R (CEO), Manjra Z (Group FD),

and Manchester. Ngumeni S (COO)

SECTOR: Inds--Constr&Mats--Constr&Mats--Construction MAJOR ORDINARY SHAREHOLDERS as at 3 Jul 2025

NUMBER OF EMPLOYEES: 9 082 Public Investment Corporation SOC Ltd. 20.25%

DIRECTORS: Bester C (ind ne), Forbay K (ind ne), Gardiner R (ld ind ne), Allan Gray 17.40%

Ntene H (ind ne), Sonqushu N (ind ne), Henwood C V (Chair), Ninety One SA (Pty) Ltd. 7.10%

Neff W (CEO), Logan A C (CFO) POSTAL ADDRESS: PO Box 680, Cape Town, 8000

MAJOR ORDINARY SHAREHOLDERS as at 9 Oct 2024 MORE INFO: www.sharedata.co.za/sdo/jse/WHL

Public Investment Corporation SOC Ltd. 20.47% COMPANY SECRETARY: Chantel Reddiar

Akani 2 20.43% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WBHO Management Trust 9.95% SPONSOR: Investec Bank Ltd.

POSTAL ADDRESS: PO Box 531, Bergvlei, 2012 AUDITORS: KPMG Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/WBO CAPITAL STRUCTURE Authorised Issued

COMPANY SECRETARY: Donna Msiska

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. WHL Ords no par value 2 410 600 000 988 695 949

SPONSOR: Investec Bank Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: PwC Inc. Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE Authorised Issued Interim No 45 25 Mar 25 31 Mar 25 107.00

WBO Ords 1c ea 100 000 000 71 018 425 Final No 44 23 Sep 24 30 Sep 24 117.50

LIQUIDITY: Jul25 Avg 17m shares p.w., R1 020.8m(90.7% p.a.)

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt WOOLIES 40 Week MA GERE

Interim 22 Apr 25 29 Apr 25 300.00 9000

Final 22 Oct 24 28 Oct 24 230.00 8000

LIQUIDITY: Jul25 Avg 627 523 shares p.w., R125.3m(45.9% p.a.) 7000

WBHO 40 Week MA CONM 6000

24000

22000 5000

20000

4000

18000

16000 3000

2021 2022 2023 2024 2025

14000

12000

10000 FINANCIAL STATISTICS

8000 (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

6000 Interim Final(rst) Final Final(rst) Final(rst)

2021 2022 2023 2024 2025 Revenue 39 965 77 335 72 688 65 739 80 942

Op Inc 2 726 5 984 6 644 5 838 6 732

FINANCIAL STATISTICS NetIntPd(Rcvd) 840 1 558 1 303 1 109 2 419

(R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Minority Int 6 7 5 2 2

Interim Final Final Final Final(rst) Att Inc 2 195 2 593 5 074 3 715 4 161

Turnover 14 658 27 526 23 769 17 240 19 464 TotCompIncLoss 2 201 2 205 6 724 4 448 2 748

Op Inc 695 1 247 1 058 814 869 Fixed Ass 7 780 8 910 7 669 9 190 9 315

NetIntPd(Rcvd) - 113 - 198 - 125 - 89 - 68 Inv & Loans 82 85 51 92 100

Minority Int 33 80 44 - 114 35 Tot Curr Ass 16 584 11 184 12 593 16 126 15 483

Att Inc 572 968 790 - 2 160 316 Ord SH Int 11 727 10 864 11 991 11 775 9 305

TotCompIncLoss 669 889 1 127 - 2 589 - 64 Minority Int 66 62 30 25 23

Fixed Ass 2 466 2 331 2 111 1 563 1 764 LT Liab 16 571 15 593 14 913 29 880 31 305

Tot Curr Ass 10 098 10 989 10 553 8 198 13 407 Tot Curr Liab 14 412 12 183 12 293 14 399 14 955

Ord SH Int 4 769 4 533 3 864 2 855 5 529 PER SHARE STATISTICS (cents per share)

Minority Int 179 145 137 81 96 HEPS-C (ZARc) 152.80 364.20 423.40 368.70 374.40

LT Liab 359 395 492 388 555 DPS (ZARc) 107.00 265.50 313.00 229.50 66.00

Tot Curr Liab 9 349 10 289 10 154 8 542 12 295 NAV PS (ZARc) 1 313.00 1 211.00 1 338.30 1 245.10 973.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.57 0.43 0.38 0.84 0.94

HEPS-C (ZARc) 1 072.00 2 020.70 1 703.40 1 297.00 1 321.90 Price High 7 065 8 113 8 047 6 449 5 700

DPS (ZARc) 300.00 460.00 - - 205.00 Price Low 5 541 5 330 5 060 4 903 2 940

NAV PS (ZARc) 6 714.64 6 382.60 5 441.41 4 767.14 9 231.56 Price Prd End 6 203 6 178 7 037 5 425 5 391

3 Yr Beta 0.64 0.37 0.77 1.12 1.20 RATIOS

Price High 24 560 16 229 11 379 12 580 12 900 Ret on SH Fnd 37.33 23.80 42.25 31.50 44.63

Price Low 16 001 10 170 7 000 6 916 7 662 Oper Pft Mgn 6.82 7.74 9.14 8.88 8.32

Price Prd End 23 327 16 008 10 448 8 088 11 300 D:E 1.60 1.56 1.32 2.56 3.43

RATIOS Current Ratio 1.15 0.92 1.02 1.12 1.04

Ret on SH Fnd 24.45 22.41 20.84 - 77.45 6.23 Div Cover 2.29 1.09 1.76 1.69 6.59

Oper Pft Mgn 4.74 4.53 4.45 4.72 4.46

D:E 0.07 0.08 0.12 0.13 0.10

Current Ratio 1.08 1.07 1.04 0.96 1.09

Div Cover 3.60 4.01 - - 2.90

212