Page 216 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 216

JSE - ZED Profile’s Stock Exchange Handbook: 2025 - Issue 3

Zeda Ltd. Zeder Investments Ltd.

ISIN: ZAE000315768 SHORT: ZEDA CODE: ZZD ISIN: ZAE000088431 SHORT: ZEDER CODE: ZED

REG NO: 2022/493042/06 FOUNDED: 2022 LISTED: 2022 REG NO: 2006/019240/06 FOUNDED: 2006 LISTED: 2006

NATURE OF BUSINESS: Zeda Ltd. (“Zeda” or “the Group”) is a leading NATURE OF BUSINESS: Zeder is an investor in the broad agribusiness

integrated mobility solutions provider in sub-Saharan Africa. and related industries. The company listed on the Johannesburg

Zeda is listed on the stock exchange operated by the JSE Ltd. Its Stock Exchange on 6 December 2006 and our underlying

headquarters are in Johannesburg, South Africa, with additional investment portfolio was valued at approximately R2.3bn as at 28

operations in 10 sub-Saharan African countries. Zeda operates the February 2025.

widely recognised Avis and Budget global brands under a long- SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs--AssMgrs&Custodians

term licence agreement with the Avis Budget Group (“ABG”). NUMBER OF EMPLOYEES: 2

SECTOR: ConsDiscr--ConsProducts&Servcs--ConsServcs--RentLease DIRECTORS: le Roux J (CEO & FD), Cassiem S (ind ne), Greeff W L (ne),

NUMBER OF EMPLOYEES: 2 004 Mjoli-Mncube N S (ld ind ne), Mouton P J (ne), Otto C A (Chair, ind ne)

DIRECTORS: Kakana X (ind ne), Miya Y (ind ne), Motsei Dr N (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

Roets M (ind ne), Wilson D G (ind ne), Bam L L (Chair, ind ne), Ganda PSG Financial Services Ltd. 48.60%

R (CEO), Mngomezulu S (Interim Chair, ind ne), Ntshiza T (CFO) Peresec Prime Brokers (Pty) Ltd. 10.70%

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024 Coronation Asset Management Holdings (Pty) Ltd. 6.80%

Zahid Tractor & Heavy Machinery Ltd. 19.02% POSTAL ADDRESS: PO Box 7403, Stellenbosch, 7599

Zarclear Securities Lending (Pty) Ltd. 7.42% MORE INFO: www.sharedata.co.za/sdo/jse/ZED

Abax Investments (Pty) Ltd. 5.33% COMPANY SECRETARY: Zeder Corporate Services (Pty) Ltd.

POSTAL ADDRESS: P.O. Box 221, Isando, Johannesburg, 1600 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/ZZD SPONSOR: BSM Sponsors (Pty) Ltd.,PSG Capital (Pty) Ltd.

COMPANY SECRETARY: Chioneso Sakutukwa AUDITORS: Deloitte & Touche Inc.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: Nedbank Ltd. ZED Ords no par 3 000 000 000 1 540 160 354

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [ZARc]

Ldt

Pay

Amt

ZZD Ords no par value 2 000 000 000 189 641 787 Ords no par 17 Dec 24 23 Dec 24 11.00

Special No 10

DISTRIBUTIONS [ZARc] Special No 9 19 Nov 24 25 Nov 24 20.00

Ords no par value Ldt Pay Amt LIQUIDITY: Jul25 Avg 3m shares p.w., R4.4m(9.2% p.a.)

Interim No 3 8 Jul 25 14 Jul 25 55.00

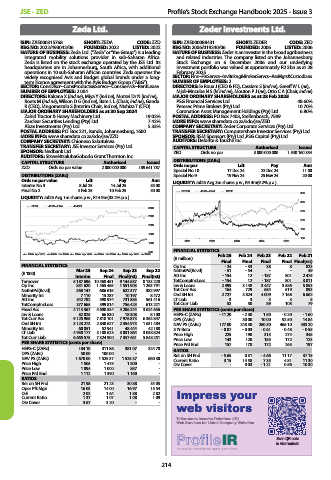

Final No 2 4 Feb 25 10 Feb 25 50.00 ZEDER 40 Week MA GENF

350

LIQUIDITY: Jul25 Avg 1m shares p.w., R14.9m(33.2% p.a.)

300

ZEDA 40 Week MA JS4021

3000

250

2500

200

2000

150

1500

100

2021 2022 2023 2024 2025

1000

FINANCIAL STATISTICS

500

Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 Apr 2025 Jul 2025 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R million) Final Final Final Final Final(rst)

FINANCIAL STATISTICS Op Inc - 24 - 33 38 8 823

Mar 25 Sep 24 Sep 23 Sep 22 NetIntPd(Rcvd) - 51 - 54 - - 49

(R ‘000)

Interim Final Final(rst) Final(rst) Att Inc - 154 12 - 187 801 2 475

Turnover 5 187 696 10 468 451 9 144 637 8 133 228 TotCompIncLoss - 154 12 - 187 801 3 011

Op Inc 831 620 1 465 465 1 551 903 1 263 791 Inv & Loans 2 499 3 148 3 447 3 586 5 853

NetIntPd(Rcvd) 368 147 686 615 622 377 382 997 Tot Curr Ass 164 729 654 519 893

Minority Int 7 110 15 287 10 197 8 472 Ord SH Int 2 727 3 824 4 009 7 168 6 662

Att Inc 342 702 598 974 731 883 561 416 LT Liab 3 3 3 3 5

TotCompIncLoss 377 665 599 814 756 423 613 221 Tot Curr Liab 52 50 89 108 79

Fixed Ass 4 713 367 4 690 534 4 206 244 3 624 656 PER SHARE STATISTICS (cents per share)

Inv & Loans 82 025 66 830 18 308 8 100 HEPS-C (ZARc) - 11.20 - 2.30 1.50 - 0.20 - 1.60

Tot Curr Ass 9 125 965 7 818 101 7 976 873 6 362 847 DPS (ZARc) - 30.00 10.00 92.50 14.84

Ord SH Int 3 123 273 2 840 627 2 354 975 1 631 484 NAV PS (ZARc) 177.00 248.30 260.30 466.10 433.20

Minority Int 60 051 52 941 48 444 42 188 3 Yr Beta - 0.07 - 0.03 - 0.61 - 0.48 - 0.55

LT Liab 4 938 177 3 188 623 3 051 864 3 038 824 Price High 225 190 315 274 345

Tot Curr Liab 6 665 575 7 324 900 7 357 651 5 848 251 Price Low 143 120 155 172 123

PER SHARE STATISTICS (cents per share) Price Prd End 157 178 172 265 197

HEPS-C (ZARc) 184.10 311.86 381.07 324.70 RATIOS

DPS (ZARc) 50.00 100.00 - - Ret on SH Fnd - 5.65 0.31 - 4.66 11.17 37.15

NAV PS (ZARc) 1 670.00 1 525.37 1 525.37 860.30 Current Ratio 3.15 14.58 7.35 4.81 11.30

Price High 1 505 1 475 1 800 - Div Cover - 0.03 - 1.21 0.56 10.30

Price Low 1 094 1 000 857 -

Price Prd End 1 112 1 390 1 160 -

RATIOS

Ret on SH Fnd 21.98 21.23 30.88 34.05

Oper Pft Mgn 16.03 14.00 16.97 15.54

Impress your

D:E 2.02 1.64 1.88 2.82 Impr ess y our

Current Ratio 1.37 1.07 1.08 1.09

Div Cover 3.67 3.20 - -

w e b visitor s

web visitors

Tailor-made Investor Relations (IR)

Web Services for Listed Company Websites

Scan QR code

to visit website

214