Page 142 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 142

JSE – LIB Profile’s Stock Exchange Handbook: 2025 – Issue 1

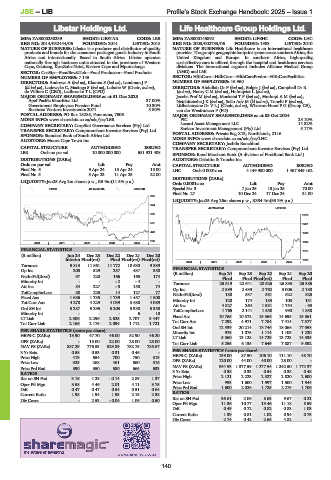

Libstar Holdings Ltd. Life Healthcare Group Holdings Ltd.

LIB LIF

ISIN: ZAE000250239 SHORT: LIBSTAR CODE: LBR ISIN: ZAE000145892 SHORT: LIFEHC CODE: LHC

REG NO: 2014/032444/06 FOUNDED: 2014 LISTED: 2018 REG NO: 2003/002733/06 FOUNDED: 1983 LISTED: 2010

NATURE OF BUSINESS: Libstar is a producer and distributor of quality NATURE OF BUSINESS: Life Healthcare is an international healthcare

products and brands for the consumer packaged goods Industry in South provider.Thegroup’sgeographicfootprintspansacrosssouthernAfrica,the

Africa and internationally. Based in South Africa. Libstar operates United Kingdom and Europe. In southern Africa, high-quality,

nationally through business units situated in the provinces of Western cost-effective care is offered through the hospital and healthcare services

Cape, Gauteng, KwaZulu-Natal, Eastern Cape and Mpumalanga. divisions. The international segment includes Alliance Medical Group

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products (AMG) and LMI.

NUMBER OF EMPLOYEES: 7 145 SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities

DIRECTORS: Andrews A (ind ne), Khanna S (ind ne), Landman J P NUMBER OF EMPLOYEES: 16 960

(ld ind ne), Lodewyks C, Masinga S (ind ne), Luhabe W (Chair, ind ne), DIRECTORS: Abdullah Dr F (ind ne), Bolger J (ind ne), Campbell Dr R

de Villiers C (CEO), Ladbrooke T L (CFO) (ind ne), HenryCM(ind ne), Holmqvist L (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 Jacobs Prof M (ind ne), MoeketsiTP(ind ne), MothupiAM(ind ne),

Apef Pacific Mauritius Ltd. 37.00% NetshitenzheJK(ind ne), Sello Adv M (ld ind ne), Tonelli F (ind ne),

Government Employees Pension Fund 10.30% Litlhakanyane DrVLJ (Chair, ind ne), Wharton-Hood P G (Group CE),

Business Venture Investments 2071 5.80% van der Westhuizen P (FD)

POSTAL ADDRESS: PO Box 15285, Panorama, 7506 MAJOR ORDINARY SHAREHOLDERS as at 03 Oct 2024

MORE INFO: www.sharedata.co.za/sdo/jse/LBR PIC 25.10%

COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd. Lazard Asset Management LLC 14.82%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Sanlam Investment Management (Pty) Ltd. 5.17%

SPONSOR: Standard Bank of South Africa Ltd. POSTAL ADDRESS: Private Bag X13, Northlands, 2116

AUDITORS: Moore Cape Town Inc. MORE INFO: www.sharedata.co.za/sdo/jse/LHC

COMPANY SECRETARY: Joshila Ranchhod

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

LBR Ords no par val 10 000 000 000 681 921 408 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

DISTRIBUTIONS [ZARc] AUDITORS: Deloitte & Touche Inc.

Ords no par val Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 6 9 Apr 24 15 Apr 24 15.00 LHC Ords 0.0001c ea 4 149 980 000 1 467 349 162

Final No 5 3 Apr 23 11 Apr 23 22.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jan25 Avg 2m shares p.w., R5.9m(11.5% p.a.)

Ords 0.0001c ea Ldt Pay Amt

FOOD 40 Week MA LIBSTAR Special No 3 7 Jan 25 13 Jan 25 70.00

Final No 27 10 Dec 24 17 Dec 24 31.00

955

LIQUIDITY: Jan25 Avg 26m shares p.w., R384.4m(93.3% p.a.)

824

40 Week MA LIFEHC

692 2576

561 2261

429 1946

298 1632

2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS 1317

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final(rst) Final Final(rst) Final(rst) 1002

2020 | 2021 | 2022 | 2023 | 2024 |

Turnover 5 813 11 861 11 772 10 630 9 339

Op Inc 208 529 237 437 350 FINANCIAL STATISTICS

NetIntPd(Rcvd) 97 220 166 165 174 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Final Final(rst)

Final

Final

Final

Minority Int - - - 2 - 4 - Turnover 25 519 22 641 20 526 26 885 25 386

Att Inc 84 227 - 5 158 74

TotCompIncLoss 80 225 14 127 77 Op Inc 2 899 2 439 2 762 3 006 2 180

581

537

NetIntPd(Rcvd)

622

825

180

Fixed Ass 1 686 1 735 1 739 1 457 1 508 Minority Int 120 174 183 100 131

Tot Curr Ass 4 278 4 229 4 039 3 688 4 089 Att Inc 4 827 264 1 531 1 754 - 93

Ord SH Int 5 287 5 295 5 203 5 338 5 358 TotCompIncLoss 1 765 2 141 1 550 990 1 858

Minority Int - - - 6 10 Fixed Ass 10 765 10 572 15 566 14 695 15 361

LT Liab 2 306 2 296 2 625 2 707 3 447 Tot Curr Ass 7 292 4 971 7 784 7 414 7 377

Tot Curr Liab 2 166 2 175 2 094 1 712 1 721

Ord SH Int 12 539 20 214 18 746 18 066 17 058

PER SHARE STATISTICS (cents per share) Minority Int 975 1 075 1 114 1 105 1 220

HEPS-C (ZARc) 13.90 47.70 46.00 52.90 46.20 LT Liab 5 560 13 128 14 729 13 723 14 535

DPS (ZARc) - 15.00 22.00 25.00 25.00 Tot Curr Liab 5 255 6 135 7 649 7 887 9 892

NAV PS (ZARc) 887.29 776.53 529.89 782.75 785.67 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.58 0.53 0.31 0.46 - HEPS-C (ZARc) 139.00 87.50 106.10 111.10 48.70

Price High 419 654 700 750 819 DPS (ZARc) 120.00 44.00 40.00 25.00 -

Price Low 325 268 461 560 516 NAV PS (ZARc) 854.53 1 377.59 1 277.54 1 242.50 1 172.37

Price Prd End 390 350 580 665 633 3 Yr Beta 0.38 0.33 0.54 0.38 0.48

RATIOS Price High 2 121 2 223 2 527 2 820 2 600

Ret on SH Fnd 3.16 4.28 - 0.14 2.89 1.37

Price Low 993 1 600 1 597 1 500 1 544

Oper Pft Mgn 3.58 4.46 2.01 4.11 3.75 Price Prd End 1 600 2 026 1 725 2 279 1 706

D:E 0.47 0.47 0.54 0.51 0.64 RATIOS

Current Ratio 1.98 1.94 1.93 2.15 2.38 Ret on SH Fnd 36.61 2.06 8.63 9.67 0.21

Div Cover - 2.53 - 0.04 1.06 0.50

Oper Pft Mgn 11.36 10.77 13.46 11.18 8.59

D:E 0.49 0.72 0.82 0.83 1.03

Current Ratio 1.39 0.81 1.02 0.94 0.75

Div Cover 2.74 0.42 2.65 4.82 -

140