Page 139 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 139

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – KOR

Kore Potash plc Kumba Iron Ore Ltd.

KOR KUM

ISIN: GB00BYP2QJ94 SHORT: KORE CODE: KP2 ISIN: ZAE000085346 SHORT: KUMBA CODE: KIO

REG NO: 10933682 FOUNDED: 2017 LISTED: 2018 REG NO: 2005/015852/06 FOUNDED: 2005 LISTED: 2006

NATURE OF BUSINESS: Kore Potash is an advanced stage mineral NATURE OF BUSINESS: Kumba Iron Ore, a business unit of Anglo

explorationanddevelopment company that is incorporated in Englandand American plc (its largest shareholder), is a single commodity iron ore

Wales and listed on AIM, a market operated by the LondonStock Exchange, minerals company listed on the JSE in South Africa, with a market cap of

the Australian Securities Exchange (ASX) and the JSE in South Africa. R198 billion (as at 31 December 2023). Kumba competes in the global iron

Through the developmentofthe Sintoukolapotashbasininthe Republic of ore market through its premium product delivery, with its business

Congo (RoC), Kore Potash is working to bring a number of globally structured around its two open-pit mines in the Northern Cape province of

significant potash deposits into production. Focus is on two high-grade South Africa.

projects: Kola and DX. SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining NUMBER OF EMPLOYEES: 11 612

NUMBER OF EMPLOYEES: 21 DIRECTORS: Bomela M S (ld ind ne), French S G (ne), Jeawon A (ind ne),

DIRECTORS: Kumar MehtaAK(ne), Netherway D (snr ind ne), Jenkins M A (ind ne), Langa-Royds N B (ind ne), Mkhwanazi T M (ne),

Pulinx W (ne), Trollip J (ne), Hathorn D A (Chair, ne) Mokhesi N V (ind ne), NtsalubaSS(ind ne), Tsele M J (ne), Walker M,

MAJOR ORDINARY SHAREHOLDERS as at 01 Mar 2024 Goodlace T P (Chair, ld ind ne), Zikalala N D (CEO), Mazarura B A (CFO)

The Bank Of New York (Nominees) Ltd. 16.62% MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

Sociedad Quimica y Minera de Chile SA (SQM) 13.06% Anglo American plc 69.71%

Huntress (CI) Nominees Ltd. 12.49% Industrial Development Corporation of SA Ltd. 12.88%

MORE INFO: www.sharedata.co.za/sdo/jse/KP2 Government Employees Pension Fund 2.86%

COMPANY SECRETARY: SJCS and Henko Vos POSTAL ADDRESS:PostnetSuite153, PrivateBagX31,Saxonwold,2132

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/KIO

SPONSOR: Questco Corporate Advisory (Pty) Ltd. COMPANY SECRETARY: Fazila Patel

AUDITORS: BDO LLP TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

CAPITAL STRUCTURE AUTHORISED ISSUED

KP2 Ords US0.001c - 4 377 869 961 AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Jan25 Avg 8m shares p.w., R3.7m(9.6% p.a.)

KIO Ords 1c ea 500 000 000 322 085 974

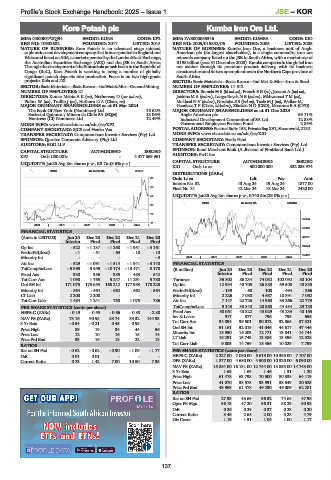

INDM 40 Week MA KORE

DISTRIBUTIONS [ZARc]

80 Ords 1c ea Ldt Pay Amt

Interim No 32 13 Aug 24 19 Aug 24 1877.00

66

Final No 31 12 Mar 24 18 Mar 24 2420.00

52 LIQUIDITY: Jan25 Avg 2m shares p.w., R740.5m(29.0% p.a.)

INDM 40 Week MA KUMBA

39

25

67034

11

2020 | 2021 | 2022 | 2023 | 2024 |

56148

FINANCIAL STATISTICS

(Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 45261

Interim Final Final Final Final

34374

Op Inc - 522 - 1 137 - 1 268 - 1 951 - 3 161

NetIntPd(Rcvd) - 1 - 51 - 63 - 10 - 10 23487

Minority Int - - - - - 3 2020 | 2021 | 2022 | 2023 | 2024 |

Att Inc - 529 - 1 091 - 1 514 - 1 941 - 3 140 FINANCIAL STATISTICS

TotCompIncLoss - 5 393 3 955 - 10 174 - 13 471 8 178 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Fixed Ass 330 356 385 483 542 Interim Final Final Final Final

Tot Curr Ass 1 090 1 765 5 247 11 291 5 780 Turnover 35 802 86 234 74 032 102 092 80 104

Ord SH Int 171 075 175 653 168 212 177 983 178 225 Op Inc 12 934 40 705 26 880 59 508 40 838

Minority Int - 564 - 564 - 562 - 562 - 564 NetIntPd(Rcvd) - 139 - 68 108 - 494 - 366

LT Liab 2 200 2 200 - - - Minority Int 2 226 7 080 4 687 10 391 7 062

Tot Curr Liab 1 484 1 241 750 1 075 786 Att Inc 7 147 22 725 14 968 33 266 22 779

PER SHARE STATISTICS (cents per share) TotCompIncLoss 9 143 30 840 20 368 44 484 29 730

HEPS-C (ZARc) - 0.19 - 0.55 - 0.66 - 0.88 - 2.80 Fixed Ass 50 061 48 822 43 029 43 233 40 165

NAV PS (ZARc) 73.16 90.95 83.74 89.32 144.93 Inv & Loans 917 877 796 795 656

3 Yr Beta - 0.54 - 0.21 0.45 0.95 - Tot Curr Ass 34 094 39 501 30 872 32 865 37 321

Price High 89 19 34 44 56 Ord SH Int 51 161 52 019 41 046 44 617 47 446

Price Low 12 10 16 15 14 Minority Int 15 950 16 203 12 771 13 841 14 744

Price Prd End 33 16 18 22 18 LT Liab 16 291 15 743 13 386 13 396 12 528

RATIOS Tot Curr Liab 9 803 14 759 15 456 10 029 7 799

Ret on SH Fnd - 0.62 - 0.62 - 0.90 - 1.09 - 1.77 PER SHARE STATISTICS (cents per share)

D:E 0.01 0.01 - - - HEPS-C (ZARc) 2 227.00 7 080.00 5 619.00 10 365.00 7 107.00

Current Ratio 0.73 1.42 7.00 10.50 7.35 DPS (ZARc) 1 877.00 4 680.00 4 500.00 10 320.00 6 090.00

NAV PS (ZARc) 15 884.00 16 151.00 12 744.00 13 853.00 14 743.00

3 Yr Beta 1.63 1.63 1.46 1.31 1.20

Price High 61 478 63 798 70 500 80 338 64 119

Price Low 41 070 38 575 33 991 38 549 20 525

Price Prd End 43 963 61 478 49 230 46 009 62 281

RATIOS

Ret on SH Fnd 27.93 43.69 36.52 74.68 47.98

Oper Pft Mgn 36.13 47.20 36.31 58.29 50.98

D:E 0.26 0.29 0.37 0.23 0.20

Current Ratio 3.48 2.68 2.00 3.28 4.79

Div Cover 1.19 1.51 1.04 1.00 1.17

137