Page 140 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 140

JSE – LAB Profile’s Stock Exchange Handbook: 2025 – Issue 1

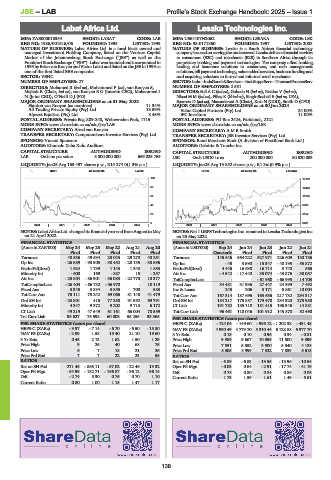

Labat Africa Ltd. Lesaka Technologies Inc.

LAB LES

ISIN: ZAE000018354 SHORT: LABAT CODE: LAB ISIN: US64107N2062 SHORT: LESAKA CODE: LSK

REG NO: 1986/001616/06 FOUNDED: 1995 LISTED: 1999 REG NO: 98-0171860 FOUNDED: 1997 LISTED: 2008

NATURE OF BUSINESS: Labat Africa Ltd. is a local black owned and NATURE OF BUSINESS: Lesaka is a South African financial technology

managed Investment Holding Company, listed on the Venture Capital companyfocusedonservingtheunderserved.Lesakadeliversfinancialservices

Market of the Johannesburg Stock Exchange (“JSE”) as well as the to consumers (B2C) and merchants (B2B) in Southern Africa through its

Frankfort Stock Exchange (“FSE”).Labat was founded and incorporated in proprietary banking and payment technologies. The company offers banking,

1995 by Brian van Rooyen and Victor Labat and listed on the JSE in 1999 as lending and insurance solutions to consumers, and cash management

one of the first listed BEE companies. solutions,billpaymenttechnology,value-addedservices,businessfundingand

SECTOR: VENC card acquiring solutions to formal and informal retail merchants.

NUMBER OF EMPLOYEES: 27 SECTOR:Inds—IndsGoods&Services—IndsSupptServ—TransactProcessServ

DIRECTORS: Mohamed R (ind ne), Mohammed P (ne), van Rooyen S, NUMBER OF EMPLOYEES: 2 531

Majiedt R (Chair, ind ne), van Rooyen B G (Interim CEO), Mohammed I DIRECTORS: Ball A C (ind ne), Gobodo N (ind ne), Naidoo V (ind ne),

N (Joint CEO), O’Neill D J (FD) NkosiMM(ind ne), Pillay K (ld ind ne), Singh-Bushell E (ind ne, USA),

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2023 Sparrow D (ind ne), Mazanderani A (Chair), Kola N (COO), Smith D (CFO)

Stanton van Rooyen (as nominee) 11.34% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

All Trading Private Equity (Pty) Ltd. 13.59% Value Capital Partners (Pty) Ltd. 24.00%

Alpvest Equities (Pty) Ltd. 8.45% IFC Investors 11.00%

POSTAL ADDRESS: Private Bag X09-248, Weltevreden Park, 1715 POSTAL ADDRESS: PO Box 2424, Parklands, 2121

MORE INFO: www.sharedata.co.za/sdo/jse/LAB MORE INFO: www.sharedata.co.za/sdo/jse/LSK

COMPANY SECRETARY: Alred van Rooyen COMPANY SECRETARY: A M R Smith

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Vunani Sponsors SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: Khumalo Xaba Xulu Auditors AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

LAB Ords no par value 5 000 000 000 669 025 769 LSK Ords USD0.1c ea 200 000 000 80 520 053

LIQUIDITY: Jan25 Avg 163 497 shares p.w., R15 274.0(1.3% p.a.) LIQUIDITY: Jan25 Avg 13 852 shares p.w., R1.3m(0.9% p.a.)

INDT 40 Week MA LABAT SUPS 40 Week MA LESAKA

103 17157

83 14406

64 11655

45 8903

25 6152

6 3401

2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Labat Africa Ltd. changed its financial year end from August to May NOTES: Net 1 UEPS Technologies Inc. renamed to Lesaka Technologies Inc.

on 21 April 2022 . on 25 May 2022.

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) May 24 May 23 May 22 Aug 21 Aug 20 (Amts in USD’000) Sep 24 Jun 24 Jun 23 Jun 22 Jun 21

Final Final Final Final Final Quarterly Final Final Final Final

Turnover 48 536 49 534 23 043 29 270 40 251 Turnover 145 546 564 222 527 971 226 609 130 786

Op Inc - 26 689 - 90 505 - 38 452 - 28 135 - 38 696 Op Inc - 45 3 590 - 15 347 - 40 195 - 53 872

NetIntPd(Rcvd) 1 624 1 739 1 143 1 343 1 853 NetIntPd(Rcvd) 4 446 16 638 16 714 3 740 566

Minority Int - 600 169 - 887 15 - 257 Att Inc - 4 542 - 17 440 - 35 074 - 43 876 - 38 057

Att Inc - 25 804 - 86 901 - 36 083 - 22 770 10 377 TotCompIncLoss - - - 61 960 - 66 995 - 14 703

TotCompIncLoss - 26 404 - 86 732 - 36 970 - 10 119 Fixed Ass 34 481 31 936 27 447 24 599 7 492

Fixed Ass 3 345 3 834 3 855 700 583 Inv & Loans 245 206 3 171 5 861 10 004

Tot Curr Ass 75 111 75 242 69 066 81 148 41 479 Tot Curr Ass 167 314 187 696 163 636 217 732 294 317

Ord SH Int - 23 801 416 77 250 91 592 69 791 Ord SH Int 184 217 175 857 179 478 234 920 275 980

Minority Int 4 347 9 372 9 202 9 713 6 172 LT Liab 191 782 185 118 181 415 196 346 14 881

LT Liab 49 219 47 549 61 161 66 004 78 559 Tot Curr Liab 96 461 118 046 101 912 145 870 52 490

Tot Curr Liab 93 627 75 598 60 008 55 255 35 365

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) - 124.04 - 149.60 - 995.12 - 1 202.38 - 431.48

HEPS-C (ZARc) - 3.97 - 7.14 - 6.70 - 6.50 - 15.80 NAV PS (ZARc) 4 930.49 4 779.70 5 310.44 6 128.88 6 977.70

NAV PS (ZARc) - 2.99 1.58 15.40 21.10 19.60 3 Yr Beta 0.15 0.10 0.96 0.34 - 0.81

3 Yr Beta 0.45 2.13 1.62 1.50 1.29 Price High 9 989 9 667 10 055 11 500 9 399

Price High 9 26 40 68 75 Price Low 7 551 5 852 5 500 5 540 4 188

Price Low 6 7 18 21 26 Price Prd End 8 305 8 999 7 322 7 839 6 615

Price Prd End 7 7 22 23 55 RATIOS

RATIOS Ret on SH Fnd - 6.89 - 6.83 - 13.55 - 13.96 - 10.54

Ret on SH Fnd 271.45 - 886.11 - 57.02 - 22.46 13.32 Oper Pft Mgn - 0.03 0.64 - 2.91 - 17.74 - 41.19

Oper Pft Mgn - 54.99 - 182.71 - 166.87 - 96.12 - 96.14 D:E 0.78 0.80 0.84 0.86 0.08

D:E - 2.74 5.30 0.76 0.70 1.10 Current Ratio 1.73 1.59 1.61 1.49 5.61

Current Ratio 0.80 1.00 1.15 1.47 1.17

138