Page 136 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 136

JSE – JSE Profile’s Stock Exchange Handbook: 2025 – Issue 1

JSE Ltd. Jubilee Metals Group plc

JSE JUB

ISIN: ZAE000079711 SHORT: JSE CODE: JSE ISIN: GB0031852162 SHORT: JUBILEE CODE: JBL

REG NO: 2005/022939/06 FOUNDED: 1887 LISTED: 2006 REG NO: 04459850 FOUNDED: 2002 LISTED: 2006

NATURE OF BUSINESS: The JSE was formed in 1887 during the first NATURE OF BUSINESS: Jubilee Metals Group plc is a diversified metal

South African gold rush. Following the first legislation covering financial recovery business with a growing world-class portfolio of projects in

marketsin1947, theJSEjoinedtheWorldFederationofExchangesin1963 Zambia and South Africa, focussed on the retreatment and metals recovery

and upgraded to an electronic trading system in the early 1990s. The from mine tailings, waste, slag, slurry and other secondary materials

bourse demutualised and listed on its own exhange in 2005. In 2003, the generated from mining operations.

company launched an alternative exchange, AltX, for small and mid-sized SECTOR: AltX

listings, followed by Yield X for interest rate and currency instruments. NUMBER OF EMPLOYEES: 886

The JSE then acquired the South African Futures Exchange (SAFEX) in DIRECTORS: Kerr T (ind ne), Khoza DrRJ(ne), Molefe C (ne),

2001 and the Bond Exchange of South Africa (BESA) in 2009. Today it Taylor N (ind ne), de Sousa-OliveiraMLS (Chair, ind ne, Ptgl),

offers five financial markets namely Equities and Bonds as well as Phosa Dr M (Vice Chair, ne), Coetzer L (CEO),

Financial, Commodity and Interest Rate Derivatives. Morley-Kirk J (Interim CFO), Smit R (Interim CFO)

SECTOR:Fins—FinServcs—InvBnkng&BrokerServcs—InvestmentServices MAJOR ORDINARY SHAREHOLDERS as at 04 Nov 2024

NUMBER OF EMPLOYEES: 545 Slater Investments 11.94%

DIRECTORS: BassaZBM(ind ne), Brewer T (ind ne), Hargreaves Lansdown Asset Management 9.70%

ClearyMS(ind ne), Kana DrSP(ld ind ne), KhanyileFN(ind ne), Kirk Interactive Investor 8.60%

IM(ne, Ire), KrugerBJ(ne), LeeuwTP(ind ne), Nhleko P F POSTAL ADDRESS: 1st Floor, 7/8 Kendrick Mews, London, SW7 2JE

(Chair, ind ne), Fourie Dr L (CEO), Suliman F (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/JBL

MAJOR ORDINARY SHAREHOLDERS as at 19 Apr 2024 COMPANY SECRETARY: Link Company Matters Ltd.

Ninety One SA (Pty) Ltd. 14.79% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Public Investment Corporation SOC Ltd. 14.17% DESIGNATED ADVISOR: Questco Corporate Advisory (Pty) Ltd.

PSG Asset Management 10.02%

POSTAL ADDRESS: Private Bag X991174, Sandton, 2146 AUDITORS: Crowe U.K. LLP

MORE INFO: www.sharedata.co.za/sdo/jse/JSE CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: G A Brookes JBL Ords GBP1p - 3 013 865 822

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. LIQUIDITY: Jan25 Avg 4m shares p.w., R5.7m(7.4% p.a.)

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

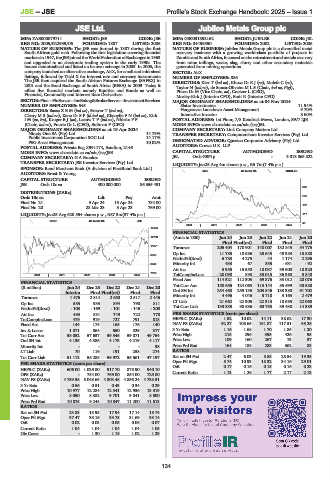

MINI 40 Week MA JUBILEE

AUDITORS: Ernst & Young

CAPITAL STRUCTURE AUTHORISED ISSUED

JSE Ords 10c ea 400 000 000 86 355 491

326

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt 256

Final No 21 9 Apr 24 15 Apr 24 784.00

187

Final No 20 28 Mar 23 3 Apr 23 769.00

LIQUIDITY: Jan25 Avg 620 554 shares p.w., R67.3m(37.4% p.a.) 117

GENF 40 Week MA JSE

48

2020 | 2021 | 2022 | 2023 | 2024 |

14194

FINANCIAL STATISTICS

12783 (Amts in ‘000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final Final Final

11371

Turnover 205 404 170 901 140 007 132 845 54 775

Op Inc 11 785 18 686 25 643 45 383 15 888

9959

NetIntPd(Rcvd) 6 783 4 275 44 1 174 2 296

8548 Minority Int 433 67 335 - 631 - 92

Att Inc 5 955 15 550 18 037 39 600 18 320

7136

2020 | 2021 | 2022 | 2023 | 2024 | TotCompIncLoss - 20 098 898 35 015 36 368 5 840

Fixed Ass 114 521 112 303 69 876 33 012 20 076

FINANCIAL STATISTICS

Tot Curr Ass 150 656 124 063 113 144 85 699 30 580

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Ord SH Int 254 468 255 135 203 846 133 380 91 702

Interim Final Final(rst) Final Final

Turnover 1 476 2 814 2 650 2 517 2 446 Minority Int 4 496 4 046 3 710 3 163 2 479

Op Inc 553 933 894 798 811 LT Liab 21 662 22 305 22 313 18 685 22 068

NetIntPd(Rcvd) - 103 - 169 - 101 - 146 - 200 Tot Curr Liab 133 335 98 586 63 753 39 438 14 389

Att Inc 493 831 749 722 778 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 479 919 727 791 818 HEPS-C (ZARc) 1.52 10.02 14.11 38.62 17.30

Fixed Ass 144 174 165 176 140 NAV PS (ZARc) 92.27 108.65 151.87 117.51 95.26

Inv & Loans 1 071 864 650 529 377 3 Yr Beta 1.16 1.68 1.70 1.85 1.20

Tot Curr Ass 53 052 57 637 59 345 59 071 49 754 Price High 215 296 395 426 95

Ord SH Int 4 135 4 386 4 173 4 219 4 117 Price Low 109 160 267 73 37

Minority Int - - - - 38 Price Prd End 164 188 283 362 83

LT Liab 70 116 191 258 274 RATIOS

Tot Curr Liab 51 112 55 288 56 972 56 561 47 197 Ret on SH Fnd 2.47 6.03 8.85 28.54 19.35

Oper Pft Mgn 5.74 10.93 18.32 34.16 29.01

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 606.00 1 029.80 917.70 878.90 940.10 D:E 0.17 0.16 0.15 0.16 0.23

DPS (ZARc) - 784.00 769.00 854.00 725.00 Current Ratio 1.13 1.26 1.77 2.17 2.13

NAV PS (ZARc) 4 759.58 5 048.65 4 803.48 4 856.24 4 738.51

3 Yr Beta 0.56 0.51 0.43 0.34 0.29

Price High 10 977 12 284 12 541 12 936 13 319

Price Low 8 050 8 382 9 701 9 841 8 500

Price Prd End 10 875 9 244 10 847 11 200 11 513

RATIOS

Ret on SH Fnd 23.83 18.95 17.94 17.14 18.74

Oper Pft Mgn 37.47 33.16 33.75 31.69 33.14

D:E 0.02 0.03 0.05 0.06 0.07

Current Ratio 1.04 1.04 1.04 1.04 1.05

Div Cover - 1.30 1.18 1.02 1.29

134