Page 132 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 132

JSE – IMP Profile’s Stock Exchange Handbook: 2025 – Issue 1

Impala Platinum Holdings Ltd. Insimbi Industrial Holdings Ltd.

IMP INS

ISIN: ZAE000083648 ISIN: ZAE000116828

SHORT: IMPLATS SHORT: INSIMBI

CODE: IMP CODE: ISB

REG NO: 1957/001979/06 REG NO: 2002/029821/06

FOUNDED: 1957 FOUNDED: 2008

LISTED: 1973 LISTED: 2008

NATURE OF BUSINESS: Impala Platinum Holdings Ltd. is principally in NATURE OF BUSINESS: Insimbi is a group of companies that sustainably

the businessofproducing andsupplying platinumgroup metals(PGMs)to source,process,beneficiate&recyclemetals.Thecorebusinessexpertiseisthe

industrial economies. ability to source and provide local, regional and global industrial consumers

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet with the required commodity over its four distinct business segments.

NUMBER OF EMPLOYEES: 66 253 SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

DIRECTORS: Earp D (ind ne), Havenstein R (ind ne), KoshaneBT(ne), NUMBER OF EMPLOYEES: 404

Mawasha B (ind ne), Moshe M (ind ne), Mufamadi DrFS(ind ne), DIRECTORS: Winde N (CFO), Botha F (CEO),

NkeliMEK(ind ne), Samuel L, Speckmann P (ind ne), Dickerson R I (Chair, ld ind ne), Mwale N (ne), NtshingilaCS(ind ne)

SwanepoelBZ(ld ind ne), Orleyn AdvNDB (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Muller N J (CEO), Kerber M (CFO) NS Investco 24.78%

MAJOR ORDINARY SHAREHOLDERS as at 30 Aug 2024 African Goshawk (Pty) Ltd. 11.14%

Public Investment Corporation 13.68% Pruta Securities 10.40%

FMR LLC 10.11% POSTAL ADDRESS: PO Box 14676, Wadeville, 1422

Lingotto 5.86% EMAIL: cosec@insimbi-alloys.co.za

POSTAL ADDRESS: Private Bag X18, Northlands, 2116 WEBSITE: insimbi-group.co.za

EMAIL: investor@implats.co.za TELEPHONE: 011-902-6930 FAX: 011-902-5749

WEBSITE: www.implats.co.za COMPANY SECRETARY: Fluidrock Governance Group (Pty) Ltd.

TELEPHONE: 011-731-9000 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Tebogo Llale SPONSOR: PSG Capital (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Moore Cape Town Inc.

SPONSOR: Nedbank Corporate and Investment Banking CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Deloitte & Touche Inc.

ISB Ords 0.000025c ea 12 000 000 000 330 898 356

CAPITAL STRUCTURE AUTHORISED ISSUED

IMP Ords no par value 1 044 008 000 904 368 485 DISTRIBUTIONS [ZARc]

Ords 0.000025c ea Ldt Pay Amt

DISTRIBUTIONS [ZARc] Interim No 22 14 Nov 23 20 Nov 23 2.50

Ords no par value Ldt Pay Amt Final No 21 4 Jul 23 10 Jul 23 5.00

Final No 99 19 Sep 23 26 Sep 23 165.00

Interim No 98 20 Mar 23 27 Mar 23 420.00 LIQUIDITY: Dec24 Avg 1m shares p.w., R1.0m(16.6% p.a.)

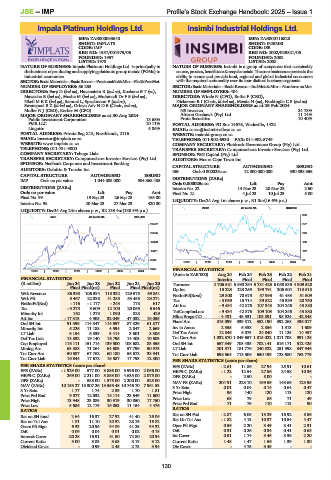

INDM 40 Week MA INSIMBI

LIQUIDITY: Dec24 Avg 24m shares p.w., R2 133.4m(138.5% p.a.)

333

MINI 40 Week MA IMPLATS

28597 277

23535 220

18473 163

13411 107

8349 50

2019 | 2020 | 2021 | 2022 | 2023 | 2024

3287 FINANCIAL STATISTICS

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

FINANCIAL STATISTICS Interim Final Final Final Final

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Turnover 2 706 581 5 590 294 5 731 423 6 058 535 4 909 528

Final Final(rst) Final Final Final(rst) Op Inc 15 223 123 259 199 791 206 504 113 518

Wrk Revenue 86 398 106 594 118 332 129 575 69 851 NetIntPd(Rcvd) 29 800 70 673 57 993 61 483 51 509

Wrk Pft 5 467 22 338 41 285 53 455 23 271 Tax - 3 069 15 714 39 522 45 389 20 750

NetIntPd(Rcd) - 116 - 1 177 - 243 178 617

Tax - 3 275 3 609 12 100 20 065 6 546 Att Inc - 9 434 42 876 107 343 104 246 43 880

Minority Int 162 1 273 1 090 823 429 TotCompIncLoss - 9 434 42 876 109 103 104 246 43 880

Att Inc - 17 313 4 905 32 049 47 032 16 055 Hline Erngs-CO - 4 431 45 331 105 891 98 924 42 848

Ord SH Int 91 399 114 847 114 697 87 829 61 877 Fixed Ass 315 099 339 812 352 190 392 268 436 017

Minority Int 5 226 11 188 4 594 2 847 2 669 Inv in Assoc 2 555 6 338 2 856 1 513 1 609

LT Liab 6 154 6 539 3 414 3 601 8 306 Def Tax Asset 12 846 5 073 24 840 11 125 14 457

Def Tax Liab 13 332 19 140 16 795 14 405 10 503 Tot Curr Ass 1 032 370 1 049 657 1 015 022 1 011 708 991 126

Cap Employed 116 111 151 714 139 500 108 682 83 355 Ord SH Int 657 349 708 435 702 141 616 171 512 425

Mining Ass 63 588 71 264 64 603 57 799 50 975 LT Liab 201 571 181 776 240 522 251 998 347 946

Tot Curr Ass 50 587 67 762 60 180 56 672 38 941 Tot Curr Liab 698 564 713 506 650 199 728 580 763 779

Tot Curr Liab 16 844 17 672 16 587 17 793 12 500

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) EPS (ZARc) - 2.61 11.86 27.94 25.91 10.61

EPS (ZARc) - 1 929.00 577.00 3 856.00 5 996.00 2 066.00 HEPS-C (ZARc) - 1.22 12.54 27.56 24.58 10.36

HEPS-C (ZARc) 269.00 2 211.00 3 853.00 4 635.00 2 075.00 DPS (ZARc) - 2.50 8.00 - -

DPS (ZARc) - 585.00 1 575.00 2 200.00 525.00 NAV PS (ZARc) 204.91 223.10 169.59 143.69 123.95

NAV (ZARc) 10 158.27 13 307.26 13 555.48 10 746.70 7 961.53 3 Yr Beta 0.01 0.04 0.14 0.64 0.47

3 Yr Beta 1.77 1.74 2.39 1.70 1.81 Price High 96 140 120 113 120

Price Prd End 9 077 12 532 18 114 23 549 11 600

Price High 13 948 23 889 30 919 30 050 17 750 Price Low 68 79 86 71 49

Price Low 5 686 12 179 16 053 11 154 4 476 Price Prd End 71 79 110 113 90

RATIOS RATIOS

Ret on SH fund 2.64 16.37 27.92 41.40 26.06 Ret on SH Fnd - 2.87 6.05 15.29 16.92 8.56

Ret on Tot Ass 1.81 11.10 20.52 28.75 16.82 Ret On Tot Ass - 1.82 4.13 10.37 10.54 4.47

Gross Pft Mgn 6.33 20.96 34.89 41.25 33.32 Oper Pft Mgn 0.56 2.20 3.49 3.41 2.31

D:E 0.06 0.04 0.01 0.02 0.15 D:E 0.31 0.26 0.34 0.41 0.68

Interest Cover -20.28 16.91 81.50 72.80 20.94 Int Cover 0.51 1.74 3.45 3.36 2.20

Current Ratio 3.00 3.83 3.63 3.19 3.12 Current Ratio 1.48 1.47 1.56 1.39 1.30

Dividend Cover - 0.99 2.45 2.73 3.94 Div Cover - 4.75 3.49 - -

130