Page 124 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 124

JSE – GOL Profile’s Stock Exchange Handbook: 2025 – Issue 1

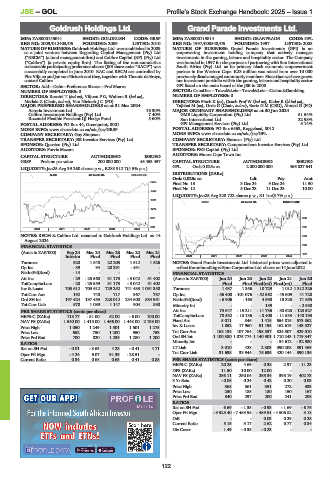

Goldrush Holdings Ltd. Grand Parade Investments Ltd.

GOL GRA

ISIN: ZAE000145041 SHORT: GOLDRUSH CODE: GRSP ISIN: ZAE000119814 SHORT: GRANPRADE CODE: GPL

REG NO: 2009/012403/06 FOUNDED: 2009 LISTED: 2010 REG NO: 1997/003548/06 FOUNDED: 1997 LISTED: 2008

NATURE OF BUSINESS: Goldrush Holdings Ltd. was established in 2009 NATURE OF BUSINESS: Grand Parade Investments (GPI) is an

as a joint venture between Regarding Capital Management (Pty) Ltd. empowering investment holding company that actively manages

(“RECM”) (a fund management firm) and Calibre Capital (RF) (Pty) Ltd. investments in the gaming, leisure and hospitality sector. The Company

(“Calibre”) (a private equity firm). The listing of the non-cumulative was founded in 1997 for the purpose of partnering with Sun International

redeemable participating preference shares (JSE share code: “RACP”) was South Africa (Pty) Ltd. as its primary black economic empowerment

successfully completed in June 2010. RAC and RECM are controlled by partner in the Western Cape. R28 million was raised from over 10 000

Piet Viljoen and Jan van Niekerk and they, together with Theunis de Bruyn, previously disadvantagedcommunity members. Since then we have grown

control Calibre. our investment portfolio within the gaming, leisure and hospitality sector.

SECTOR: Add—Debt—Preference Shares—Pref Shares GPI listed on the main board of the JSE in 2008.

NUMBER OF EMPLOYEES: 0 SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling

DIRECTORS: Rossini T (ind ne), Viljoen P G, Walters R (ind ne), NUMBER OF EMPLOYEES: 0

Matlala Z (Chair, ind ne), Van Niekerk J C (FD) DIRECTORS: Finch K (ne), Geach Prof W (ind ne), Kader R (ld ind ne),

MAJOR PREFERRED SHAREHOLDERS as at 31 Mar 2024 Tajbhai M (ne), Orrie G (Chair, ind ne), Bortz G M (CEO), Ahmed G (FD)

Astoria Investment Ltd. 16.30% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Calibre Investment Holdings (Pty) Ltd. 7.40% GMB Liquidity Corporation (Pty) Ltd. 51.54%

Rozendal Flexible Prescient QI Hedge Fund 5.60% Sun International Ltd. 22.98%

POSTAL ADDRESS: PO Box 44, Greenpoint, 8001 GPI Management Services (Pty) Ltd. 5.14%

MORE INFO: www.sharedata.co.za/sdo/jse/GRSP POSTAL ADDRESS: PO Box 6563, Roggebaai, 8012

COMPANY SECRETARY: Guy Simpson MORE INFO: www.sharedata.co.za/sdo/jse/GPL

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: Statucor (Pty) Ltd.

SPONSOR: Questco (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Forvis Mazars SPONSOR: PSG Capital (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Moore Cape Town Inc.

GRSP Prefs no par value 200 000 000 45 453 457 CAPITAL STRUCTURE AUTHORISED ISSUED

GPL Ords 0.025c ea 2 000 000 000 466 827 641

LIQUIDITY: Jan25 Avg 39 260 shares p.w., R288 912.7(4.5% p.a.)

DISTRIBUTIONS [ZARc]

ALSH 40 Week MA GOLDRUSH

Ords 0.025c ea Ldt Pay Amt

2285 Final No 13 3 Dec 24 9 Dec 24 11.50

Final No 12 5 Dec 23 11 Dec 23 10.00

1948

LIQUIDITY: Jan25 Avg 328 722 shares p.w., R1.1m(3.7% p.a.)

1611

GENF 40 Week MA GRANPRADE

1274

937 333

600 292

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: RECM & Calibre Ltd. renamed to Goldrush Holdings Ltd. on 14 250

August 2024.

FINANCIAL STATISTICS 209

(Amts in ZAR’000) Sep 24 Mar 24 Mar 23 Mar 22 Mar 21

Interim Final Final Final Final 2020 | 2021 | 2022 | 2023 | 2024 | 167

Turnover 920 1 548 22 203 1 512 1 526 NOTES: Grand Parade Investments Ltd. historical prices were adjusted to

Op Inc - 39 94 20 291 - 431 - reflecttheunbundlingofSpurCorporationLtd.shareson14June2022.

NetIntPd(Rcvd) - 14 - - - - FINANCIAL STATISTICS

Att Inc - 29 - 25 560 31 173 - 3 042 51 402 (Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

TotCompIncLoss - 28 - 25 559 31 173 - 3 042 51 402 Final Final Final(rst) Final(rst) Final

Inv & Loans 703 612 703 612 729 252 741 433 1 091 350 Turnover 1 437 1 356 10 729 1 012 1 312 326

Tot Curr Ass 192 740 717 367 787 Op Inc - 56 408 - 101 076 - 52 562 - 45 609 41 720

Ord SH Int 197 424 197 453 223 012 234 600 584 951 NetIntPd(Rcvd) - 6 906 - 163 4 590 15 325 71 655

Tot Curr Liab 570 1 089 1 147 904 890 Minority Int - - 159 - - 2 980

PER SHARE STATISTICS (cents per share) Att Inc 73 647 - 15 211 - 11 736 - 30 625 - 123 527

HEPS-C (ZARc) 113.77 - 51.00 62.00 - 6.00 100.00 TotCompIncLoss 78 532 - 13 136 - 8 405 - 11 533 - 140 193

NAV PS (ZARc) 1 540.00 1 415.00 1 466.00 1 448.00 2 133.00 Fixed Ass 5 011 846 1 415 554 815 573 862

Price High 1 050 1 249 1 501 1 501 1 275 Inv & Loans 1 852 17 960 91 195 162 619 143 527

Price Low 652 750 1 200 950 753 Tot Curr Ass 163 134 107 764 198 537 324 507 329 010

Price Prd End 700 820 1 236 1 280 1 200 Ord SH Int 1 100 380 1 075 774 1 140 901 1 710 243 1 719 347

RATIOS Minority Int - - - - 34 612 - 32 980

Ret on SH Fnd - 0.01 - 3.63 4.28 - 0.41 4.71 LT Liab 3 010 428 2 303 390 208 391 469

Oper Pft Mgn - 4.24 6.07 91.39 - 28.51 - Tot Curr Liab 31 698 33 944 75 635 420 144 390 136

Current Ratio 0.34 0.68 0.63 0.41 0.88 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 20.25 4.69 0.38 2.97 - 11.23

DPS (ZARc) 11.50 10.00 12.00 - -

NAV PS (ZARc) 256.11 250.04 265.34 398.19 402.73

3 Yr Beta - 0.08 0.24 0.42 0.20 0.03

Price High 368 361 351 272 333

Price Low 250 185 180 150 167

Price Prd End 340 297 200 241 208

RATIOS

Ret on SH Fnd 6.69 - 1.35 - 0.93 - 1.69 - 6.76

Oper Pft Mgn - 3 925.40 - 7 453.98 - 489.91 - 4 506.82 3.18

D:E - - 0.03 0.29 0.28

Current Ratio 5.15 3.17 2.62 0.77 0.84

Div Cover 1.49 - 0.35 - 0.23 - -

122