Page 126 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 126

JSE – GRO Profile’s Stock Exchange Handbook: 2025 – Issue 1

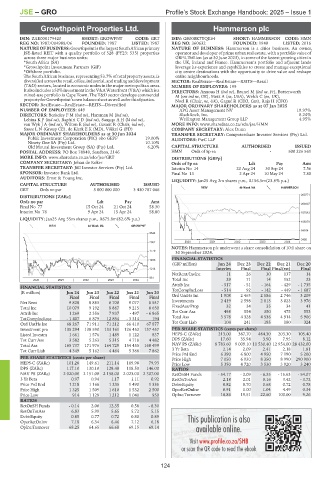

Growthpoint Properties Ltd. Hammerson plc

GRO HAM

ISIN: ZAE000179420 SHORT: GROWPNT CODE: GRT ISIN: GB00BK7YQK64 SHORT: HAMMERSON CODE: HMN

REG NO: 1987/004988/06 FOUNDED: 1987 LISTED: 1987 REG NO: 360632 FOUNDED: 1940 LISTED: 2016

NATUREOFBUSINESS:GrowthpointisthelargestSouthAfricanprimary NATURE OF BUSINESS: Hammerson is a cities business. An owner,

JSE-listed REIT with a quality portfolio of 528 (FY23: 535) properties operator and developer of prime urban real estate, with a portfolio value of

across three major business units: GBP4.7billion (as at 30 June 2023), in some of the fastest growing cities in

*South Africa (SA) the UK, Ireland and France. Hammerson’s portfolio and adjacent lands

*Growthpoint Investment Partners (GIP) leverage its experience and capabilities to create and manage exceptional

*Offshore portfolio. city centre destinations with the opportunity to drive value and reshape

The South African business, representing 53.7% of total property assets, is entire neighbourhoods.

diversifiedacrosstheretail,office,industrial,andtradinganddevelopment SECTOR: RealEstate—RealEstate—REITS—Retail

(T&D) sectors, located in economic nodes in the major metropolitan areas. NUMBER OF EMPLOYEES: 199

Italsoincludesa50% investmentinthe V&AWaterfront(V&A) which isa DIRECTORS: Annous H (ind ne), Brunel M (ind ne, Fr), Butterworth

mixed-use portfolio in Cape Town. The T&D sector develops commercial M(snr ind ne, UK), Metz A (ne, USA), Welch C (ne, UK),

propertyforGrowthpoint’sownbalancesheetaswellasforthirdparties. Noel R (Chair, ne, UK), Gagné R (CEO, Can), Raja H (CFO)

SECTOR: RealEstate—RealEstate—REITS—Diversified MAJOR ORDINARY SHAREHOLDERS as at 07 Jan 2025

NUMBER OF EMPLOYEES: 649 APG Asset Management NV 19.97%

DIRECTORS: BerkeleyFM(ind ne), Hamman M (ind ne), BlackRock, Inc. 8.24%

LebinaKP(ind ne), RaphiriCD(ind ne), SangquAH(ld ind ne), Wellington Management Group LLP 4.95%

van WykJA(ind ne), Wilton E (ind ne), Gasant R (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/HMN

Sasse L N (Group CE), de Klerk E K (MD), Völkel G (FD) COMPANY SECRETARY: Alex Dunn

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Public Investment Corporation (PIC) obo GEPF 19.00% AUDITORS: PwC LLP

Ninety One SA (Pty) Ltd. 10.10%

Old Mutual Investment Group (SA) (Pty) Ltd. 6.20% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 78949, Sandton, 2146 HMN Ords of 5p ea - 500 226 561

MORE INFO: www.sharedata.co.za/sdo/jse/GRT DISTRIBUTIONS [GBPp]

COMPANY SECRETARY: Johan de Koker Ords of 5p ea Ldt Pay Amt

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Interim No 14 20 Aug 24 30 Sep 24 7.56

SPONSOR: Investec Bank Ltd. Final No 13 2 Apr 24 10 May 24 7.80

AUDITORS: Ernst & Young Inc.

LIQUIDITY: Jan25 Avg 2m shares p.w., R156.5m(23.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

GRT Ords no par 5 000 000 000 3 430 787 066 REIV 40 Week MA HAMMERSON

DISTRIBUTIONS [ZARc] 260771

Ords no par Ldt Pay Amt

209307

Final No 77 15 Oct 24 21 Oct 24 58.30

Interim No 76 9 Apr 24 15 Apr 24 58.80 157843

LIQUIDITY: Jan25 Avg 55m shares p.w., R675.8m(82.6% p.a.)

106378

REIV 40 Week MA GROWPNT

54914

2344

3450

2062 2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Hammerson plc underwent a share consolidation of 10:1 share on

1779

30 September 2024.

FINANCIAL STATISTICS

1496

(GBP million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

1214 Interim Final Final Final(rst) Final

NetRent/InvInc 11 26 30 137 14

931 Total Inc 29 71 14 152 23

2020 | 2021 | 2022 | 2023 | 2024 |

Attrib Inc - 517 - 51 - 164 - 429 - 1 735

FINANCIAL STATISTICS

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 TotCompIncLoss - 514 92 - 142 - 449 - 1 687

Final Final Final Final Final Ord UntHs Int 1 908 2 463 2 586 2 746 3 209

Net Rent 9 828 8 883 8 700 9 077 8 547 Investments 2 419 2 598 2 813 3 023 3 976

Total Inc 10 079 9 192 8 867 9 215 8 650 FixedAss/Prop 32 34 35 34 41

Tot Curr Ass 498 554 350 475 553

Attrib Inc 1 269 2 356 7 937 - 497 - 6 865

TotCompIncLoss - 1 407 6 879 12 854 - 3 314 194 Total Ass 3 578 4 328 4 536 4 914 5 906

Ord UntHs Int 68 267 71 911 71 212 66 410 67 877 Tot Curr Liab 104 241 185 180 324

Investment pro 135 294 138 590 133 161 126 452 137 457 PER SHARE STATISTICS (cents per share)

Listed Investm 1 661 1 576 1 489 1 122 837 HEPS-C (ZARc) 213.00 387.70 484.30 203.30 105.40

Tot Curr Ass 3 582 5 263 5 315 4 718 4 482 DPS (ZARc) 17.60 35.94 3.90 7.95 8.12

Total Ass 165 737 171 976 164 729 154 455 168 499 NAV PS (ZARc) 8 783.60 9 009.10 11 530.40 12 954.00 28 432.00

Tot Curr Liab 4 349 5 162 4 464 5 388 7 862 3 Yr Beta 2.14 2.09 2.41 2.18 1.81

Price Prd End 6 390 6 800 4 950 7 190 5 200

PER SHARE STATISTICS (cents per share) Price High 7 050 6 930 8 350 8 990 290 900

HEPS-C (ZARc) 101.26 149.61 211.14 169.98 79.93 Price Low 5 350 4 720 3 530 3 920 3 240

DPS (ZARc) 117.10 130.10 128.40 118.50 146.00 RATIOS

NAV PS (ZARc) 2 020.00 2 151.00 2 158.00 2 023.00 2 307.00 RetOnSH Funds - 54.17 - 2.09 - 6.35 - 15.63 - 54.07

3 Yr Beta 0.97 0.94 1.17 1.11 0.92 RetOnTotAss 2.18 2.01 0.16 3.42 - 3.72

Price Prd End 1 218 1 166 1 235 1 490 1 335 Debt:Equity 0.82 0.70 0.68 0.72 0.78

Price High 1 325 1 509 1 610 1 532 2 500 OperRetOnInv 0.91 1.00 1.04 4.49 0.34

Price Low 914 1 129 1 212 1 040 950 OpInc:Turnover 18.86 19.51 22.60 100.00 9.26

RATIOS

RetOnSH Funds - 0.14 2.00 12.35 0.58 - 8.30

RetOnTotAss 6.83 5.99 5.65 5.72 5.15

Debt:Equity 0.85 0.77 0.72 0.80 0.89

OperRetOnInv 7.18 6.34 6.46 7.12 6.18

OpInc:Turnover 68.25 64.65 66.68 69.15 69.14

124