Page 119 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 119

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – FIN

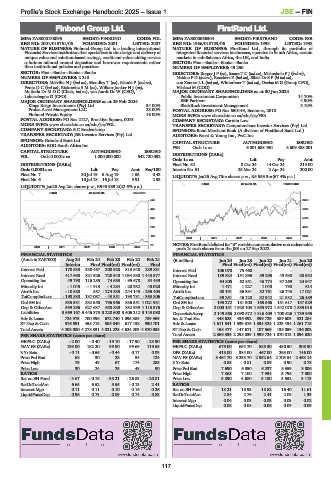

Finbond Group Ltd. FirstRand Ltd.

FIN FIR

ISIN: ZAE000138095 SHORT: FINBOND CODE: FGL ISIN: ZAE000066304 SHORT: FIRSTRAND CODE: FSR

REG NO: 2001/015761/06 FOUNDED: 2001 LISTED: 2007 REG NO: 1966/010753/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: Finbond Group Ltd. is a leading international NATURE OF BUSINESS: FirstRand Ltd., through its portfolio of

Financial Services institution that specialises in the design and delivery of integrated financial services businesses, operates in South Africa, certain

unique value and solution-based savings, credit and value adding service markets in sub-Saharan Africa, the UK, and India.

solutions tailored around depositor and borrower requirements rather SECTOR: Fins—Banks—Banks—Banks

than institutional policies and practices. NUMBER OF EMPLOYEES: 49 250

SECTOR: Fins—Banks—Banks—Banks DIRECTORS: Burger J P (ne), Isaacs T C (ind ne), Makosholo P J (ind ne),

NUMBER OF EMPLOYEES: 2 210 Naidoo P D (ind ne), Roscherr Z (ind ne), Sibisi Dr S P (ld ind ne),

DIRECTORS: MelvilleNJ(ind ne), Moodley T (ne), Naude P (ind ne), von Zeuner L L (ind ne), Winterboer T (ind ne), Davias M G (Group CFO),

PentzDC(ind ne), RiskowitzSM(ne), Wilken-JonkerHJ(ne), Vilakazi M (COO)

Motlatla DrMDC (Chair, ind ne), van Aardt Dr W (CEO), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Labuschagne G (CFO) Public Investment Corporation 14.70%

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 BEE Partners 4.90%

Kings Reign Investments (Pty) Ltd. 34.00% BlackRock Investment Management 3.10%

Protea Asset Management LLC 23.00% POSTAL ADDRESS: PO Box 650149, Benmore, 2010

Finbond Private Equity 16.00% MORE INFO: www.sharedata.co.za/sdo/jse/FSR

POSTAL ADDRESS: PO Box 2127, Brooklyn Square, 0075 COMPANY SECRETARY: Carnita Low

MORE INFO: www.sharedata.co.za/sdo/jse/FGL TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: B C Bredenkamp SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. AUDITORS: Ernst & Young Inc., PwC Inc.

SPONSOR: Grindrod Bank Ltd.

AUDITORS: BDO South Africa Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

FSR Ords 1c ea 6 001 688 450 5 609 488 001

CAPITAL STRUCTURE AUTHORISED ISSUED

FGL Ords 0.0001c ea 1 000 000 000 542 720 092 DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 52 8 Oct 24 14 Oct 24 215.00

Ords 0.0001c ea Ldt Pay Amt Scr/100 Interim No 51 25 Mar 24 2 Apr 24 200.00

FinalNo 7 30 Jul19 5 Aug 19 1.55 0.43 LIQUIDITY: Jan25 Avg 73m shares p.w., R5 353.3m(67.4% p.a.)

Final No 6 10 Jul 18 16 Jul 18 9.91 2.53

BANK 40 Week MA FIRSTRAND

LIQUIDITY: Jan25 Avg 2m shares p.w., R946 939.2(22.6% p.a.)

BANK 40 Week MA FINBOND

525 8256

425 6993

325 5730

226 4467

126 3204

2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: FirstRand delisted its “B” variable non cumulative non redeemable

26

2020 | 2021 | 2022 | 2023 | 2024 |

prefs 1c each shares from the JSE on 27 Sep 2022.

FINANCIAL STATISTICS FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final(rst) Final(rst) Final Final Final(rst) Final(rst) Final(rst) Final(rst)

Interest Paid 178 530 330 467 308 928 313 548 289 831 Interest Paid 106 070 75 460 - - -

Interest Rcvd 417 698 821 526 720 948 1 034 530 1 443 577 Interest Rcvd 189 524 151 896 59 295 49 630 38 532

Operating Inc 49 798 116 285 74 553 - 95 678 84 439 Operating Inc 64 805 62 851 46 774 37 269 24 947

Minority Int - 1 045 - 1 913 - 4 284 - 28 932 40 020 Minority Int 1 471 1 227 1 040 790 614

Attrib Inc - 10 580 557 - 274 835 - 244 145 - 295 403 Attrib Inc 38 191 36 331 32 761 26 743 17 021

TotCompIncLoss - 198 830 137 087 - 43 851 - 193 781 - 363 806 TotCompIncLoss 39 251 46 128 32 942 21 832 26 489

Ord SH Int 635 531 832 558 796 966 836 551 1 021 931 Ord SH Int 195 272 181 300 165 566 151 617 137 529

Dep & OtherAcc 599 296 627 637 658 830 832 939 1 115 576 Dep & OtherAcc 2 003 151 1 923 103 1 655 972 1 542 078 1 535 015

Liabilities 3 569 167 3 446 373 3 228 600 3 606 212 3 143 080 Deposits&Accep 2 149 566 2 098 572 1 816 409 1 700 626 1 739 955

Adv & Loans 724 973 700 596 672 740 1 095 389 789 969 Inv & Trad Sec 448 625 436 392 399 729 389 603 321 284

ST Dep & Cash 576 591 455 719 585 040 617 138 930 701 Adv & Loans 1 611 541 1 539 375 1 334 324 1 223 434 1 261 715

Total Assets 4 203 080 4 278 331 4 021 225 4 624 203 4 370 085 ST Dep & Cash 158 477 147 671 107 569 135 059 136 002

PER SHARE STATISTICS (cents per share) Total Assets 2 369 339 2 298 039 1 999 724 1 870 013 1 894 620

HEPS-C (ZARc) - 2.00 - 0.40 - 19.10 - 17.90 - 23.90 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 139.00 182.20 99.80 99.69 119.65 HEPS-C (ZARc) 679.00 654.70 585.30 480.50 308.90

3 Yr Beta - 0.11 - 0.56 - 0.44 0.17 0.03 DPS (ZARc) 415.00 384.00 467.00 263.00 146.00

Price Prd End 68 30 28 54 124 NAV PS (ZARc) 3 484.70 3 233.70 2 952.64 2 703.54 2 453.14

Price High 79 49 67 174 285 3 Yr Beta 0.85 0.81 0.89 0.90 0.78

Price Low 30 24 25 48 90 Price Prd End 7 690 6 850 6 237 5 359 3 806

RATIOS Price High 7 868 7 100 7 934 5 796 7 000

Ret on SH Fund - 3.67 - 0.16 - 35.21 - 26.83 - 20.81 Price Low 5 890 5 680 5 180 3 552 3 113

RetOnTotalAss 6.65 6.52 5.55 - 0.13 2.41 RATIOS

Interest Mgn 0.11 0.11 0.10 0.16 0.26 Ret on SH Fund 18.21 18.93 18.62 16.40 11.61

LiquidFnds:Dep 0.96 0.73 0.89 0.74 0.83 RetOnTotalAss 2.84 2.76 2.41 2.09 1.33

Interest Mgn 0.04 0.03 0.03 0.03 0.02

LiquidFnds:Dep 0.08 0.08 0.06 0.09 0.09

117