Page 116 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 116

JSE – EXX Profile’s Stock Exchange Handbook: 2025 – Issue 1

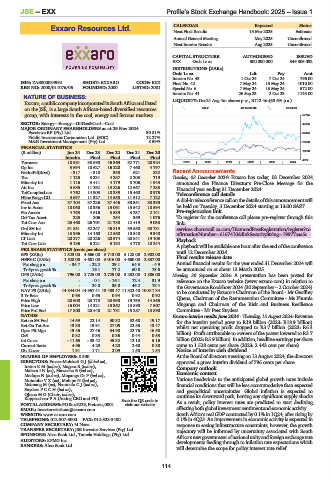

Exxaro Resources Ltd. CALENDAR Expected Status

Next Final Results 13 Mar 2025 Estimate

EXX

Annual General Meeting May 2025 Unconfirmed

Next Interim Results Aug 2025 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 349 305 092

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Interim No 43 1 Oct 24 7 Oct 24 796.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Final No 42 7 May 24 13 May 24 1010.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001

Special No 6 7 May 24 13 May 24 572.00

Interim No 41 26 Sep 23 2 Oct 23 1143.00

NATURE OF BUSINESS:

Exxaro,apubliccompanyincorporatedinSouthAfricaandlisted LIQUIDITY: Dec24 Avg 4m shares p.w., R712.4m(60.6% p.a.)

on the JSE, is a large South African-based diversified resources OILP 40 Week MA EXXARO

group, with interests in the coal, energy and ferrous markets. 57725

SECTOR: Energy—Energy—OilGas&Coal—Coal 47094

MAJOR ORDINARY SHAREHOLDERS as at 29 Nov 2024

Eyesizwe RF (Pty) Ltd. 30.81% 36464

Public Investment Corporation Ltd. (SOC) 12.27%

M&G Investment Management (Pty) Ltd. 8.59% 25833

FINANCIAL STATISTICS

15203

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final

4572

Turnover 18 981 38 698 46 369 32 771 28 924 2019 | 2020 | 2021 | 2022 | 2023 | 2024

Op Inc 3 694 10 627 16 220 7 460 4 797

NetIntPd(Rcvd) - 317 - 318 358 621 832 Recent Announcements

Tax 1 125 3 231 4 287 2 203 719 Tuesday, 03 December 2024: Exxaro has today, 03 December 2024,

Minority Int 1 116 3 411 4 179 3 706 1 943 announced the Finance Director’s Pre-Close Message for the

Att Inc 3 686 11 292 13 826 12 667 7 283 Financial year ending 31 December 2024

TotCompIncLoss 4 762 14 903 18 389 15 460 8 975 Teleconference call details

Hline Erngs-CO 3 697 11 327 14 558 11 512 7 122

Fixed Ass 37 104 37 226 37 446 38 351 38 395 Adial-inteleconferencecallonthedetailsofthisannouncementwill

Inv in Assoc 18 060 18 356 15 061 15 542 18 594 be held on Tuesday, 3 December 2024 starting at 13:00 SAST.

Fin Assets 4 763 4 616 3 539 3 237 2 141 Pre-registration link

Def Tax Asset 225 206 254 369 1 076 To register for the conference call please pre-register through this

Tot Curr Ass 25 468 26 701 21 788 12 419 9 033 link:

Ord SH Int 51 851 52 247 46 819 39 550 38 781 services.choruscall.za.com/DiamondPassRegistration/register?co

Minority Int 13 996 14 160 12 560 10 548 9 340 nfirmationNumber=6167410&linkSecurityString=19977aaa5c

LT Liab 20 277 20 226 20 574 20 841 19 103 Playback

Tot Curr Liab 5 136 6 221 5 192 4 778 10 244

Aplaybackwillbeavailable onehourafter theend of theconference

PER SHARE STATISTICS (cents per share) until 12 December 2024.

EPS (ZARc) 1 523.00 4 666.00 5 713.00 5 128.00 2 902.00

HEPS-C (ZARc) 1 528.00 4 681.00 6 016.00 4 660.00 2 837.00 Final results release date

Pct chng p.a. - 34.7 - 22.2 29.1 64.3 - 4.9 Annual financial results for the year ended 31 December 2024 will

Tr 5yr av grwth % - 16.1 77.2 60.8 78.6 be announced on or about 13 March 2025.

DPS (ZARc) 796.00 2 725.00 2 729.00 3 252.00 1 886.00 Monday, 30 September 2024: A presentation has been posted for

Pct chng p.a. - - 0.1 - 16.1 72.4 31.9 reference on the Exxaro website (www.exxaro.com) in relation to

Tr 5yr av grwth % - 24.0 35.0 46.2 78.4 the Governance Roadshow 2024 (30 September – 2 October 2024)

NAV PS (ZARc) 14 844.04 14 957.41 13 403.47 11 322.48 10 811.34

3 Yr Beta 0.63 0.65 0.94 0.92 0.92 to be conducted by Exxaro’s Chairman of the Board - Mr Geoffrey

Price High 20 608 23 173 23 998 19 753 14 865 Qhena, Chairman of the Remuneration Committee - Ms Phumla

Price Low 16 004 14 521 15 362 13 890 7 507 Mnganga and Chairman of the Risk and Business Resilience

Price Prd End 17 800 20 448 21 731 15 287 13 890 Committee - Mr Peet Snyders.

RATIOS Exxaro interim results June 2024 - Thursday, 15 August 2024: Revenue

Ret on SH Fnd 14.59 22.14 30.32 32.68 19.17 for the interim period grew to R19 billion (2023: R18.9 billion)

Ret On Tot Ass 13.38 19.91 27.05 22.85 13.47 whilst net operating profit dropped to R3.7 billion (2023: R6.3

Oper Pft Mgn 19.46 27.46 34.98 22.76 16.58 billion). Profit attributable to owners of the parent lowered to R3.7

D:E 0.32 0.33 0.36 0.44 0.53

Int Cover - 11.65 - 33.42 45.32 12.10 5.16 billion(2023: R5.9 billion). Inaddition, headline earnings per share

Current Ratio 4.96 4.29 4.20 2.60 0.88 came to 1 528 cents per share (2023: 2 443 cent per share).

Div Cover 1.91 1.71 2.09 1.58 1.54 Notice of interim cash dividend

NUMBER OF EMPLOYEES: 8500 At the Board of directors meeting on 13 August 2024, the directors

DIRECTORS: Fraser-MoleketiGJ(ld ind ne), approved a gross interim dividend of 796 cents per share.

IretonKM(ind ne), Magara B (ind ne), Company outlook

MalevuIN(ne), Mawasha B (ind ne),

Medupe N (ind ne), Mnganga Dr P (ind ne), Economic context

MntamboVZ(ne), Molope N (ind ne), Various headwinds to the anticipated global growth rates include

Msimang M (ne), NxumaloCJ(ind ne), financial conditions that will be less accommodative than expected

SnydersPCCH(ind ne), and geopolitical uncertainties. Global inflation is expected to

Qhena M G (Chair, ind ne),

Koppeschaar P A (Acting CEO and FD) Scan the QR code to continue its downward path, barring any significant supply shocks.

POSTAL ADDRESS:POBox9229, Pretoria,0001 visit our website As a result, policy interest rates are predicted to start declining,

EMAIL: investorrelations@exxaro.com affectingbothglobalinvestmentsentimentandeconomicactivity.

WEBSITE: www.exxaro.com South Africa’s real GDP contracted by 0.1% in 1Q24, after rising by

TELEPHONE: 012-307-5000 FAX: 012-323-3400 0.1% in 4Q23. An improvement in economic activity is expected in

COMPANY SECRETARY: M Nana response to easing infrastructure constraints, however, the growth

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. trajectory will be informed by uncertainty associated with South

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd. Africa’snewgovernmentofnationalunityandforeignexchangerate

AUDITORS: KPMG Inc.

BANKERS: Absa Bank Ltd. developments feeding through to inflation rate expectations which

will determine the scope for policy interest rate relief.

114