Page 69 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 69

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – ADC

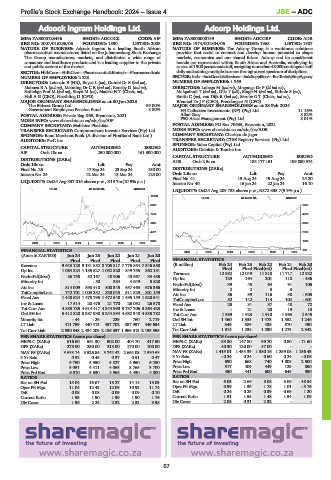

Adcock Ingram Holdings Ltd. Adcorp Holdings Ltd.

ADC ADC

ISIN: ZAE000123436 SHORT: ADCOCK CODE: AIP ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR

REG NO: 2007/016236/06 FOUNDED: 1890 LISTED: 2008 REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987

NATURE OF BUSINESS: Adcock Ingram is a leading South African NATURE OF BUSINESS: The Adcorp Group is a workforce solutions

pharmaceutical manufacturer, listed on the Johannesburg Stock Exchange. provider that seeks to connect and develop human potential to shape

The Group manufactures, markets, and distributes a wide range of markets, economies and our shared future. Adcorp and its constituent

consumer and healthcare products and is a leading supplier to the private brands are represented within South Africa and Australia, employing in

and public sectors of the market. excessof1 900 permanentstaff,assigning morethan48 000 contingentstaff

SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals dailyandtrainingmultiplelearnersthroughavastspectrumofdisciplines.

NUMBER OF EMPLOYEES: 2 223 SECTOR: Inds—IndsGoods&Services—IndsSupptServ—BusTrain&EmpAgency

DIRECTORS: Letsoalo B (HR), Boyce L (ne), Gumbi Dr S (ind ne), NUMBER OF EMPLOYEES: 1 959

MabuzaBA(ind ne), Manning DrCE(ind ne), Ransby D (ind ne), DIRECTORS: Lubega M (ind ne), Mnganga Dr P (ld ind ne),

Sathekge Prof M (ind ne), Steyn M (ne), Madisa N T (Chair, ne), Mokgabudi T (ind ne), Olls T (alt), Singh H (ind ne), Sithole S (ne),

Hall A G (CEO), Neethling D (CFO) Smith C (ne), van Dijk R (ind ne), Serobe G T (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 Wentzel Dr J P (CEO), Prendergast N (CFO)

The Bidvest Group Ltd. 59.00% MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2024

Government Employees Pension Fund 8.80% H4 Collective Investments (RF) (Pty) Ltd. 11.16%

POSTAL ADDRESS: Private Bag X69, Bryanston, 2021 Allan Gray 8.82%

MORE INFO: www.sharedata.co.za/sdo/jse/AIP PSG Asset Management (Pty) Ltd. 8.01%

COMPANY SECRETARY: Mahlatse Phalafala POSTAL ADDRESS: PO Box 70635, Bryanston, 2021

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ADR

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) COMPANY SECRETARY: Charissa de Jager

AUDITORS: PwC Inc. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SPONSOR: Valeo Capital (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Deloitte & Touche Inc.

AIP Ords 10c ea 250 000 000 161 300 000

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] ADR Ords 2.5c ea 183 177 151 109 880 974

Ords 10c ea Ldt Pay Amt

Final No 25 17 Sep 24 23 Sep 24 150.00 DISTRIBUTIONS [ZARc]

Interim No 24 12 Mar 24 18 Mar 24 125.00 Ords 2.5c ea Ldt Pay Amt

Final No 41 13 Aug 24 19 Aug 24 24.20

LIQUIDITY: Oct24 Avg 337 015 shares p.w., R19.7m(10.9% p.a.)

Interim No 40 16 Jan 24 22 Jan 24 16.10

PHAR 40 Week MA ADCOCK

LIQUIDITY: Oct24 Avg 209 733 shares p.w., R872 835.7(9.9% p.a.)

10783

SUPS 40 Week MA ADCORP

9268 6050

7752 4870

6237 3690

4721 2510

3206 1330

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 2019 | 2020 | 2021 | 2022 | 2023 | 2024 150

(Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final Final Final Final FINANCIAL STATISTICS

Revenue 9 643 128 9 131 852 8 705 817 7 776 854 7 346 558 (R million) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final(rst) Final Final(rst)

Op Inc 1 064 824 1 135 527 1 052 820 849 755 862 181

NetIntPd(Rcvd) 86 758 52 167 40 906 43 667 33 486 Turnover 12 982 12 049 11 318 11 717 12 922

129

- 486

118

Op Inc

164

201

Minority Int - - 50 384 4 649 5 828 NetIntPd(Rcvd) 39 45 64 91 106

Att Inc 814 009 898 410 800 345 657 463 676 366 Minority Int 2 2 3 3 -

TotCompIncLoss 742 701 1 003 232 830 043 511 829 801 159 Att Inc 86 39 116 38 - 605

Fixed Ass 1 448 624 1 475 795 1 472 548 1 495 159 1 528 541 TotCompIncLoss 52 142 114 102 - 601

Inv & Loans 17 514 20 476 21 770 26 092 26 570 Fixed Ass 25 31 37 48 72

Tot Curr Ass 4 885 785 4 614 417 4 344 990 3 737 706 3 864 423 Inv & Loans - 21 20 19 18

Ord SH Int 5 412 820 5 387 938 5 244 894 4 682 348 4 535 782 Tot Curr Ass 1 989 1 923 1 910 1 963 2 545

Minority Int - 44 - 26 229 760 2 719 Ord SH Int 1 460 1 535 1 473 1 352 1 246

LT Liab 411 759 440 413 457 702 387 997 449 654 LT Liab 349 389 438 870 490

Tot Curr Liab 2 530 348 2 434 209 2 186 337 1 969 313 2 193 595 Tot Curr Liab 1 314 1 238 1 290 1 273 2 342

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 616.60 561.30 502.00 404.70 417.50 HEPS-C (ZARc) 83.80 147.80 99.70 0.80 - 71.60

DPS (ZARc) 275.00 250.00 213.00 170.00 100.00 DPS (ZARc) 40.30 120.00 47.00 - -

NAV PS (ZARc) 3 688.14 3 526.86 3 242.42 2 664.08 2 580.68 NAV PS (ZARc) 1 419.01 1 484.39 1 380.16 1 259.08 1 156.43

3 Yr Beta 0.52 0.45 0.37 0.51 0.47 3 Yr Beta - 0.24 0.24 0.60 0.24 - 0.06

Price High 6 750 5 950 5 827 4 950 6 250 Price High 690 668 740 1 008 2 500

Price Low 5 051 4 411 4 065 3 765 3 700 Price Low 317 409 449 129 850

Price Prd End 6 010 5 630 4 966 4 430 4 800 Price Prd End 450 441 600 649 950

RATIOS RATIOS

Ret on SH Fnd 15.04 16.67 15.27 14.14 15.03 Ret on SH Fnd 6.03 2.66 8.08 3.06 - 48.54

Oper Pft Mgn 11.04 12.43 12.09 10.93 11.74 Oper Pft Mgn 0.99 1.36 1.78 1.01 - 3.76

D:E 0.08 0.08 0.09 0.09 0.10 D:E 0.24 0.25 0.39 0.69 1.20

Current Ratio 1.93 1.90 1.99 1.90 1.76 Current Ratio 1.51 1.55 1.48 1.54 1.09

Div Cover 1.96 2.25 2.32 2.33 3.98 Div Cover 2.08 0.31 2.32 - -

67