Page 67 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 67

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – ABS

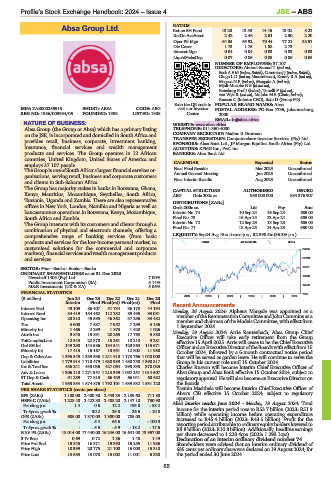

RATIOS

Absa Group Ltd. Ret on SH Fund 13.20 13.50 14.46 13.02 5.22

RetOn AveAsset 2.42 2.46 2.61 2.30 2.20

ABS

Oper Pft Mgn 64.35 65.92 70.44 77.21 38.57

Div Cover 1.73 1.75 1.88 2.73 -

Interest Mgn 0.04 0.04 0.03 0.03 0.03

LiquidFnds:Dep 0.07 0.06 0.05 0.06 0.06

NUMBER OF EMPLOYEES: 37 107

DIRECTORS: Abdool-Samad T (ind ne),

Beck A E M (ind ne, British), Cummins J J (ind ne, British),

Diogo L D (ind ne, Mozambican), Keanly R A (ind ne),

Mageza N P (ind ne), Mangale A (ind ne),

Mjoli-Mncube N S (ld ind ne),

Rensburg ProfI(ind ne), Tonelli F (ind ne),

van Wyk R (ind ne), Moloko M S (Chair, ind ne),

Russon C (Interim CEO), Raju D (Group FD)

Scan the QR code to POPULAR BRAND NAMES: Absa

ISIN: ZAE000255915 SHORT: ABSA CODE: ABG visit our Investor POSTAL ADDRESS: PO Box 7735, Johannesburg,

REG NO: 1986/003934/06 FOUNDED: 1986 LISTED: 1986 Centre 2000

EMAIL: ir@absa.africa

NATURE OF BUSINESS: WEBSITE: www.absa.africa

Absa Group (the Group or Absa) which has a primary listing TELEPHONE: 011-350-4000

on the JSE, is incorporated and domiciled in South Africa and COMPANY SECRETARY: Nadine R Drutman

provides retail, business, corporate, investment banking, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: Absa Bank Ltd., JP Morgan Equities South Africa (Pty) Ltd.

insurance, financial services and wealth management AUDITORS: KPMG Inc., PwC Inc.

products and services. The Group operates in 12 African BANKERS: Absa Bank Ltd.

countries, United Kingdom, United States of America and

employs 37 107 people. CALENDAR Expected Status

TheGroup isoneofSouthAfrica’slargestfinancialservicesor- Next Final Results Mar 2025 Unconfirmed

Jun 2025

ganisations, serving retail, business and corporate customers Annual General Meeting Aug 2025 Unconfirmed

Next Interim Results

Unconfirmed

and clients in Sub-Saharan Africa.

The Group has majority stakes in banks in Botswana, Ghana, CAPITAL STRUCTURE AUTHORISED ISSUED

Kenya, Mauritius, Mozambique, Seychelles, South Africa, ABG Ords 200c ea 950 000 000 894 376 907

Tanzania, Uganda and Zambia. There are also representative DISTRIBUTIONS [ZARc]

offices in New York, London, Namibia and Nigeria as well as Ords 200c ea Ldt Pay Amt

bancassurance operations in Botswana, Kenya, Mozambique, Interim No 74 10 Sep 24 16 Sep 24 685.00

South Africa and Zambia. Final No 73 16 Apr 24 22 Apr 24 685.00

The Group interacts with its customers and clients through a Interim No 72 12 Sep 23 18 Sep 23 685.00

combination of physical and electronic channels, offering a Final No 71 18 Apr 23 24 Apr 23 650.00

comprehensive range of banking services (from basic LIQUIDITY: Sep24 Avg 15m shares p.w., R2 390.5m(86.2% p.a.)

products and services for the low-income personal market, to BANK 40 Week MA ABSA

customised solutions for the commercial and corporate

24085

markets), financialservices and wealth managementproducts

and services. 20708

SECTOR: Fins—Banks—Banks—Banks 17331

ORDINARY SHAREHOLDERS as at 31 Dec 2023

Newshelf 1405 (Pty) Ltd. 7.00% 13953

Public Investment Corporation (SA) 5.14%

M&G Investments (UK & ZA) 5.06% 10576

FINANCIAL STATISTICS 7199

2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final(rst) Final(rst) Final

Interest Paid 49 109 86 407 51 734 36 173 44 194 Recent Announcements

Monday, 26 August 2024: AlpheusMangale wasappointedasa

Interest Rcvd 84 419 154 462 112 232 89 495 93 051 member of the Remuneration Committee and John Cummins as a

Operating Inc 23 310 45 585 46 362 37 296 33 482 member and chairman of the Models Committee, with effect from

Tax 3 600 7 687 7 952 7 299 3 156 1 September 2024.

Minority Int 1 466 2 299 1 873 1 420 1 026 Monday, 19 August 2024: Arrie Rautenbach, Absa Group Chief

Attrib Inc 9 845 19 891 20 265 17 763 5 880 ExecutiveOfficerwilltakeearly retirement from theGroup,

TotCompIncLoss 12 343 22 878 15 261 18 210 9 281 effective 15 April 2025. Arrie will cease to be the Chief Executive

Ord SH Int 149 298 144 586 134 541 129 863 115 671 Officer and anExecutiveDirector oftheBoards with effectfrom 15

Minority Int 17 415 15 167 13 951 12 802 11 988 October 2024, followed by a 6-month contractual notice period

Dep & OtherAcc 1 395 345 1 339 536 1 241 918 1 173 766 1 048 000 that will be served as garden leave. He will continue to serve the

Liabilities 1 779 914 1 710 479 1 638 939 1 488 758 1 398 817 Group in his current role until 15 October 2024.

Inv & Trad Sec 456 241 433 036 427 064 395 835 378 025 Charles Russon will become Interim Chief Executive Officer of

Adv & Loans 1 306 110 1 271 357 1 213 399 1 092 257 1 014 507 Absa Group and Absa Bank effective 15 October 2024, subject to

ST Dep & Cash 91 259 77 815 66 429 66 041 60 682 regulatory approval. He will also become an Executive Director on

Total Assets 1 953 354 1 874 876 1 792 101 1 639 532 1 531 120 the Boards.

Yasmin Masithela will become Interim Chief Executive Officer of

PER SHARE STATISTICS (cents per share)

Absa’s CIB effective 15 October 2024, subject to regulatory

EPS (ZARc) 1 188.00 2 400.30 2 443.33 2 139.60 711.80 approval.

HEPS-C (ZARc) 1 228.40 2 422.30 2 408.20 2 147.10 730.90 Absa interim results June 2024 - Monday, 19 August 2024: Total

Pct chng p.a. 1.4 0.6 12.2 193.8 - 58.2

Tr 5yr av grwth % - 30.2 29.8 26.6 - 10.8 income for the interim period rose to R53.7 billion (2023: R51.9

DPS (ZARc) 685.00 1 370.00 1 300.00 785.00 - billion) while operating income before operating expenditure

increased to R45.4 billion (2023: R43.6 billion). Profit for the

Pct chng p.a. - 5.4 65.6 - - 100.0 reportingperiodattributabletoordinaryequityholdersloweredto

Tr 5yr av grwth % - - 5.5 - 5.9 - 18.2 - 17.6 R9.8 billion (2023: R10.8 billion). Additionally, headline earnings

NAV PS (ZARc) 18 014.00 17 440.00 16 246.00 15 641.00 13 957.00 per share decreased to 1 228.4cps (2023: 1 293.1cps).

3 Yr Beta 0.69 0.72 1.36 1.48 1.49 Declaration of an interim ordinary dividend number 74

Price Prd End 15 845 16 371 19 390 15 255 11 986 Shareholders were advised that an interim ordinary dividend of

Price High 18 399 20 775 21 100 16 000 15 318 685 cents per ordinary share was declared on 19 August 2024, for

Price Low 13 683 15 070 15 002 11 001 6 330 the period ended 30 June 2024.

65