Page 74 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 74

JSE – AFR Profile’s Stock Exchange Handbook: 2024 – Issue 4

African Media Entertainment Ltd. African Rainbow Capital Investments

AFR Ltd.

ISIN: ZAE000055802 SHORT: AME CODE: AME

REG NO: 1926/008797/06 FOUNDED: 1997 LISTED: 1997 AFR

NATURE OF BUSINESS: AME is a broadcast company listed in the ISIN: MU0553S00000 SHORT: ARCINVEST CODE: AIL

“Media” sector of the JSE Ltd. REG NO: C148430 FOUNDED: 2015 LISTED: 2017

SECTOR: ConsDiscr—Media—Media—Radio and TV Broadcasters NATURE OF BUSINESS: African Rainbow Capital Investments Ltd. (ARC

NUMBER OF EMPLOYEES: 208 Investments/the Company/ARCI) is incorporated in the Republic of

Mauritius and holds a Global Business Licence under the Mauritian

DIRECTORS: da CostaMA(ind ne), Edwards J (ind ne), Fedder R (ne), Financial Services Act of 2007. It is regulated by the Mauritian Financial

NgobeseSN(ind ne), PrinslooMJ(ind ne), Qocha D (ind ne), Services Commission and is listed on the JSE Ltd. with a secondary listing

Williams-Thipe K (ind ne), MolusiACG (Chair, ind ne), on A2X. ARC Investments is an investment holding company and focuses

Isbister A J (FD), Tiltmann D (Group CEO) on being a broad-based, Black-controlled investment vehicle of significant

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 scale, offering shareholders the opportunity to indirectly invest in a

Moolman and Coburn Partnership 33.40% diversified portfolio of listed and unlisted investments.

John Biccard 9.30% SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

Trucha Ltd. 7.70%

POSTAL ADDRESS: PO Box 3014, Houghton, 2041 NUMBER OF EMPLOYEES: 0

MORE INFO: www.sharedata.co.za/sdo/jse/AME DIRECTORS: Algoo-Bissonauth S (ind ne), Currimjee A (ind ne),

Mokate DrRD(ind ne), Msipha C (ind ne, Zim), Nkadimeng R (ind ne),

COMPANY SECRETARY: Chrisna Roberts Olivier M C (Chair, ind ne, UK)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd. African Rainbow Capital (Pty) Ltd. 43.46%

AUDITORS: Mazars Public Investment Corporation (SOC) Ltd. 13.41%

UBI GP Co (Pty) Ltd. 5.86%

CAPITAL STRUCTURE AUTHORISED ISSUED

AME Ords 100c ea 15 000 000 6 949 917 MORE INFO: www.sharedata.co.za/sdo/jse/AIL

COMPANY SECRETARY: Intercontinental Trust Ltd.

DISTRIBUTIONS [ZARc] TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ords 100c ea Ldt Pay Amt SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

Final No 22 9 Jul 24 15 Jul 24 350.00 AUDITORS: PricewaterhouseCoopers Inc.

Interim No 21 11 Dec 23 18 Dec 23 100.00

CAPITAL STRUCTURE AUTHORISED ISSUED

LIQUIDITY: Oct24 Avg 10 650 shares p.w., R385 194.4(8.0% p.a.) AIL Ord shares no par val - 1 505 529 552

LIQUIDITY: Oct24 Avg 2m shares p.w., R9.1m(6.3% p.a.)

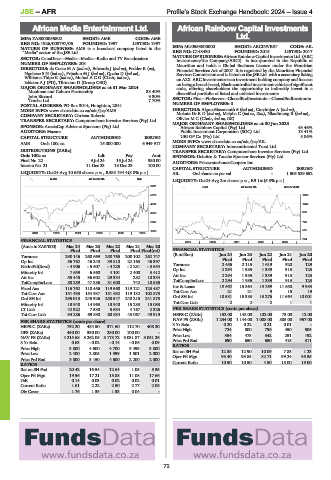

ALSH 40 Week MA AME

6531 EQII 40 Week MA ARCINVEST

5573 1490

4614 1243

3656 996

2697 748

1739 501

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS 2019 | 2020 | 2021 | 2022 | 2023 | 254

(Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final Final Final(rst) FINANCIAL STATISTICS

Turnover 290 146 268 669 250 765 200 102 262 747 (R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Op Inc 56 762 46 248 39 810 22 163 46 397 Final Final Final Final Final

Turnover 2 456 2 115 1 619 920 129

NetIntPd(Rcvd) - 4 906 - 5 607 - 4 225 - 2 281 - 3 654

Minority Int 7 659 6 560 4 101 2 400 3 412 Op Inc 2 294 1 985 1 339 913 123

2 294

123

913

Att Inc

1 339

1 985

Att Inc 55 445 36 602 29 334 282 10 334

1 339

913

2 294

1 985

123

TotCompIncLoss 88 259 47 886 31 600 742 10 585 TotCompIncLoss 18 562 15 364 13 269 11 650 9 983

Inv & Loans

Fixed Ass 116 762 118 456 119 560 119 121 123 487

Tot Curr Ass 151 433 154 937 151 682 119 132 102 873 Tot Curr Ass 21 21 9 15 19

Ord SH Int 295 013 245 926 250 547 240 215 241 873 Ord SH Int 18 581 2 15 383 2 13 276 2 11 664 1 10 001 1

Tot Curr Liab

Minority Int 13 948 14 963 13 948 15 283 15 083

LT Liab 42 922 7 530 5 634 4 167 2 325 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 94 286 69 890 60 634 43 067 49 919 HEPS-C (ZARc) 152.00 148.00 102.00 73.00 12.00

NAV PS (ZARc) 1 234.00 1 144.00 1 008.00 885.00 957.00

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 792.20 484.50 371.60 112.70 408.20 3 Yr Beta 0.20 0.22 0.21 0.01 505 -

800

450

724

Price High

796

DPS (ZARc) 450.00 350.00 280.00 100.00 -

NAV PS (ZARc) 4 215.68 3 262.05 3 178.72 3 031.87 3 051.26 Price Low 354 473 342 251 192

650

650

415

311

Price Prd End

690

3 Yr Beta 0.63 - 0.02 - 0.14 - 0.06 0.09

Price High 3 800 4 600 4 700 9 499 3 800 RATIOS

1.23

7.83

Price Low 2 400 2 805 1 999 1 501 2 000 Ret on SH Fnd 12.35 12.90 10.09 99.24 95.35

93.40

93.85

82.71

Oper Pft Mgn

Price Prd End 3 800 3 150 4 600 2 200 2 000

RATIOS Current Ratio 10.50 10.50 4.50 15.00 19.00

Ret on SH Fnd 20.42 16.54 12.64 1.05 5.35

Oper Pft Mgn 19.56 17.21 15.88 11.08 17.66

D:E 0.14 0.03 0.02 0.02 0.01

Current Ratio 1.61 2.22 2.50 2.77 2.06

Div Cover 1.76 1.39 1.33 0.04 -

72