Page 75 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 75

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – AFR

TELEPHONE: 011-779-1300

African Rainbow Minerals Ltd. COMPANY SECRETARY: Alyson D’Oyley

TRANSFER SECRETARY: Computershare Investor

AFR

Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: Deloitte, KPMG Inc.

BANKERS: ABSA Bank Ltd., FirstRand Bank Ltd.,

NedbankLtd.,StandardBankofSouthAfricaLtd.

Scan the QR code to

visit our website

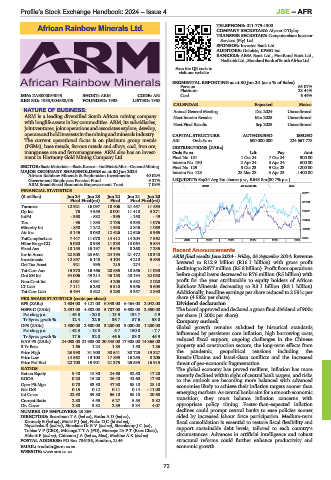

SEGMENTAL REPORTING as at 30 Jun 24 (asa%of Sales)

Ferrous 65.07%

Platinum 28.44%

ISIN: ZAE000054045 SHORT: ARM CODE: ARI Coal 6.49%

REG NO: 1933/004580/06 FOUNDED: 1933 LISTED: 1988

CALENDAR Expected Status

NATURE OF BUSINESS: Annual General Meeting Dec 2024 Unconfirmed

ARM is a leading diversified South African mining company Next Interim Results Mar 2025 Unconfirmed

with longlife assets in key commodities.ARM,its subsidiaries, Next Final Results Sep 2025 Unconfirmed

jointventures,jointoperationsandassociatesexplore,develop,

operateandholdinterestsintheminingandmineralsindustry. CAPITAL STRUCTURE AUTHORISED ISSUED

The current operational focus is on platinum group metals ARI Ords 5c ea 500 000 000 224 667 778

(PGMs), base metals, ferrous metals and alloys, coal, iron ore, DISTRIBUTIONS [ZARc]

manganese ore and ferromanganese. ARM also has an invest- Ords 5c ea Ldt Pay Amt

ment in Harmony Gold Mining Company Ltd. Final No 131 1 Oct 24 7 Oct 24 900.00

Interim No 130 2 Apr 24 8 Apr 24 600.00

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining Final No 129 3 Oct 23 9 Oct 23 1200.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Interim No 128 28 Mar 23 3 Apr 23 1400.00

African Rainbow Minerals & Exploration Investments 40.02%

Government Employees Pension Fund 9.27% LIQUIDITY: Sep24 Avg 3m shares p.w., R643.8m(80.7% p.a.)

ARM Broad-Based Economic Empowerment Trust 7.08% INDM 40 Week MA ARM

FINANCIAL STATISTICS

36711

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final Final(rst) Final Final Final(rst) 31299

Turnover 12 921 16 097 18 406 21 457 11 653

Op Inc 76 4 953 8 001 11 418 3 271 25887

IntPd - 868 - 582 - 395 - 158 - 49

20474

Tax - 96 1 833 2 736 3 333 1 076

Minority Int - 850 1 242 1 938 2 846 1 069 15062

Att Inc 3 146 8 080 12 426 12 626 3 965

TotCompIncLoss 7 447 11 070 14 412 14 204 7 562 9650

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Hline Erngs-CO 5 080 8 983 11 338 13 064 5 534

Fixed Ass 18 153 16 197 9 645 8 268 7 235 Recent Announcements

Inv in Assoc 22 808 23 661 24 193 21 472 18 340 ARM final results June 2024 - Friday, 06 September 2024: Revenue

Investments 12 857 6 148 4 104 4 210 5 635 lowered to R12.9 billion (R16.1 billion) with gross profit

Def Tax Asset 921 935 215 274 - declining to R877 million (R5.8 billion). Profit from operations

Tot Curr Ass 15 370 16 466 20 685 18 556 11 030

Ord SH Int 54 006 49 214 46 158 40 194 32 080 before capital items decreased to R76 million (R5 billion) with

Non-Cont Int 4 081 4 931 4 205 3 582 2 028 profit for the year attributable to equity holders of African

LT Liab 7 111 6 250 5 510 5 956 5 603 Rainbow Minerals decreasing to R3.1 billion (R8.1 billion).

Tot Curr Liab 5 494 3 622 3 298 3 357 2 890 Additionally, headline earnings per share reduced to 2 591c per

PER SHARE STATISTICS (cents per share) share (4 582c per share).

EPS (ZARc) 1 604.00 4 121.00 6 343.00 6 464.00 2 042.00 Dividend declaration

HEPS-C (ZARc) 2 591.00 4 582.00 5 787.00 6 688.00 2 850.00 The board approved and declared a gross final dividend of 900c

Pct chng p.a. - 43.5 - 20.8 - 13.5 134.7 4.9 per share (1 200c per share).

Tr 5yr av grwth % 12.4 22.6 36.7 87.6 53.0 Company outlook

DPS (ZARc) 1 500.00 2 600.00 3 200.00 3 000.00 1 200.00 Global growth remains subdued by historical standards,

Pct chng p.a. - 42.3 - 18.8 6.7 150.0 - 7.7 influenced by persistent core inflation, high borrowing costs,

Tr 5yr av grwth % 17.6 32.0 46.6 83.0 45.9

NAV PS (ZARc) 24 038.00 21 905.00 20 545.00 17 908.00 14 365.00 reduced fiscal support, ongoing challenges in the Chinese

3 Yr Beta 1.66 1.24 1.83 1.50 1.86 property and construction sectors, the long-term effects from

Price High 23 998 31 900 30 641 30 725 19 327 the pandemic, geopolitical tensions including the

Price Low 14 662 19 100 17 895 16 255 8 206 Russia-Ukraine and Israel-Gaza conflicts and the increased

Price Prd End 22 700 19 901 21 375 25 535 16 915 threat of geo-economic fragmentation.

RATIOS The global economy has proved resilient, inflation has more

Ret on Equity 9.40 18.30 24.60 32.50 17.20 recently declined within sight of central bank targets, and risks

ROOA 0.20 15.20 26.40 42.60 17.90 to the outlook are becoming more balanced with advanced

Oper Pft Mgn 0.70 33.80 47.30 58.10 28.10 economies likely to achieve their inflation targets sooner than

Net D:E 0.13 0.12 0.11 0.14 - 11.00 emerging markets. As central banks aim for a smooth economic

Int Cover 22.90 39.80 56.10 58.10 20.60

Current Ratio 2.80 4.55 6.27 5.53 3.82 transition, they must balance inflation concerns with

Div Cover 2.88 3.82 2.89 3.34 4.07 appropriate policy timing. Faster-than-expected inflation

NUMBER OF EMPLOYEES: 23 369 declines could prompt central banks to ease policies sooner,

DIRECTORS: BoardmanTA(ind ne), BothaAD(ind ne), aided by increased labour force participation. Medium-term

Kennedy B (ind ne), MnisiPJ(ne), NokoDC(ld ind ne), fiscal consolidation is essential to restore fiscal flexibility and

Nqwababa B (ind ne), Simelane DrRV(ind ne), SteenkampJC(ne), support sustainable debt levels, tailored to each country’s

Tobias V P (CEO), MhlangaTTA (FD), Motsepe Dr P T (Exec Chair),

Abbott F (ind ne), ChissanoJA(ind ne, Moz), MaditseAK(ind ne) circumstances. Advances in artificial intelligence and robust

POSTAL ADDRESS: PO Box 786136, Sandton, 2146 structural reforms could further enhance productivity and

EMAIL: ir.admin@arm.co.za economic growth.

WEBSITE: www.arm.co.za

73