Page 170 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 170

JSE – PSG Profile’s Stock Exchange Handbook: 2024 – Issue 4

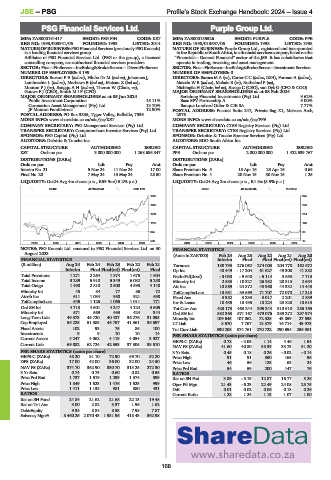

PSG Financial Services Ltd. Purple Group Ltd.

PSG PUR

ISIN: ZAE000191417 SHORT: PSG FIN CODE: KST ISIN: ZAE000185526 SHORT: PURPLE CODE: PPE

REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014 REG NO: 1998/013637/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS:PSG FinancialServices (previously PSG Konsult) NATURE OF BUSINESS: Purple Group Ltd., registered and incorporated

is a leading financial services group. inthe Republic ofSouth Africa, isafinancialservices companylistedonthe

Affiliates of PSG Financial Services Ltd. (PSG or the group), a licensed “Financials – General Financial” sector of the JSE. It has subsidiaries that

controlling company, are authorised financial services providers. operate in trading, investing and asset management.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services

NUMBER OF EMPLOYEES: 3 199 NUMBER OF EMPLOYEES: 0

DIRECTORS: BurtonPE(ind ne), Hlobo Dr M (ind ne), Johannes J, DIRECTORS: Barnes M A (ne), Carter C C (ind ne, USA), Forman A (ind ne),

Lambrechts L (ind ne), Mathews B (ind ne), Matsau Z (ind ne), Maisela W B (ind ne), Mohale B (ne), Rutheford P (ne),

MoutonPJ(ne), SangquAH(ind ne), Theron W (Chair, ne), Ntshingila H (Chair, ind ne), Savage C (CEO), van Dyk G (CFO & COO)

Gouws F J (CEO), SmithMIF (CFO) MAJOR ORDINARY SHAREHOLDERS as at 08 Feb 2024

MAJOR ORDINARY SHAREHOLDERS as at 05 Jun 2024 Serialong Financial Investments (Pty) Ltd. 9.62%

Public Investment Corporation 15.11% Base SPV Partnership A 9.00%

Coronation Asset Management (Pty) Ltd. 13.70% Banque Lombard Odier & CIE SA 7.77%

JF Mouton Familietrust 12.90% POSTAL ADDRESS: Postnet Suite 247, Private Bag X1, Melrose Arch,

POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536 2076

MORE INFO: www.sharedata.co.za/sdo/jse/KST MORE INFO: www.sharedata.co.za/sdo/jse/PPE

COMPANY SECRETARY: PSG Management Services (Pty) Ltd. COMPANY SECRETARY: CTSE Registry Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

KST Ords no par 3 000 000 000 1 268 686 847 PPE Ords no par 2 000 000 000 1 422 539 767

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt Ords no par Ldt Pay Amt

Interim No 21 5 Nov 24 11 Nov 24 17.00 Share Premium No 5 15 Apr 16 25 Apr 16 0.65

Final No 20 7 May 24 13 May 24 28.50 Share Premium No 4 20 Nov 15 30 Nov 15 1.25

LIQUIDITY: Oct24 Avg 4m shares p.w., R59.9m(15.2% p.a.) LIQUIDITY: Oct24 Avg 2m shares p.w., R1.8m(8.5% p.a.)

GENF 40 Week MA PSG FIN GENF 40 Week MA PURPLE

1903 345

1638 279

1374 214

1109 148

845 83

580 17

2019 | 2020 | 2021 | 2022 | 2023 | 2024 2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: PSG Konsult Ltd. renamed to PSG Financial Services Ltd. on 30 FINANCIAL STATISTICS

August 2023.

(Amts in ZAR’000) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

FINANCIAL STATISTICS Interim Final Final Final(rst) Final(rst)

(R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 Turnover 188 793 276 062 274 003 204 778 162 672

Interim Final Final(rst) Final(rst) Final Op Inc 40 449 - 17 204 61 627 49 308 41 882

Total Premiums 1 271 2 264 1 874 1 675 1 604 NetIntPd(Rcvd) - 3 030 - 9 640 - 5 114 3 553 7 713

Total Income 3 289 5 910 5 349 6 032 5 250 Minority Int 2 583 - 10 327 26 982 28 313 2 694

Total Outgo 1 490 2 810 2 500 4 598 4 140 Att Inc 10 869 - 24 872 43 968 44 332 14 443

Minority Int 45 84 77 86 72 TotCompIncLoss 13 681 - 33 669 71 707 72 070 17 213

Attrib Inc 611 1 034 950 921 698 Fixed Ass 3 352 3 233 3 017 2 201 2 839

TotCompIncLoss 645 1 125 1 065 1 011 771 Inv & Loans 18 435 18 435 18 224 23 828 18 613

Ord SH Int 4 713 4 601 4 247 4 124 3 605 Tot Curr Ass 423 173 463 244 305 244 310 610 256 165

Minority Int 571 569 493 424 344 Ord SH Int 582 363 571 167 479 076 389 272 297 974

Long-Term Liab 49 373 45 720 40 427 36 276 31 095 Minority Int 109 645 107 062 72 325 43 859 27 535

Cap Employed 55 225 51 385 45 757 41 361 35 697 LT Liab 8 670 7 767 18 879 16 714 43 973

Fixed Assets 102 93 75 86 100 Tot Curr Liab 330 208 374 761 270 722 290 694 255 981

Investments 9 9 10 10 14 PER SHARE STATISTICS (cents per share)

Current Assets 4 247 4 062 4 119 4 054 3 927 HEPS-C (ZARc) 0.78 - 2.05 1.14 4.46 1.54

Current Liab 69 082 62 724 42 353 37 305 38 510

NAV PS (ZARc) 41.60 40.80 38.39 33.73 31.20

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.45 0.18 0.26 - 0.02 - 0.14

HEPS-C (ZARc) 48.20 81.10 72.90 69.70 52.20 Price High 91 91 350 165 96

DPS (ZARc) 17.00 42.00 36.00 32.00 24.50 Price Low 46 56 125 63 24

NAV PS (ZARc) 374.70 362.90 330.70 313.25 272.30 Price Prd End 54 59 200 147 76

3 Yr Beta 0.74 0.73 0.60 0.82 0.55 RATIOS

Price Prd End 1 737 1 519 1 299 1 374 899 Ret on SH Fnd 3.89 - 5.19 12.87 16.77 5.26

Price High 1 849 1 623 1 476 1 523 999 Oper Pft Mgn 21.43 - 6.23 22.49 24.08 25.75

Price Low 1 411 1 138 981 880 431 D:E 0.01 0.02 0.06 0.13 0.26

RATIOS Current Ratio 1.28 1.24 1.13 1.07 1.00

Ret on SH Fund 24.84 21.62 21.68 22.13 19.48

Ret on Tot Ass 3.00 2.82 3.37 1.96 1.62

Debt:Equity 9.34 8.84 8.53 7.98 7.87

Solvency Mgn% 8 460.25 2 070.43 1 931.96 418.43 362.98

168