Page 168 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 168

JSE – PRE Profile’s Stock Exchange Handbook: 2024 – Issue 4

Premier Group Ltd. Primary Health Properties plc

PRE PRI

ISIN: ZAE000320321 SHORT: PREMIER CODE: PMR ISIN: GB00BYRJ5J14 SHORT: PHP CODE: PHP

REG NO: 2007/016008/06 FOUNDED: 2007 LISTED: 2023 REG NO: 3033634 FOUNDED: 1995 LISTED: 2023

NATURE OF BUSINESS: Premier is a leading South African JSE-listed NATURE OF BUSINESS: PHP invests in flexible, modern properties for

consumer packaged goods (CPG) company, with a proud history dating localprimaryhealthcare, letonlongtermleaseswithapropertyportfolioof

back 200 years. 513 assets in the UK and Ireland valued at GBP2.8 billion.

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products SECTOR: RealEstate—RealEstate—REITS—Health

NUMBER OF EMPLOYEES: 8 600 NUMBER OF EMPLOYEES: 65

DIRECTORS: FerreiraDD(ind ne), KhanyileFN(ld ind ne), Matthews J DIRECTORS: Cantú I (ind ne), Duhot L (ind ne), KriegerIS(snr ind ne),

(ind ne), Ramsumer H (ind ne), Sihlobo W (ind ne), Rawal Dr B (ind ne), Hyman H (Chair, ne), Davies M (CEO),

van Heerden I (Chair, ne), Gertenbach J J (CEO), Grobbelaar F (CFO) Howell R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 22 Aug 2024 MAJOR ORDINARY SHAREHOLDERS as at 02 Feb 2024

Titan Premier Investments (Pty) Ltd. 45.60% BlackRock 8.55%

Brait Mauritius Ltd. 22.60% Hargreaves Lansdown Asset Management 5.47%

Allan Gray 10.85% SSGA 5.13%

POSTAL ADDRESS: Private Bag X2127, Isando, Johannesburg, 1600 MORE INFO: www.sharedata.co.za/sdo/jse/PHP

MORE INFO: www.sharedata.co.za/sdo/jse/PMR COMPANY SECRETARY: Toby Newman

COMPANY SECRETARY: Bronwyn Baker TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: PSG Capital (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) AUDITORS: Deloitte LLP

AUDITORS: PwC Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED PHP Ords GBP12.5 ea - 1 336 493 786

PMR Ords no par 200 000 000 128 905 800 DISTRIBUTIONS [GBPp]

DISTRIBUTIONS [ZARc] Ords GBP12.5 ea Ldt Pay Amt

Ords no par Ldt Pay Amt Quarterly No 4 8 Oct 24 22 Nov 24 1.73

Final No 1 30 Jul 24 5 Aug 24 220.00 Quarterly No 3 2 Jul 24 16 Aug 24 1.73

Ords no par Ldt Pay Amt LIQUIDITY: Oct24 Avg 540 546 shares p.w., R12.3m(2.1% p.a.)

Final No 1 30 Jul 24 5 Aug 24 220.00

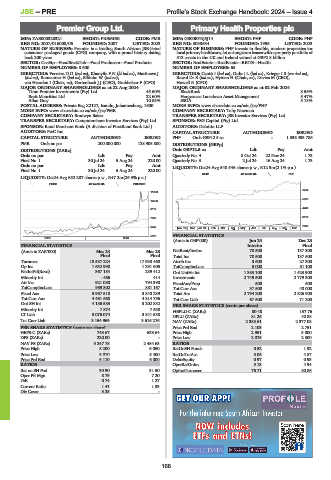

REIV 40 Week MA PHP

LIQUIDITY: Oct24 Avg 652 287 shares p.w., R47.2m(26.3% p.a.)

FOOD 40 Week MA PREMIER

6412

11900

5329

10536

9172 4246

3163

7808

6443 2080

|Nov 23 | Dec |Jan 24 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct |

5079 FINANCIAL STATISTICS

2023 | 2024

(Amts in GBP’000) Jun 24 Dec 23

FINANCIAL STATISTICS Interim Final

(Amts in ZAR’000) Mar 24 Mar 23 NetRent/InvInc 70 500 137 300

Final Final Total Inc 70 500 137 500

Turnover 18 587 224 17 938 460 Attrib Inc 3 600 27 300

Op Inc 1 632 990 1 291 605 TotCompIncLoss 5 000 31 100

NetIntPd(Rcvd) 367 184 289 412 Ord UntHs Int 1 383 100 1 423 900

Minority Int - 466 414 Investments 2 749 500 2 779 300

Att Inc 921 080 794 390 FixedAss/Prop 500 500

TotCompIncLoss 959 302 881 167 Tot Curr Ass 37 500 40 000

Fixed Ass 3 967 510 3 840 239 Total Ass 2 794 200 2 826 900

Tot Curr Ass 4 461 668 4 814 756 Tot Curr Liab 67 500 71 200

Ord SH Int 4 186 583 3 202 832 PER SHARE STATISTICS (cents per share)

Minority Int 7 874 7 538 HEPLU-C (ZARc) 80.48 137.76

LT Liab 3 076 074 3 841 538 DPLU (ZARc) 81.26 40.88

Tot Curr Liab 3 154 969 3 616 276 NAV (ZARc) 2 383.61 2 377.08

PER SHARE STATISTICS (cents per share) Price Prd End 2 103 2 751

HEPS-C (ZARc) 743.67 633.64 Price High 2 951 5 000

DPS (ZARc) 220.00 - Price Low 2 075 2 300

NAV PS (ZARc) 3 247.78 2 484.63 RATIOS

Price High 8 200 6 050 RetOnSH Funds 0.52 1.92

Price Low 5 010 5 400 RetOnTotAss 5.06 4.87

Price Prd End 6 110 6 000 Debt:Equity 0.97 0.93

RATIOS OperRetOnInv 5.13 4.94

Ret on SH Fnd 30.90 31.50 OpInc:Turnover 76.71 80.86

Oper Pft Mgn 8.79 7.20

D:E 0.74 1.27

Current Ratio 1.41 1.33

Div Cover 3.25 -

166