Page 167 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 167

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – POW

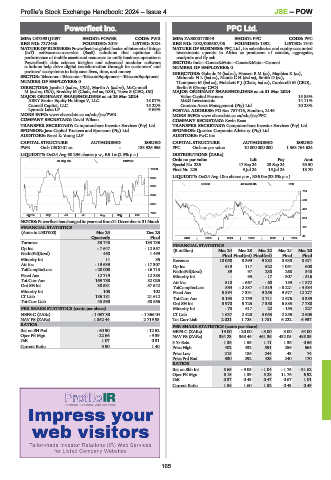

Powerfleet Inc. PPC Ltd.

POW PPC

ISIN: US73931J1097 SHORT: POWER CODE: PWR ISIN: ZAE000170049 SHORT: PPC CODE: PPC

REG NO: 7272486 FOUNDED: 2019 LISTED: 2024 REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910

NATURE OF BUSINESS: Powerfleet is a global leader of internet of things NATURE OF BUSINESS: PPC Ltd., its subsidiaries and equity-accounted

(IoT) software-as-a-service (SaaS) solutions that optimize the investments operate in Africa as producers of cement, aggregates,

performance of mobile assets and resources to unify business operations. readymix and fly ash.

Powerfleet’s data science insights and advanced modular software SECTOR: Inds—Constr&Mats—Constr&Mats—Cement

solutions help drive digital transformation through its customers’ and NUMBER OF EMPLOYEES: 0

partners’ ecosystems to help save lives, time, and money. DIRECTORS: Gobodo N (ind ne), HansenBM(ne), Maphisa K (ne),

SECTOR: Telecoms—Telecoms—TelecomEquipment—TelecomEquipment MkhondoNL(ind ne), NaudeCH(ind ne), Smith D (ne),

NUMBER OF EMPLOYEES: 0 Thompson M (ind ne), Moleketi P J (Chair, ind ne), Cardarelli M (CEO),

DIRECTORS: Jacobs I (ind ne, USA), Martin A (ind ne), McConnell Berlin B (Group CFO)

M(ind ne, USA), Brodsky M (Chair, ind ne, USA), Towe S (CEO, UK) MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024

MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2024 Value Capital Partners 15.85%

ABRY Senior Equity Holdings V, LLC 18.07% M&G Investments 14.11%

Cannell Capital, LLC 15.22% Camissa Asset Management (Pty) Ltd. 10.28%

Lynrock Lake LP 9.69% POSTAL ADDRESS: PO Box 787416, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/PWR MORE INFO: www.sharedata.co.za/sdo/jse/PPC

COMPANY SECRETARY: David Wilson COMPANY SECRETARY: Kevin Ross

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: Ernst & Young LLP AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED CAPITAL STRUCTURE AUTHORISED ISSUED

PWR Ords USD0.01 ea - 133 926 955 PPC Ords no par value 10 000 000 000 1 553 764 624

LIQUIDITY: Oct24 Avg 60 296 shares p.w., R5.1m(2.3% p.a.) DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

80 Day MA POWER

Special No 226 17 Sep 24 23 Sep 24 33.50

10100

Final No 225 9 Jul 24 15 Jul 24 13.70

9580 LIQUIDITY: Oct24 Avg 10m shares p.w., R36.0m(33.0% p.a.)

CONM 40 Week MA PPC

9060

714

8540

580

8020

447

7500

Apr 24 | May | Jun | Jul | Aug | Sep | Oct |

314

NOTES:Powerfleethaschangeditsyearendfrom31December to31March.

FINANCIAL STATISTICS 181

(Amts in USD’000) Mar 24 Dec 23

Quarterly Final 2019 | 2020 | 2021 | 2022 | 2023 | 2024 48

Turnover 33 740 133 736 FINANCIAL STATISTICS

Op Inc - 7 647 - 12 557 (R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

NetIntPd(Rcvd) 450 1 499 Final Final(rst) Final(rst) Final Final

Minority Int 11 35 Revenue 10 058 8 399 9 882 8 938 8 671

AttInc -19639 -17307 Op Inc 619 117 522 1 051 600

TotCompIncLoss - 20 008 - 16 713 NetIntPd(Rcvd) 89 97 230 268 340

Fixed Ass 12 719 12 383 Minority Int - 93 - 17 - 307 - 516

Tot Curr Ass 169 788 82 025

Att Inc 510 - 667 - 60 189 - 1 872

Ord SH Int 38 531 57 542 TotCompIncLoss 554 - 2 887 - 1 519 - 3 221 - 4 534

Minority Int 105 102 Fixed Ass 5 894 7 331 9 255 9 577 12 277

LT Liab 136 181 21 612 Tot Curr Ass 3 193 2 759 2 711 2 676 3 389

Tot Curr Liab 43 590 58 556 Ord SH Int 5 970 5 725 7 350 6 883 7 780

PER SHARE STATISTICS (cents per share) Minority Int - 73 617 22 - 153 - 227

HEPS-C (ZARc) - 1 037.30 - 1 366.04 LT Liab 1 637 2 420 3 053 2 855 2 603

NAV PS (ZARc) 1 852.44 2 719.93 Tot Curr Liab 2 021 1 725 1 781 6 222 6 937

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH Fnd - 60.90 - 12.52 HEPS-C (ZARc) 19.00 - 20.00 - 3.00 3.00 54.00

Oper Pft Mgn - 22.66 - 9.39 NAV PS (ZARc) 384.23 368.46 461.36 432.05 488.35

D:E 1.07 0.31 3 Yr Beta 1.36 1.55 1.11 1.36 0.56

Current Ratio 3.90 1.40 Price High 402 432 591 256 564

Price Low 215 186 244 43 74

Price Prd End 330 292 425 240 170

RATIOS

Ret on Shh Int 8.65 - 9.05 - 1.04 - 1.75 - 31.62

Oper Pft Mgn 6.15 1.39 5.28 11.76 6.92

D:E 0.37 0.43 0.47 0.67 1.01

Current Ratio 1.58 1.60 1.52 0.43 0.49

165