Page 139 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 139

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – KUM

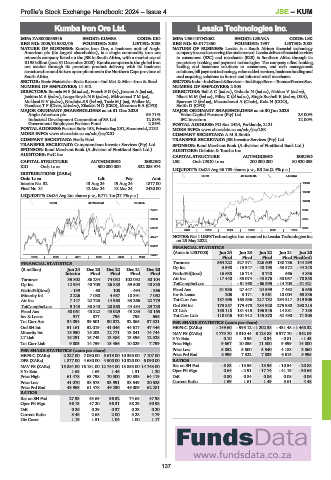

Kumba Iron Ore Ltd. Lesaka Technologies Inc.

KUM LES

ISIN: ZAE000085346 SHORT: KUMBA CODE: KIO ISIN: US64107N2062 SHORT: LESAKA CODE: LSK

REG NO: 2005/015852/06 FOUNDED: 2005 LISTED: 2006 REG NO: 98-0171860 FOUNDED: 1997 LISTED: 2008

NATURE OF BUSINESS: Kumba Iron Ore, a business unit of Anglo NATURE OF BUSINESS: Lesaka is a South African financial technology

American plc (its largest shareholder), is a single commodity iron ore companyfocusedonservingtheunderserved.Lesakadeliversfinancialservices

minerals company listed on the JSE in South Africa, with a market cap of to consumers (B2C) and merchants (B2B) in Southern Africa through its

R198 billion (as at 31 December 2023). Kumba competes in the global iron proprietary banking and payment technologies. The company offers banking,

ore market through its premium product delivery, with its business lending and insurance solutions to consumers, and cash management

structured around its two open-pit mines in the Northern Cape province of solutions, bill payment technology, value-added services, business funding and

South Africa. card acquiring solutions to formal and informal retail merchants.

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel SECTOR:Inds—IndsGoods&Services—IndsSupptServ—TransactProcessServ

NUMBER OF EMPLOYEES: 11 612 NUMBER OF EMPLOYEES: 2 303

DIRECTORS: Bomela M S (ld ind ne), French S G (ne), Jeawon A (ind ne), DIRECTORS: BallAC(ind ne), Gobodo N (ind ne), Naidoo V (ind ne),

Jenkins M A (ind ne), Langa-Royds N B (ind ne), Mkhwanazi T M (ne), NkosiMM(ind ne), Pillay K (ld ind ne), Singh-Bushell E (ind ne, USA),

Mokhesi N V (ind ne), NtsalubaSS(ind ne), Tsele M J (ne), Walker M, Sparrow D (ind ne), Mazanderani A (Chair), Kola N (COO),

Goodlace T P (Chair, ld ind ne), Zikalala N D (CEO), Mazarura B A (CFO) Smith D (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

Anglo American plc 69.71% Value Capital Partners (Pty) Ltd. 25.00%

Industrial Development Corporation of SA Ltd. 12.88% IFC Investors 12.00%

Government Employees Pension Fund 2.86% POSTAL ADDRESS: PO Box 2424, Parklands, 2121

POSTAL ADDRESS:PostnetSuite153, PrivateBagX31,Saxonwold,2132 MORE INFO: www.sharedata.co.za/sdo/jse/LSK

MORE INFO: www.sharedata.co.za/sdo/jse/KIO COMPANY SECRETARY: A M R Smith

COMPANY SECRETARY: Fazila Patel TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) AUDITORS: Deloitte & Touche Inc.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED LSK Ords USD0.1c ea 200 000 000 80 520 053

KIO Ords 1c ea 500 000 000 322 085 974

LIQUIDITY: Oct24 Avg 36 709 shares p.w., R3.2m(2.4% p.a.)

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt SUPS 40 Week MA LESAKA

Interim No 32 13 Aug 24 19 Aug 24 1877.00 18826

Final No 31 12 Mar 24 18 Mar 24 2420.00

15833

LIQUIDITY: Oct24 Avg 2m shares p.w., R771.1m(27.7% p.a.)

12840

INDM 40 Week MA KUMBA

77921 9846

66806 6853

55692 3860

2019 | 2020 | 2021 | 2022 | 2023 | 2024

44577 NOTES: Net 1 UEPS Technologies Inc. renamed to Lesaka Technologies Inc.

on 25 May 2022.

33462

FINANCIAL STATISTICS

(Amts in USD’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

22347

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Final Final Final Final Final(rst)

Turnover 564 222 527 971 226 609 130 786 144 299

FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Op Inc 3 590 - 15 347 - 40 195 - 53 872 - 44 248

Interim Final Final Final Final NetIntPd(Rcvd) 16 638 16 714 3 740 566 4 836

Turnover 35 802 86 234 74 032 102 092 80 104 Att Inc - 17 440 - 35 074 - 43 876 - 38 057 - 78 358

Op Inc 12 934 40 705 26 880 59 508 40 838 TotCompIncLoss - - 61 960 - 66 995 - 14 703 - 51 621

NetIntPd(Rcvd) - 139 - 68 108 - 494 - 366 Fixed Ass 31 936 27 447 24 599 7 492 6 656

Minority Int 2 226 7 080 4 687 10 391 7 062 Inv & Loans 206 3 171 5 861 10 004 65 836

Att Inc 7 147 22 725 14 968 33 266 22 779 Tot Curr Ass 187 696 163 636 217 732 294 317 319 306

TotCompIncLoss 9 143 30 840 20 368 44 484 29 730 Ord SH Int 175 857 179 478 234 920 275 980 290 213

Fixed Ass 50 061 48 822 43 029 43 233 40 165 LT Liab 185 118 181 415 196 346 14 881 7 183

Inv & Loans 917 877 796 795 656 Tot Curr Liab 118 046 101 912 145 870 52 490 71 303

Tot Curr Ass 34 094 39 501 30 872 32 865 37 321 PER SHARE STATISTICS (cents per share)

Ord SH Int 51 161 52 019 41 046 44 617 47 446 HEPS-C (ZARc) - 149.60 - 995.12 - 1 202.38 - 431.48 - 1 468.32

Minority Int 15 950 16 203 12 771 13 841 14 744 NAV PS (ZARc) 4 779.70 5 310.44 6 128.88 6 977.70 - 342.09

LT Liab 16 291 15 743 13 386 13 396 12 528 3 Yr Beta 0.10 0.96 0.34 - 0.81 - 1.43

Tot Curr Liab 9 803 14 759 15 456 10 029 7 799 Price High 9 667 10 055 11 500 9 399 14 800

PER SHARE STATISTICS (cents per share) Price Low 5 852 5 500 5 540 4 188 3 860

HEPS-C (ZARc) 2 227.00 7 080.00 5 619.00 10 365.00 7 107.00 Price Prd End 8 999 7 322 7 839 6 615 5 995

DPS (ZARc) 1 877.00 4 680.00 4 500.00 10 320.00 6 090.00 RATIOS

NAV PS (ZARc) 15 884.00 16 151.00 12 744.00 13 853.00 14 743.00 Ret on SH Fnd - 6.83 - 13.55 - 13.96 - 10.54 - 20.88

3 Yr Beta 1.63 1.63 1.46 1.31 1.20 Oper Pft Mgn 0.64 - 2.91 - 17.74 - 41.19 - 30.66

Price High 61 478 63 798 70 500 80 338 64 119 D:E 0.80 0.84 0.86 0.08 0.06

Price Low 41 070 38 575 33 991 38 549 20 525 Current Ratio 1.59 1.61 1.49 5.61 4.48

Price Prd End 43 963 61 478 49 230 46 009 62 281

RATIOS

Ret on SH Fnd 27.93 43.69 36.52 74.68 47.98

Oper Pft Mgn 36.13 47.20 36.31 58.29 50.98

D:E 0.26 0.29 0.37 0.23 0.20

Current Ratio 3.48 2.68 2.00 3.28 4.79

Div Cover 1.19 1.51 1.04 1.00 1.17

137