Page 138 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 138

JSE – KIB Profile’s Stock Exchange Handbook: 2024 – Issue 4

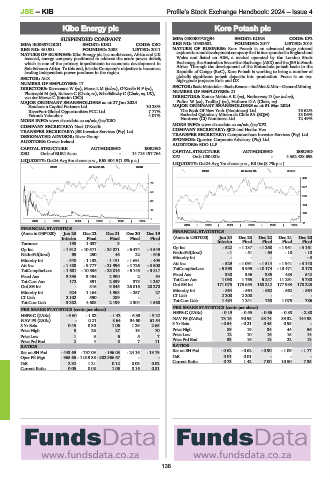

Kibo Energy plc Kore Potash plc

KIB KOR

SUSPENDED COMPANY ISIN: GB00BYP2QJ94 SHORT: KORE CODE: KP2

ISIN: IE00B97C0C31 SHORT: KIBO CODE: KBO REG NO: 10933682 FOUNDED: 2017 LISTED: 2018

REG NO: 451931 FOUNDED: 2008 LISTED: 2011 NATURE OF BUSINESS: Kore Potash is an advanced stage mineral

NATURE OF BUSINESS: Kibo Energy plc is a multi-asset, Africa and UK explorationanddevelopmentcompany that is incorporated in Englandand

focused, energy company positioned to address the acute power deficit, Wales and listed on AIM, a market operated by the London Stock

which is one of the primary impediments to economic development in Exchange, the Australian Securities Exchange (ASX) and the JSE in South

Sub-Saharan Africa. To this end, it is the Company’s objective to become a Africa. Through the development of the Sintoukola potash basin in the

leading independent power producer in the region. Republic of Congo (RoC), Kore Potash is working to bring a number of

SECTOR: AltX globally significant potash deposits into production. Focus is on two

NUMBER OF EMPLOYEES: 17 high-grade projects: Kola and DX.

DIRECTORS: Kerremans W (ne), Maree L M (ind ne), O’Keeffe N F (ne), SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

Phumaphi M (ne), Roberts C (Chair, ne), Schaffalitzky C (Chair, ne, UK), NUMBER OF EMPLOYEES: 21

van der Merwe C (Interim CEO) DIRECTORS: Kumar MehtaAK(ne), Netherway D (snr ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 27 Jun 2024 Pulinx W (ne), Trollip J (ne), Hathorn D A (Chair, ne)

Sanderson Capital Partners Ltd. 10.28% MAJOR ORDINARY SHAREHOLDERS as at 01 Mar 2024

RiverFort Global Opportunities PCC Ltd. 7.77% The Bank Of New York (Nominees) Ltd. 16.62%

Yakoub Yakoubov 4.07% Sociedad Quimica y Minera de Chile SA (SQM) 13.06%

MORE INFO: www.sharedata.co.za/sdo/jse/KBO Huntress (CI) Nominees Ltd. 12.49%

COMPANY SECRETARY: Noel O’Keeffe MORE INFO: www.sharedata.co.za/sdo/jse/KP2

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: SJCS and Henko Vos

DESIGNATED ADVISOR: River Group TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Crowe Ireland SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: BDO LLP

CAPITAL STRUCTURE AUTHORISED ISSUED

KBO Ords of EUR1.5c ea - 14 715 197 764 CAPITAL STRUCTURE AUTHORISED ISSUED

KP2 Ords US0.001c - 4 352 428 693

LIQUIDITY: Oct24 Avg 5m shares p.w., R53 304.9(1.8% p.a.)

LIQUIDITY: Oct24 Avg 7m shares p.w., R3.0m(8.7% p.a.)

INDM 40 Week MA KIBO

INDM 40 Week MA KORE

469

75

377

56

286

38

194

19

103

1

2019 | 2020 | 2021 | 2022 | 2023 | 2024 11

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

(Amts in GBP’000) Jun 23 Dec 22 Dec 21 Dec 20 Dec 19 FINANCIAL STATISTICS

Interim Final Final Final Final (Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Turnover 198 1 037 3 - - Interim Final Final Final Final

Op Inc - 1 912 - 10 571 - 24 071 - 6 474 - 4 549 Op Inc - 522 - 1 137 - 1 268 - 1 951 - 3 161

NetIntPd(Rcvd) 69 250 46 22 - 646 NetIntPd(Rcvd) - 1 - 51 - 63 - 10 - 10

Minority Int - 340 - 1 132 - 1 151 - 1 691 - 403 Minority Int - - - - - 3

Att Inc - 1 488 - 9 777 - 21 996 - 4 726 - 3 500 Att Inc - 529 - 1 091 - 1 514 - 1 941 - 3 140

TotCompIncLoss - 1 681 - 10 536 - 23 016 - 6 143 - 3 817 TotCompIncLoss - 5 393 3 955 - 10 174 - 13 471 8 178

Fixed Ass 3 396 3 494 2 900 2 64 Fixed Ass 330 356 385 483 542

Tot Curr Ass 172 391 2 339 373 1 267 Tot Curr Ass 1 090 1 765 5 247 11 291 5 780

Ord SH Int - 316 9 845 26 816 28 270 Ord SH Int 171 075 175 653 168 212 177 983 178 225

Minority Int 824 1 164 1 963 - 257 27 Minority Int - 564 - 564 - 562 - 562 - 564

LT Liab 2 102 590 289 - - LT Liab 2 200 2 200 - - -

Tot Curr Liab 3 382 4 608 2 199 2 304 1 560 Tot Curr Liab 1 484 1 241 750 1 075 786

PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 3.60 - 1.82 - 1.42 - 6.33 - 9.22 HEPS-C (ZARc) - 0.19 - 0.55 - 0.66 - 0.88 - 2.80

NAV PS (ZARc) - 0.21 8.64 34.60 61.54 NAV PS (ZARc) 73.16 90.95 83.74 89.32 144.93

3 Yr Beta 0.45 0.30 1.06 1.29 2.65 3 Yr Beta - 0.54 - 0.21 0.45 0.95 -

Price High 5 26 27 19 70 Price High 89 19 34 44 56

Price Low 1 3 6 5 7 Price Low 12 10 16 15 14

Price Prd End 33 16 18 22 18

Price Prd End 2 4 8 7 11

RATIOS RATIOS

Ret on SH Fnd - 443.69 - 737.09 - 196.03 - 24.16 - 13.79 Ret on SH Fnd - 0.62 - 0.62 - 0.90 - 1.09 - 1.77

Oper Pft Mgn - 965.66 - 1 019.38 - 802 366.67 - - D:E 0.01 0.01 - - -

D:E 2.92 1.21 0.12 0.03 0.02 Current Ratio 0.73 1.42 7.00 10.50 7.35

Current Ratio 0.05 0.08 1.06 0.16 0.81

136