Page 134 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 134

JSE – INV Profile’s Stock Exchange Handbook: 2024 – Issue 4

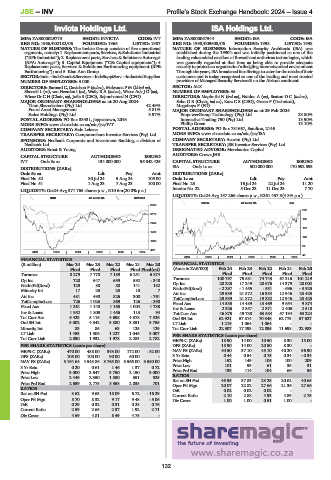

Invicta Holdings Ltd. ISA Holdings Ltd.

INV ISA

ISIN: ZAE000029773 SHORT: INVICTA CODE: IVT ISIN: ZAE000067344 SHORT: ISA CODE: ISA

REG NO: 1966/002182/06 FOUNDED: 1966 LISTED: 1987 REG NO: 1998/009608/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: The Invicta Group consists of five operational NATURE OF BUSINESS: Information Security Architects (ISA) was

segments, namely: 1. Replacement parts, Services, & Solutions: Industrial established during the 1990’s and was initially positioned as one of the

(“RPI: Industrial”); 2. Replacement parts, Services & Solutions: Auto-agri leading value-added resellers of firewall and anti-virus technologies, which

(RPA: Auto-agri”); 3. Capital Equipment (“CE: Capital equipment”); 4. was generally regarded at that time as being able to provide adequate

Replacement parts, Services & Solutions: Earthmoving equipment (RPE: security to protect an organisation’s fledgling internetworked environment.

Earthmoving”); and 5. Kian Ann Group. Through the years, ISA broadened its offerings to cater for the needs of their

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies customers and is today recognised as one of the leading and most trusted

NUMBER OF EMPLOYEES: 3 000 providers of Managed Security Services® on the African continent.

DIRECTORS: Barnard C, Davidson F (ind ne), Makwana P M (ld ind ne), SECTOR: AltX

Sherrell L (ne), van Heerden I (ne), Wally R A (ind ne), Wiese Adv J D (ne), NUMBER OF EMPLOYEES: 36

Wiese Dr C H (Chair, ne), Joffe S (CEO), Rajmohamed N (CFO) DIRECTORS: Maphothi N (ind ne), Naidoo A (ne), SeatonDC(ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2024 Seku O B (Chair, ind ne), Katz C S (CEO), Green P (Technical),

Titan Sharedealers (Pty) Ltd. 42.49% Mogoboya P (FD)

Foord Asset Management 5.81% MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Sades Holdings (Pty) Ltd. 3.97% EmpowerGroup Technology (Pty) Ltd. 23.80%

POSTAL ADDRESS: PO Box 33431, Jeppestown, 2043 Interactive Trading 750 (Pty) Ltd. 13.90%

MORE INFO: www.sharedata.co.za/sdo/jse/IVT Phillip Green 13.10%

COMPANY SECRETARY: Sade Lekena POSTAL ADDRESS: PO Box 781667, Sandton, 2146

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ISA

SPONSORS: Nedbank Corporate and Investment Banking, a division of COMPANY SECRETARY: Acorim (Pty) Ltd.

Nedbank Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young DESIGNATED ADVISOR: Merchantec Capital

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Crowe JHB

IVT Ords 5c ea 134 000 000 96 842 425 CAPITAL STRUCTURE AUTHORISED ISSUED

ISA Ords 1c ea 500 000 000 170 592 593

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 52 30 Jul 24 5 Aug 24 105.00 Ords 1c ea Ldt Pay Amt

Final No 51 1 Aug 23 7 Aug 23 100.00 Final No 23 16 Jul 24 22 Jul 24 11.20

Interim No 22 5 Dec 23 11 Dec 23 7.70

LIQUIDITY: Oct24 Avg 371 765 shares p.w., R10.6m(20.0% p.a.)

LIQUIDITY: Oct24 Avg 157 266 shares p.w., R261 457.5(4.8% p.a.)

IIND 40 Week MA INVICTA

SCOM 40 Week MA ISA

3865

232

3173

195

2482

157

1790

120

1099

82

407

2019 | 2020 | 2021 | 2022 | 2023 | 2024

45

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

(R million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20 FINANCIAL STATISTICS

Final Final Final Final Final(rst) (Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Turnover 8 279 7 770 7 189 6 251 6 874 Final Final Final Final Final

Op Inc 720 647 659 592 - 348 Turnover 100 797 75 581 74 743 67 316 101 219

NetIntPd(Rcvd) 129 88 80 141 182 Op Inc 20 225 17 249 20 676 14 379 28 002

Minority Int 17 25 23 10 7 NetIntPd(Rcvd) - 2 297 - 1 455 - 551 - 696 - 3 925

Att Inc 481 490 826 308 - 761 Att Inc 29 539 21 872 16 354 12 946 23 425

19 232

12 946

23 425

TotCompIncLoss

21 872

29 539

TotCompIncLoss 726 1 026 869 126 - 390 Fixed Ass 14 535 14 489 13 469 9 654 9 874

Fixed Ass 1 261 1 140 1 165 1 004 1 738 Inv & Loans 2 326 2 357 2 371 2 406 2 518

Inv & Loans 1 952 1 805 1 456 113 94 Tot Curr Ass 46 875 49 738 63 584 57 194 63 224

Tot Curr Ass 5 423 5 116 4 698 4 378 7 526 Ord SH Int 62 921 57 814 70 348 62 773 57 627

Ord SH Int 5 002 4 542 3 880 3 851 3 755 LT Liab 1 219 1 064 1 064 - -

Minority Int 83 85 63 125 129 Tot Curr Liab 22 307 17 293 12 895 11 698 22 983

LT Liab 1 453 1 506 1 227 1 046 3 007 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 2 090 1 932 1 978 2 283 2 782

HEPS-C (ZARc) 18.90 14.00 10.50 8.30 15.00

PER SHARE STATISTICS (cents per share) DPS (ZARc) 18.90 14.00 20.50 8.30 -

HEPS-C (ZARc) 470.00 488.00 343.00 172.00 - 82.00 NAV PS (ZARc) 40.50 37.10 45.10 40.20 36.90

DPS (ZARc) 105.00 100.00 90.00 60.00 - 3 Yr Beta 0.44 0.54 0.75 0.34 - 0.34

NAV PS (ZARc) 5 164.64 4 548.86 3 765.00 3 566.00 3 580.00 Price High 152 149 106 100 209

3 Yr Beta 0.20 0.61 1.46 1.37 0.72 Price Low 101 93 61 35 31

Price High 3 000 3 647 3 750 2 150 3 000 Price Prd End 139 114 104 66 56

Price Low 2 449 2 350 1 850 351 525 RATIOS

Price Prd End 2 639 2 775 3 358 2 035 701 Ret on SH Fnd 46.95 37.83 23.25 20.62 40.65

RATIOS Oper Pft Mgn 20.07 22.82 27.66 21.36 - 27.66 -

D:E

0.02

0.02

0.02

Ret on SH Fnd 8.62 9.63 18.09 6.72 - 16.29 Current Ratio 2.10 2.88 4.93 4.89 2.75

Oper Pft Mgn 8.70 8.32 9.17 9.48 - 5.06 Div Cover 1.00 1.00 0.51 1.00 -

D:E 0.29 0.32 0.31 0.28 0.76

Current Ratio 2.59 2.65 2.37 1.92 2.71

Div Cover 4.69 4.81 8.49 4.75 -

132