Page 195 - shbh24_complete

P. 195

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – SOU

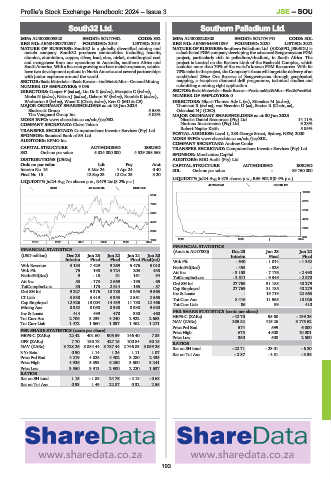

South32 Ltd. Southern Palladium Ltd.

SOU SOU

ISIN: AU000000S320 SHORT: SOUTH32 CODE: S32 ISIN: AU0000220808 SHORT: SOUTH PD CODE: SDL

REG NO: ABN84093732597 FOUNDED: 2015 LISTED: 2015 REG NO: ABN59646391899 FOUNDED: 2020 LISTED: 2022

NATURE OF BUSINESS: South32 is a globally diversified mining and NATURE OF BUSINESS: Southern Palladium Ltd. (ASX:SPD, JSE:SDL) is

metals company. South32 produces commodities including bauxite, a dual-listed PGM company developing the advanced Bengwenyama PGM

alumina, aluminium, copper, silver, lead, zinc, nickel, metallurgical coal project, particularly rich in palladium/rhodium, in South Africa. The

and manganese from our operations in Australia, southern Africa and project is located on the Eastern Limb of the Bushveld Complex, which

South America. With a focus on growing our base metals exposure, we also contains more than 70% of the world’s known PGM Resources. With its

have two development options in North America and several partnerships 70% stake in the project, the Company’s focus will target the delivery of an

with junior explorers around the world. established 2Moz Ore Reserve at Bengwenyama through geophysical

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining mapping, a twophase diamond drill programme, technical studies and

NUMBER OF EMPLOYEES: 9 096 submitting a mining right application.

DIRECTORS: Cooper F (ind ne), Liu Dr X (ind ne), Mesquita C (ind ne), SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

Mtoba N (ind ne), Nelson J (ind ne), Osborn W (ind ne), Rumble K (ind ne), NUMBER OF EMPLOYEES: 0

Warburton S (ind ne), Wood K (Chair, ind ne), Kerr G (MD & CE) DIRECTORS: Nkosi-Thomas Adv L (ne), Stirzaker M (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 18 Jun 2024 Thomson R (ind ne), van Heerden D (ne), Baxter R (Chair, ne),

Blackrock Group 5.58% Odendaal N J (CEO)

The Vanguard Group Inc. 5.08% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

MORE INFO: www.sharedata.co.za/sdo/jse/S32 Nicolas Daniel Resources (Pty) Ltd. 14.11%

COMPANY SECRETARY: Claire Tolcon Nurinox Investments (Pty) Ltd. 9.28%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Robert Napier Keith 5.85%

SPONSOR: Standard Bank of SA Ltd. POSTAL ADDRESS: Level 1, 283 George Street, Sydney, NSW, 2000

AUDITORS: KPMG Inc. MORE INFO: www.sharedata.co.za/sdo/jse/SDL

COMPANY SECRETARY: Andrew Cooke

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

S32 Ords no par value 5 324 000 000 4 529 258 568 SPONSOR: Merchantec Capital

DISTRIBUTIONS [USDc] AUDITORS: BDO Audit (Pty) Ltd.

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Interim No 16 5 Mar 24 4 Apr 24 0.40 SDL Ords no par value - 89 750 000

Final No 15 12 Sep 23 12 Oct 23 3.20

LIQUIDITY: Jul24 Avg 6 875 shares p.w., R36 902.8(0.4% p.a.)

LIQUIDITY: Jul24 Avg 7m shares p.w., R479.2m(8.2% p.a.)

40 Week MA SOUTH PD

INDM 40 Week MA SOUTH32

10000

9142

8070

7690

6140

6238

4210

4786

2280

3334

350

2022 | 2023 | 2024

1882

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

FINANCIAL STATISTICS (Amts in AUD’000) Dec 23 Jun 23 Jun 22

(USD million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Interim Final Final

Interim Final Final Final Final(rst) Wrk Pft - 640 - 1 014 - 1 352

Wrk Revenue 3 133 7 429 9 269 5 476 5 010 NetIntPd(Rcd) - 435 - 325 -

Wrk Pft 75 198 3 724 203 438 Att Inc - 3 153 - 7 176 - 2 498

NetIntPd(Rcd) 9 - 15 31 161 94 TotCompIncLoss - 3 511 - 9 345 - 2 570

Att Inc 53 - 173 2 669 - 195 - 65 Ord SH Int 27 769 31 185 40 279

TotCompIncLoss 33 - 173 2 614 - 165 - 87 Cap Employed 27 769 31 185 40 279

Ord SH Int 9 227 9 376 10 780 8 955 9 563 Inv & Loans - 19 719 22 663

LT Liab 3 538 3 419 3 353 2 561 2 565 Tot Curr Ass 8 416 11 565 18 026

Cap Employed 12 926 13 004 14 439 11 780 12 466 Tot Curr Liab 86 99 410

Mining Ass 8 352 8 050 8 988 8 938 9 680

Inv & Loans 414 499 470 380 460 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 2 706 3 239 4 240 2 922 2 663 HEPS-C (ZARc) - 42.70 95.60 - 199.26

Tot Curr Liab 1 472 1 560 1 897 1 462 1 271 NAV (ZARc) 385.82 415.26 3 175.52

Price Prd End 574 599 6 000

PER SHARE STATISTICS (cents per share) Price High 675 4 500 10 001

HEPS-C (ZARc) 22.42 401.60 905.59 146.40 7.83

Price Low 350 500 2 500

DPS (ZARc) 7.70 150.78 427.15 100.84 50.18 RATIOS

NAV (ZARc) 3 728.26 3 884.44 3 787.44 2 746.83 3 059.26 Ret on SH fund - 22.71 - 23.01 - 6.20

3 Yr Beta 0.90 1.14 1.24 1.11 1.07 Ret on Tot Ass - 2.87 - 4.51 - 3.36

Price Prd End 4 219 4 825 4 402 3 280 2 435

Price High 4 926 5 893 6 250 3 500 3 241

Price Low 3 550 3 913 2 900 2 220 1 637

RATIOS

Ret on SH fund 1.15 - 1.85 24.76 - 2.18 - 0.68

Ret on Tot Ass 0.93 1.49 22.87 0.32 2.55

193