Page 165 - Profile's Stock Exchange Handbook - 2025 Issue 4

P. 165

Profile’s Stock Exchange Handbook: 2025 - Issue 4 JSE - OMN

Omnia Holdings Ltd. Orion Minerals Ltd.

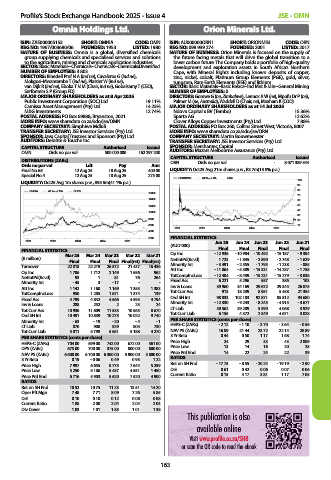

ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN

REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980 REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017

NATURE OF BUSINESS: Omnia is a global, diversified chemicals NATURE OF BUSINESS: Orion Minerals is focused on the supply of

group supplying chemicals and specialised services and solutions the future facing metals that will drive the global transition to a

to the agriculture, mining and chemicals application industries. lower carbon future. The Company holds a portfolio of high-quality

SECTOR: Basic Materials--Chemicals--Chemicals--Chemicals:Diversified development and exploration assets in South Africa’s Northern

NUMBER OF EMPLOYEES: 3 803 Cape, with Mineral Rights including known deposits of copper,

DIRECTORS: Binedell Prof N A (ind ne), Cavaleros G (ind ne), zinc, nickel, cobalt, Platinum Group Elements (PGE), gold, silver,

Mokgosi-Mwantembe T (ind ne), Plaizier W (ind ne), tungsten, Rare Earth Elements (REE) and lithium.

van Dijk R (ind ne), Eboka T N M (Chair, ind ne), Gobalsamy T (CEO), SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--General Mining

Serfontein S P (Group FD) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 8 Apr 2025 DIRECTORS: Gomwe G (ne, Zimbabwe), Lennox A W (ne), Mpofu Dr P (ne),

Public Investment Corporation (SOC) Ltd. 19.11% Palmer M (ne, Australia), Waddell D (Chair, ne), Moxham K (COO)

Camissa Asset Management (Pty) Ltd. 14.23% MAJOR ORDINARY SHAREHOLDERS as at 14 Jul 2025

M&G Investments 12.74% Ndovu Capital x BV (Tembo) 15.36%

POSTAL ADDRESS: PO Box 69888, Bryanston, 2021 Sparta AG 12.62%

MORE INFO: www.sharedata.co.za/sdo/jse/OMN Clover Alloys Copper Investments (Pty) Ltd. 7.88%

COMPANY SECRETARY: Simphiwe Mdluli POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ORN

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. COMPANY SECRETARY: Martin Bouwmeester

AUDITORS: Deloitte & Touche Inc. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued SPONSOR: Merchantec Capital

OMN Ords no par val 500 000 000 162 297 200 AUDITORS: Mazars Melbourne Assurance (Pty) Ltd.

Issued

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE Authorised - 8 071 389 544

ORN

Ords no par val

Ords no par val Ldt Pay Amt

Final No 65 12 Aug 25 18 Aug 25 400.00 LIQUIDITY: Oct25 Avg 21m shares p.w., R3.7m(13.8% p.a.)

Special No 4 12 Aug 25 18 Aug 25 275.00

ORIONMIN 40 Week MA MINI

LIQUIDITY: Oct25 Avg 1m shares p.w., R93.6m(41.1% p.a.) 100

90

80

OMNIA 40 Week MA CHES

16000

70

14000 60

12000 50

40

10000

30

8000

20

6000 10

2021 2022 2023 2024 2025

4000

2000 FINANCIAL STATISTICS

2021 2022 2023 2024 2025 Jun 25 Jun 24 Jun 23 Jun 22 Jun 21

(AUD’000)

FINANCIAL STATISTICS Final Final Final Final Final

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Op Inc - 12 936 - 10 984 - 10 492 - 15 187 - 9 394

(R million) NetIntPd(Rcvd) 1 723 - 1 845 - 2 890 - 2 748 - 1 629

Final Final Final Final(rst) Final(rst)

Turnover 22 818 22 219 26 572 21 437 16 436 Minority Int - 3 491 - 2 555 - 1 795 - 1 238 - 885

Op Inc 1 706 1 712 2 149 1 556 962 Att Inc - 11 864 - 5 389 - 15 331 - 14 287 - 1 758

NetIntPd(Rcvd) 93 1 81 76 264 TotCompIncLoss - 12 404 - 8 439 - 15 231 - 15 279 - 3 036

103

557

5 296

6 221

386

Fixed Ass

Minority Int - 45 3 - 17 - -

Att Inc 1 142 1 160 1 169 1 353 1 383 Inv & Loans 39 960 34 169 29 672 29 345 26 875

913

5 458

8 951

18 239

TotCompIncLoss 950 1 285 1 671 1 374 139 Tot Curr Ass 98 833 102 183 92 871 85 812 21 354

Ord SH Int

94 680

Fixed Ass 4 799 4 842 4 566 4 593 4 794

Inv & Loans 288 252 2 23 24 Minority Int - 12 330 - 9 243 - 8 245 - 4 915 - 3 677

Tot Curr Ass 10 936 11 609 11 535 10 563 8 670 LT Liab 50 562 39 289 5 390 4 068 3 929

Ord SH Int 10 491 10 839 10 275 10 022 9 740 Tot Curr Liab 6 155 4 372 2 349 4 671 3 028

Minority Int - 63 - 19 - 20 - 4 - 1 PER SHARE STATISTICS (cents per share)

LT Liab 870 908 929 805 730 HEPS-C (ZARc) - 2.12 - 1.10 - 3.70 - 3.64 - 0.56

Tot Curr Liab 5 811 5 798 5 651 5 188 4 270 NAV PS (ZARc) 16.89 21.44 23.72 22.14 28.89

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.44 0.50 1.17 1.68 1.74

HEPS-C (ZARc) 704.00 699.00 742.00 672.00 361.00 Price High 24 29 33 43 2 889

DPS (ZARc) 675.00 700.00 375.00 800.00 600.00 Price Low 13 14 16 20 25

Price Prd End

22

24

39

22

14

NAV PS (ZARc) 6 600.00 6 700.00 6 300.00 5 900.00 5 800.00

3 Yr Beta 0.19 - 0.06 0.49 0.93 1.22 RATIOS

Price High 7 997 6 655 8 775 7 644 5 259 Ret on SH Fnd - 17.75 - 8.55 - 20.24 - 19.19 - 2.90

Price Low 5 250 5 186 5 437 4 551 1 450 D:E 0.61 0.42 0.06 0.07 0.06

Price Prd End 6 716 5 903 5 620 7 520 4 900 Current Ratio 0.15 4.17 3.81 1.17 7.05

RATIOS

Ret on SH Fnd 10.52 10.75 11.23 13.51 14.20

Oper Pft Mgn 7.48 7.71 8.09 7.26 5.85

D:E 0.10 0.10 0.12 0.08 0.08

Current Ratio 1.88 2.00 2.04 2.04 2.03

Div Cover 1.03 1.01 1.85 1.01 1.38

This publication is also

available online

Visit www.profile.co.za/SHB

or scan the QR code to read the ebook

163