Page 69 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 69

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - ACC

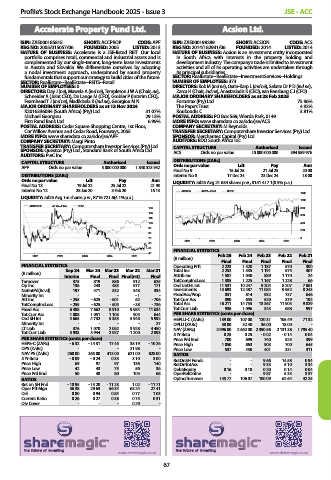

Accelerate Property Fund Ltd. Acsion Ltd.

ISIN: ZAE000185815 SHORT: ACCPROP CODE: APF ISIN: ZAE000198289 SHORT: ACSION CODE: ACS

REG NO: 2005/015057/06 FOUNDED: 2005 LISTED: 2013 REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014

NATURE OF BUSINESS: Accelerate is a JSE-listed REIT. Our local NATURE OF BUSINESS: Acsion is an investment entity incorporated

portfolio comprises retail, commercial and industrial assets and is in South Africa with interests in the property holding and

complemented by our single-tenant, long-term lease investments development industry. The company’s trade is limited to investment

in Austria and Slovakia. We differentiate ourselves by adopting activities and all of its operating activities are undertaken through

a nodal investment approach, underpinned by sound property its principal subsidiaries.

fundamentals that support our strategy to build cities of the future. SECTOR: RealEstate--RealEstate--InvestmentServices--Holdings

SECTOR: RealEstate--RealEstate--REITS--Retail NUMBER OF EMPLOYEES: 373

NUMBER OF EMPLOYEES: 0 DIRECTORS: Kok M (ind ne), Osrin-Karp L (ind ne), Sekete Dr P D (ind ne),

DIRECTORS: Day J (ne), Mawela A (ind ne), Templeton J W A (Chair, ne), Zarca H (Chair, ind ne), Anastasiadis K (CEO), van Rensburg C J (CFO)

Schneider A (Joint CEO), De Lange M (CFO), Grobler P (Interim CFO), MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

Fearnhead T J (ind ne), Madikizela K (ind ne), Georgiou M N Fortutrax (Pty) Ltd. 75.96%

MAJOR ORDINARY SHAREHOLDERS as at 13 Nov 2024 The Papa’s Trust 4.92%

K2016336084 (South Africa) (Pty) Ltd. 31.07% Koukoudis C 3.81%

Michael Georgiou 29.13% POSTAL ADDRESS: PO Box 569, Wierda Park, 0149

First Rand Bank Ltd. 6.99% MORE INFO: www.sharedata.co.za/sdo/jse/ACS

POSTAL ADDRESS: Cedar Square Shopping Centre, 1st Floor, COMPANY SECRETARY: M Reynolds

Cnr Willow Avenue and Cedar Road, Fourways, 2055 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/APF SPONSOR: Merchantec Capital (Pty) Ltd.

COMPANY SECRETARY: Margi Pinto AUDITORS: BDO South Africa Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: Questco (Pty) Ltd., Standard Bank of South Africa Ltd. ACS Ords no par value 10 000 000 000 394 959 976

AUDITORS: PwC Inc.

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [ZARc]

Pay

Ldt

Amt

APF Ords no par value 5 000 000 000 1 840 323 952 Ords no par value 15 Jul 25 21 Jul 25 20.00

Final No 9

DISTRIBUTIONS [ZARc] Interim No 8 17 Dec 24 23 Dec 24 18.00

Ords no par value Ldt Pay Amt LIQUIDITY: Jul25 Avg 21 634 shares p.w., R151 417.1(0.3% p.a.)

Final No 13 19 Jul 22 25 Jul 22 21.98

Interim No 12 28 Jan 20 3 Feb 20 16.13 ACSION 40 Week MA REDS

1200

LIQUIDITY: Jul25 Avg 1m shares p.w., R716 721.6(4.1% p.a.)

1000

ACCPROP 40 Week MA REIV

130 800

120

600

110

100 400

90

200

80

70 0

60 2021 2022 2023 2024 2025

50 FINANCIAL STATISTICS

40

2021 2022 2023 2024 2025 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R million) Final Final Final Final Final

FINANCIAL STATISTICS Operating Prft 2 223 1 520 1 187 570 300

Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 Total Inc 2 252 1 535 1 191 575 307

(R million)

Interim Final Final Final(rst) Final Attrib Inc 1 587 1 040 889 1 170 24

Turnover 375 819 856 912 625 TotCompIncLoss 1 385 1 225 1 167 1 228 66

Op Inc 136 243 483 577 171 Ord UntHs Int 11 531 10 247 9 204 8 207 7 061

NetIntPd(Rcvd) 197 471 332 348 334 Investments 13 693 12 487 11 084 9 952 8 243

Minority Int - - - - 1 - FixedAss/Prop 851 814 932 737 646

Att Inc - 255 - 625 - 601 62 - 706 Tot Curr Ass 890 655 520 379 192

TotCompIncLoss - 255 - 625 - 605 - 38 - 736 Total Ass 16 211 14 755 13 367 11 903 9 829

Fixed Ass 6 488 7 662 8 910 9 984 11 634 Tot Curr Liab 936 1 096 343 688 997

Tot Curr Ass 1 008 1 051 1 103 905 644 PER SHARE STATISTICS (cents per share)

Ord SH Int 4 665 4 732 5 353 5 948 5 992 HEPLU-C (ZARc) 139.00 107.00 120.31 105.49 71.32

Minority Int - - - - 27 DPLU (ZARc) 38.00 32.40 36.00 18.00 -

LT Liab 376 1 070 2 062 3 928 4 450 NAV (ZARc) 2 996.00 2 662.00 2 390.56 2 131.38 1 795.40

Tot Curr Liab 3 933 3 944 2 927 1 200 2 093 3 Yr Beta 0.25 0.25 - 0.02 - 0.14 0.04

PER SHARE STATISTICS (cents per share) Price Prd End 700 699 740 525 399

HEPS-C (ZARc) - 6.32 - 14.31 17.45 38.19 - 10.26 Price High 1 050 863 903 700 645

DPS (ZARc) - - - 21.98 - Price Low 537 450 401 331 311

NAV PS (ZARc) 260.00 365.00 413.00 621.00 628.00 RATIOS

3 Yr Beta - 0.09 - 0.24 0.35 3.10 3.00 RetOnSH Funds - - 9.66 14.58 0.94

Price High 69 97 97 136 140 RetOnTotAss - - 9.35 5.10 3.34

Price Low 42 43 75 56 36 Debt:Equity 0.16 0.18 0.20 0.14 0.04

Price Prd End 50 48 80 105 68 OperRetOnInv - - 9.87 5.33 3.37

RATIOS OpInc:Turnover 145.77 106.07 100.09 62.64 42.25

Ret on SH Fnd - 10.95 - 13.20 - 11.23 1.02 - 11.71

Oper Pft Mgn 36.38 29.63 56.34 63.24 27.41

D:E 0.80 0.94 0.84 0.77 1.03

Current Ratio 0.26 0.27 0.38 0.75 0.31

Div Cover - - - 0.29 -

67